Best savings accounts of the week: Britons told to 'lock in' as banks offering 7.5% interest rate - full list

GB NEWS

Savers have benefited from a period of high interest rates in recent years

Don't Miss

Most Read

Latest

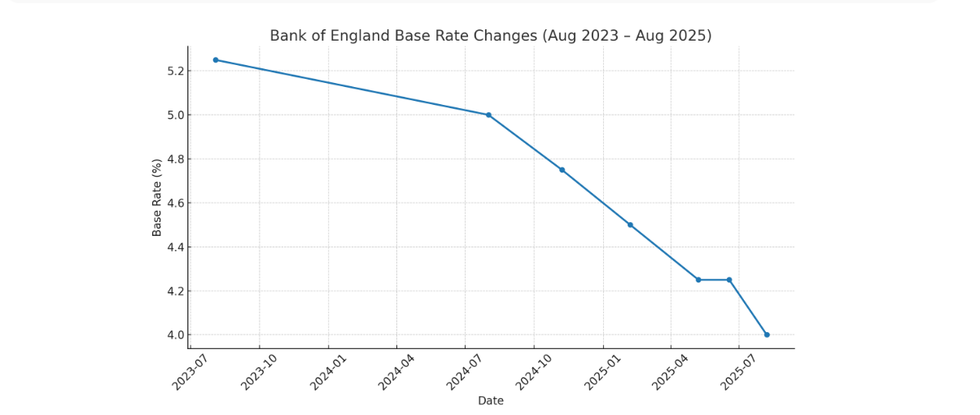

Savers in the UK are looking for the best deals from banks and building societies following the Bank of England's latest interest rate cut.

Earlier this month, the central bank's Monetary Policy Committee (MPC) voted to slash the base rate to four per cent in a win for borrowers, however analysts have warned savings accounts could take a hit.

Experts from Moneyfactscompare have compiled a list of the best savings accounts for the week beginning August 18, 2025.

Britons are being reminded to "lock down" deals offering interest rates of up to 7.5 per cent before banks beginning to make cuts.

**ARE YOU READING THIS ON OUR APP? DOWNLOAD NOW FOR THE BEST GB NEWS EXPERIENCE**

What are this week's best savings accounts?

|GETTY

Best regular savings accounts:

Here is a list of the best regular savings accounts currently on offer for the week with interest rates attached:

- Principality BS – 7.50 per cent AER / 7.36 per cent Gross

- Zopa – 7.10 per cent AER / 6.87 per cent Gross

- The Co-operative Bank – seven per cent AER / Gross

- Nationwide BS – 6.50 per cent AER / Gross

- Virgin Money – 6.50 per cent AER / Gross

- Melton BS – 6.50 per cent AER / Gross

- Monmouthshire BS – six per cent AER / Gross

- Darlington BS – six per cent AER / Gross

- West Brom BS – six per cent AER / Gross

- Market Harborough BS – 5.80 per cent AER / Gross.

Best fixed-rate savings accounts

Here is a list of the best savings accounts offering a one-year fixed interest rate:

- JN Bank - 4.43 per cent AER / Gross

- Habib Bank Zurich plc – 4.40 per cent AER / Gross

- Habib Bank Zurich plc – 4.40 per cent AER / Gross

- Atom Bank - 4.36 per cent AER / Gross

- JN Bank – 4.35 per cent AER / Gross

- DF Capital – 4.35 per cent AER / Gross

- Zenith Bank (UK) Ltd - 4.35 per cent AER / Gross

- Cynergy Bank - 4.34 per cent AER / Gross

- Cynergy Bank – 4.33 per cent AER / Gross

- Close Brothers Savings – 4.35 per cent AER / Gross.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Britons are looking for the best savings account deal

| GETTYBest cash ISAs

Here is a list of the best cash ISAs with a one year fixed interest rate attached currently on offer:

- Vida Savings - 4.31 per cent AER / Gross

- Shawbrook Bank – 4.31 per cent AER / Gross

- Paragon Bank – 4.28 per cent AER / 4.27 per cent Gross

- Tembo Money – 4.27 per cent AER / Gross

- Kent Reliance – 4.26 per cent AER / Gross

- Vanquis Bank – 4.23 per cent AER / Gross

- Charter Savings Bank – 4.21 per cent AER / Gross

- Cynergy Bank – 4.20 per cent AER / Gross

- Aldermore – 4.20 per cent AER / Gross

- United Trust Bank – 4.20 per cent AER / Gross.

Here is a full list of the best cash ISAs with a variable interest rate attached currently on offer:

- Chip – 4.70 per cent AER / 4.60 per cent Gross

- Tembo Money – 4.64 per cent AER / 4.54 per cent Gross

- Trading 212 – 4.50 per cent AER / 4.41 per cent Gross

- Plum – 4.41 per cent AER / 4.36 per cent Gross

- Principality BS – 4.40 per cent AER / Gross

- Aldermore – 4.40 per cent AER / Gross

- Kent Reliance – 4.38 per cent AER / Gross

- Vida Savings – 4.38 per cent AER / 4.29 per cent Gross

- The Stafford BS - 4.35 per cent AER / Gross

- Charter Savings Bank - 4.31 per cent / Gross.

- Labour's stronghold crumbles in double election blow as Keir Starmer rocked by shock result - but who won?

- Bournemouth is just the beginning. Vigilante groups are coming to a town near you - Renee Hoenderkamp

- Rachel Reeves just gifted Richard Tice her chancellorship in 24 hours. Inheritance tax does pay - Kelvin MacKenzie

- POLL OF THE DAY: Is it in Britain's interests to show solidarity with Ukraine? VOTE NOW

- Want to stop Britain from becoming one big Bradford? The answer lies 85 miles off the coast - Colin Brazier

Best easy-access accounts

Here is a full list of the best easy access savings accounts without a bonus attached:

- cahoot – five per cent AER / Gross

- cahoot – 4.55 per cent AER / Gross

- West Brom BS – 4.55 per cent AER / Gross

- Kent Reliance – 4.41 per cent AER / Gross

- Kent Reliance – 4.41 per cent AER / Gross

- Hodge Bank – 4.40 per cent AER / 4.31 per cent Gross

- Vida Savings – 4.38 per cent AER / Gross

- Oxbury Bank – 4.32 per cent AER / 4.24 per cent Gross

- Harpenden BS – 4.31 per cent AER / Gross

- Charter Savings Bank – 4.31 per cent AER / Gross.

Here is a full list of the best easy access accounts with a bonus attached:

- Chip – 4.84 per cent AER / 4.74 per cent Gross

- Chase – 4.75 per cent AER / 4.65 per cent Gross

- Cynergy Bank – 4.45 per cent AER / Gross

- Principality BS – 4.45 per cent AER / Gross

- Oxbury Bank – 4.36 per cent AER / 4.28 per cent Gross

- Chip – 4.07 per cent AER / four per cent Gross

- Tesco Bank – 4.10 per cent AER / Gross

- Nottingham BS – 4.05 per cent AER / Gross

- Marcus by Goldman Sachs® – 4.01 per cent AER / 3.94 per cent Gross

- SAGA – 4.01 per cent AER / 3.94 per cent Gross.

How has the UK base rate changed over the last two years? | CHAT GPT

How has the UK base rate changed over the last two years? | CHAT GPT Adam French, the head of News at Moneyfactscompare.co.uk, said: "After a several savings providers made cuts following the Bank of England’s decision to cut the base rate the savings market has been fairly calm this last week.

"There have been handful of headline changes, however, including a drop in one of the best paying easy access accounts and a new top paying one-year fix.

"Savers should be aware that the rates on offer after the bonus periods end are below inflation forecasts, so it is essential savers shop around to secure the best returns on their savings.

"Locking down a market-leading savings rate is an imperative with inflation now forecast to hit four per cent before too long. The good news is that the market remains competitive despite many providers slashing rates in recent weeks."