Bank account switches hit record high as rates rise but Britons 'may end up regretting their decision’

Bank customers may 'regret' their decision to switch accounts

|GETTY

Bank customers can use the Current Account Switch Service to change to another financial institution’s product with ease

Don't Miss

Most Read

A record number of bank customers have switched current accounts amid high interest rates, according to the latest data. However, experts are warning Britons may “end up regretting their decision” and should do their research.

The Current Account Switch Service (CASS) reported 433,701 switches between October and December 2023 which is the highest quarterly total recorded since its launch more than a decade ago. With these figures, the total number of account switches from Britons has risen to 10.2 million since September 2013.

Bank customers may 'regret' their decision to switch accounts

|GETTY

These hiked figures are reflective of consumers and businesses exploring their account options between banks and building societies as the cost of living crisis continues.

Despite the impact of high inflation on households, bank customers have enjoyed high interest rates over the last year-and-a-half which has been passed down to current accounts.

As well as this, high street banks and building societies, including Nationwide and Santander have offered favourable incentive offers to get Britons to make the switch.

Figures from the last quarter are 15 per cent higher than fourth quarter of 2022 (376,107) which was the highest switching quarter at the time.

From July to September 2023, end user data revealed that NatWest had the highest net switching gains at 59,158. This was followed by HSBC at 25,037, as well as TSB and Royal Bank of Scotland at 15,754 and 6,382, respectively.

During the fourth quarter of 2023, 77 per cent of Britons were aware of CASS with 87 per cent satisfied with their switch. John Dentry, the product owner of Pay UK which operates the service, described the latest figures as “encouraging”.

He explained: “As interest rates appear to be stabilising, it will be interesting to see how the market develops.

“Despite higher interest rates, cash incentives and other financial benefits, online and mobile banking still continues to be the most significant reason that consumers prefer their new current account.

LATEST DEVELOPMENTS:

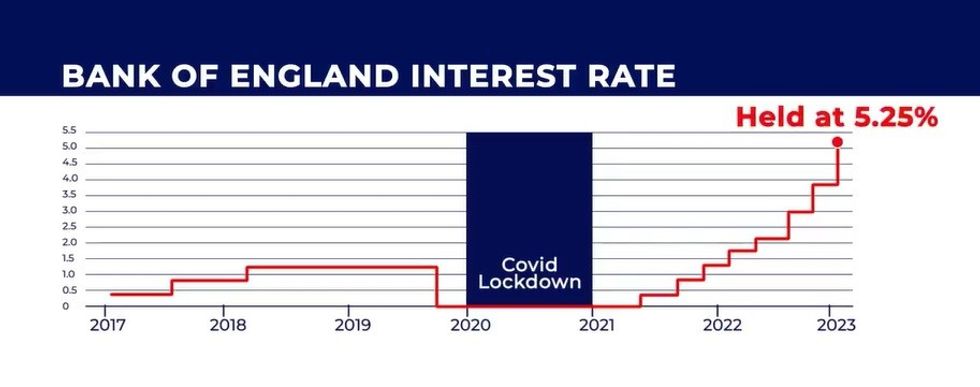

The Bank of England base rate is currently at a 15-year high | GB NEWS

The Bank of England base rate is currently at a 15-year high | GB NEWS“Following another year of high switching volumes, those considering a new current account should be comforted by the fact that the Service has facilitated over 10 million switches through a quick, free and easy process.”

Despite this activity from bank customers, Which?’s Money Editor Jenny Ross issued a warning about the type of deals bank customers risk falling into.

She said: “The latest CASS figures show the power of offering financial incentives for switching, but it’s important to take into account other factors like complaints handling, mobile and online banking service, customer service and local branch closures.

“Some of the banks with the highest number of switches were near the bottom of Which?’s current account customer satisfaction rankings, meaning some customers could end up regretting their decision long after the switching cash has been spent if they overlook crucial service quality indicators.”