Bank of England cuts interest rates to TWO-YEAR LOW despite inflation rise

BANK OF ENGLAND / GB NEWS

The UK's base rate has been slashed to four per cent in a win for borrowers

Don't Miss

Most Read

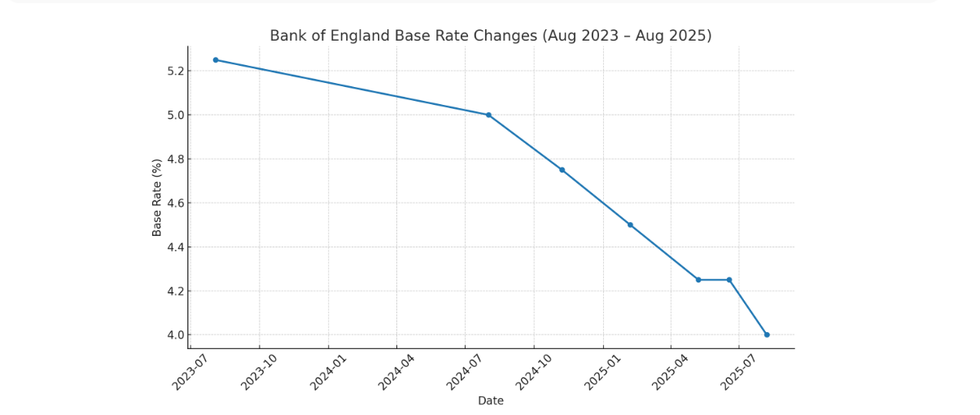

The Bank of England has slashed the UK's base rate from 4.25 per cent to four per cent despite inflation rising slightly last month.

In recent years, the central bank has raised interest rates to as high as 5.25 per cent in its effort to bring the consumer price index (CPI) rate down.

Today's action by the Bank's Monetary Policy Committee (MPC) will come as relief for mortgage holders and debt borrowers who have been saddled with hiked repayments.

The Bank's rate cut also assists Chancellor Rachel Reeves in her attempts to grow the British economy thanks to lower borrowing costs.

Economists have cited a slowdown in the UK jobs market and stagnant gross domestic product (GDP) growth as reasons the committee's members are likely to support a rate hike.

**ARE YOU READING THIS ON OUR APP? DOWNLOAD NOW FOR THE BEST GB NEWS EXPERIENCE**

The Bank of England has slashed the UK's base rate from 4.25 per cent to four per cent despite inflation rising slightly last month

| PABased on recent figures from the Office for National Statistics (ONS), the rate of UK unemployment jumped to 4.7 per cent in the three months to May, which the highest level for four years.

Furthermore, average earnings growth, excluding bonuses, eased to five per cent in the period to May to its lowest level for almost three years.

Earlier this month, Bank of England governor Andrew Bailey confirmed the financial institution would slash rates further if the jobs market began to weaken.

According to ONS data, the UK economy contracted in both April and May despite decent growth in the first quarter of 2025.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

How has the UK base rate changed over the last two years?

|CHAT GPT

This development is placing additional pressure on policymakers to bring the base rate closer to pre-Covid levels.

Alastair Douglas, the CEO of TotallyMoney, noted that a rate cut from the Bank of England will assist in bolstering GDP growth throughout the year.

Douglas said: "The global trade war, National Insurance hikes, and a lack of certainty and direction from the government around what will happen in the next Autumn Budget continues to impact economic growth.

"So, a rate cut will be widely welcomed by both consumers and businesses.

“Over the past year, we’ve seen greater competition in the market, with options increasing, and balance transfer and purchase card lengths getting longer.

"And this is better for customers, and better for the economy, as people’s spending power increases. Further cuts will help stimulate the economy, by reducing the cost of borrowing, and driving investment.

"Fintech has felt the of brunt higher rates, but with more money moving into the sector, and new technologies driving innovation, we should see faster improvements in both the financial services and customer outcomes."

LATEST DEVELOPMENTS:

Britons have been concerned about rising mortgage and debt costs in recent years

| GETTYAnalysts are pricing in at least one more interest rate cut from the Bank of England in 2025, which would bring the cost of borrowing down to 3.75 per cent.

However, economists have warned the CPI inflation rate remains noticeably higher than the central bank's desired target of two per cent.

In the 12 months to June 2025, inflation rose slightly to 3.6 per cent, up 0.2 percentage points from the month before.

The Bank of England's next MPC meeting regarding interest rates is scheduled to next take place on September 18, 2025.