Pension warning: Britons urged to 'supercharge' retirement pots with five savings hacks

Shadow Work & Pensions Secretary Helen Whately speaks to GB News Breakfast |

GB NEWS

Analysts are urging pension savers not to 'postpone' boosting their retirement savings

Don't Miss

Most Read

Pension savers are being urged to "supercharge" their retirement pots with five easy savings hack hacks. Research from digital wealth manager Moneyfarm has exposed a significant gap between pension participation and financial preparedness for retirement.

The study reveals that while an overwhelming 92 per cent of individuals contribute to pension schemes, fewer than half possess a clear understanding of their retirement finances.

Only 44 per cent of contributors can estimate their pension's eventual value, while a mere 43 per cent have established a concrete plan for achieving their retirement objectives.

The research also uncovered that 59 per cent of participants remain unaware of their pension's risk profile, with 47 per cent acknowledging they find the entire pension system bewildering.

**ARE YOU READING THIS ON OUR APP? DOWNLOAD NOW FOR THE BEST GB NEWS EXPERIENCE**

Pension savers can 'supercharge' their retirement savings

|GETTY

The Pensions and Lifetime Savings Association (PLSA) currently sets retirement income targets at £14,000 for basic needs, £31,300 for a moderate lifestyle, and £43,100 for comfortable living.

Analysts note that younger workers face even steeper challenges. Inflation, extended lifespans, and evolving lifestyle demands will push these benchmarks substantially higher for future retirees.

Adding to the burden, many will continue servicing mortgages or rental payments well into retirement.

Economists have long highlighted that this marks a stark departure from earlier generations who typically achieved outright homeownership much sooner in life.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

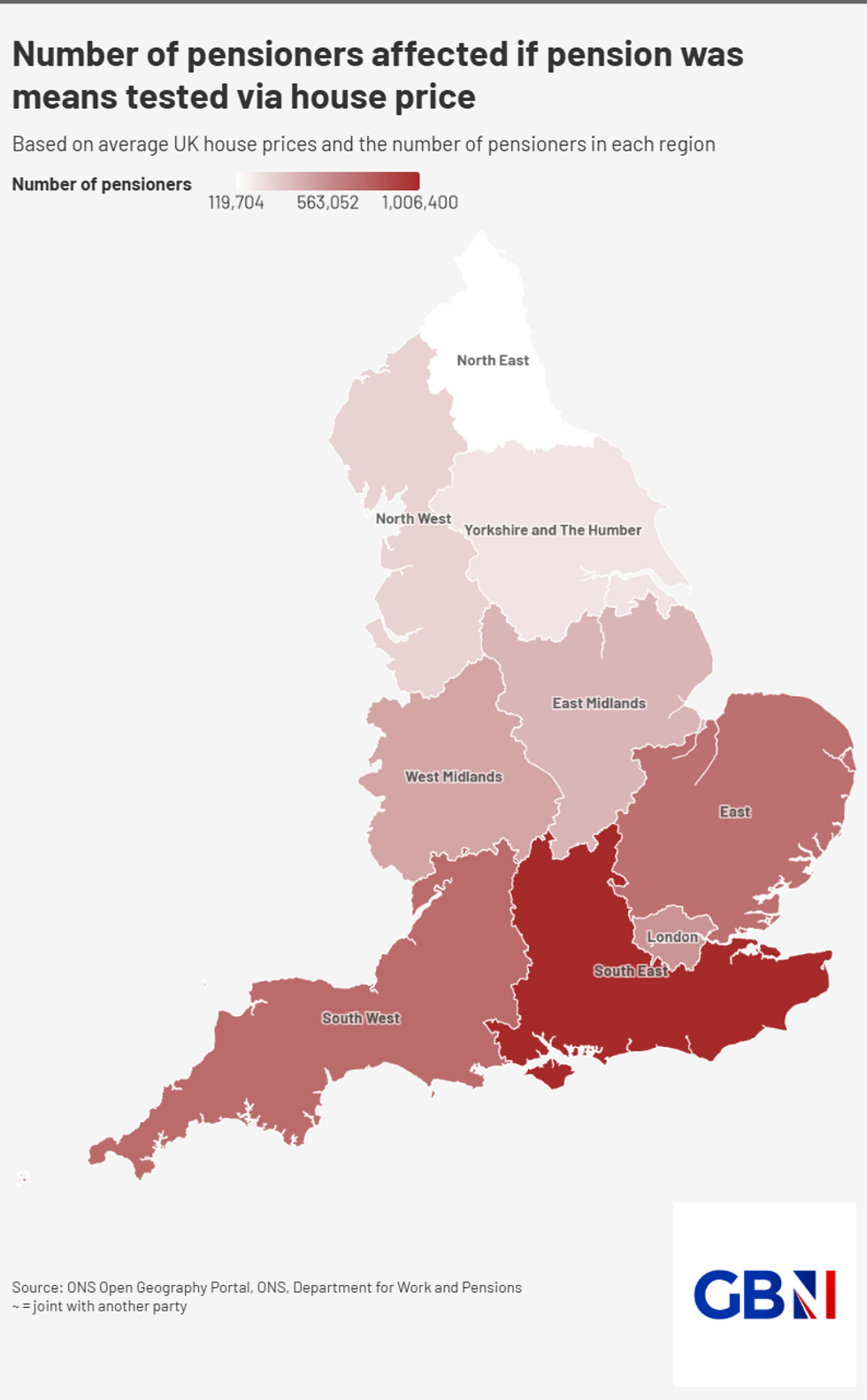

Number of pensioners affected if pension was means tested via house price | GBN

Number of pensioners affected if pension was means tested via house price | GBNTo address these challenges, Moneyfarm has identified five crucial strategies for optimising retirement funds.

First, they advise maintaining only essential cash reserves, as excessive liquid holdings lose value to inflation whilst invested capital generates returns.

The wealth manager recommends prioritising withdrawals from general investment accounts before touching tax-advantaged savings.

This approach minimises capital gains tax exposure and preserves the growth potential of ISAs and pensions.

MEMBERSHIP:

- POLL OF THE DAY: After the mega-dinghy crossed the Channel, will France ever stop the boats? VOTE NOW

- Three SHOCK graphs expose who is REALLY crossing the Channel in small boats - and it's NOT women and children

- Having stolen every penny from the living, Rachel Reeves wants to steal from the dead - Kelvin MacKenzie

- You are likely unaware of the term Da’wah. But it is dragging Britain back to the dark ages - James Price

- Reform 48 hours away from locking horns with Labour in two key battlegrounds as Rachel Reeves joins the fight

Strategic blending of ISA and pension withdrawals represents another key tactic. Since ISA withdrawals incur no tax and 25 per cent of pension funds can be accessed tax-free, combining these sources helps retirees maximise personal allowances and remain in lower tax brackets.

Deferring state pension payments offers another avenue for boosting retirement income. Those who postpone claiming can increase their eventual payments by approximately 5.8 per cent annually, potentially adding £13.35 to weekly income after a single year's delay.

Future inheritance tax modifications require careful consideration. From April 2027, pension assets may fall within estate valuations, potentially subjecting beneficiaries to both inheritance and income taxes. Early withdrawals, gifting strategies, and trust arrangements can help mitigate these forthcoming changes.

LATEST DEVELOPMENTS:

Britons are looking into how to boost their pension income | GETTY

Britons are looking into how to boost their pension income | GETTY Carina Chambers, a technical pensions expert at Moneyfarm, shared why it is important Britons are proactive in bolstering their retirement savings.

She shared: "While retirement may seem a long way off, it's not something we can afford to neglect or keep postponing. Our research shows that 57 per cent of people don’t have a pension strategy, and nearly half admit they find pensions confusing.

"There's a good reason for this - regulations keep changing, the rules often feel like they’re being rewritten, and living costs continue to rise.

"However, by following just a few simple steps, including blending withdrawals from different sources to minimise tax; planning for IHT changes and maintaining an effective but not wasteful cash buffer, you can put yourself in a much stronger position to build a comfortable pension pot, gain peace of mind, and look forward to a more secure retirement.”

More From GB News