What falling inflation means for your pension – online tool shows impact on your pension savings

The UK rate of inflation has fallen sharply to 4.6 per cent in the year to October 2023

|GETTY

The Bank of England’s inflation target is two per cent

Don't Miss

Most Read

The UK Consumer Prices Index (CPI) inflation rate has fallen sharply to 4.6 per cent in the year to October 2023, down from 6.7 per cent in the previous month, marking the lowest level in two years.

The fall, which means prices still rise but at a slower rate than in previous months, was driven by the lower energy price cap last month after energy costs soared last year.

It's welcome news for households as incomes may be less stretched than they have been previously, although prices aren't falling.

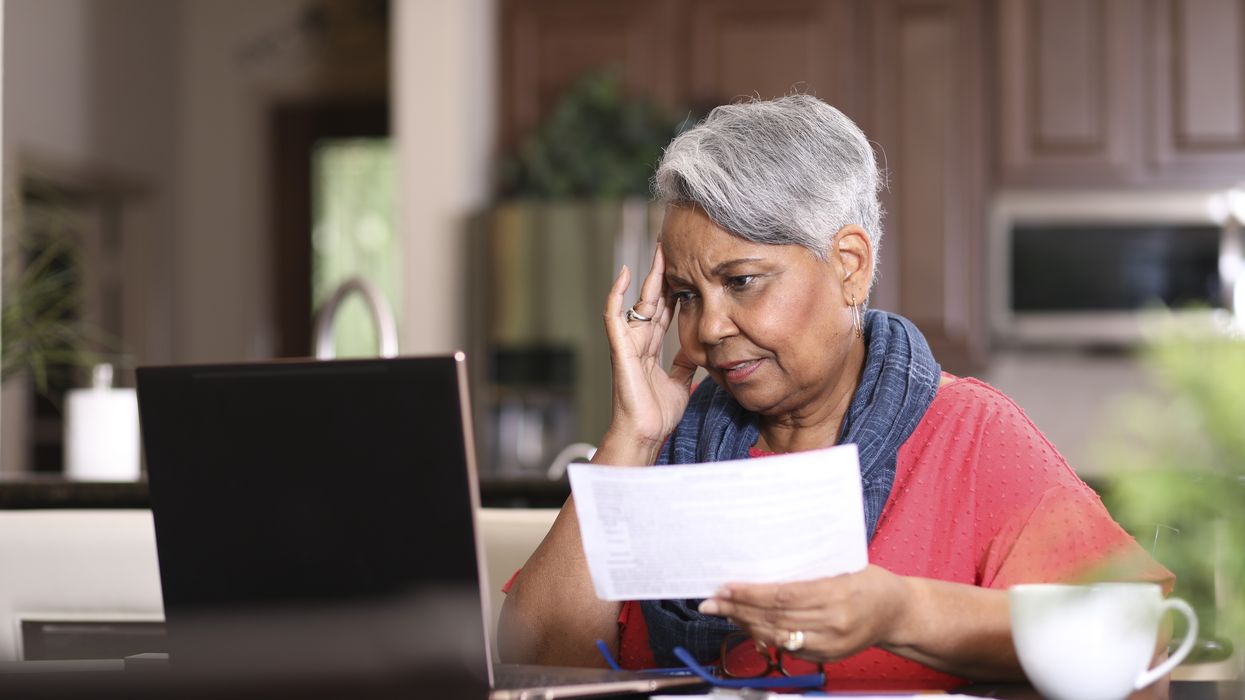

Pension savers and retirees may be wondering what the data means for their pension pots.

WATCH NOW: Liam Halligan on falling inflation

Becky O’Connor, Director of Public Affairs at PensionBee, said the fall in inflation of this scale was "sorely needed", explaining lower inflation was crucial for people trying to protect the long term value of their pension savings.

She said: "Such a drop could mark the beginning of the end of the cost of living crisis, although prices are still high and the painful effects of this difficult period will continue to be felt for some time.

“For those trying to preserve the long term value of their life savings, including their pension, returning to lower inflation is absolutely vital.

"Retirees have been struggling to make their pensions last in the face of the recent bout of ultra-high inflation; while workers trying to boost their future pension pot have faced an uphill battle to maintain the real future value of their savings.

“A return to more normal economic conditions will be a boost to financial resilience and security and may enable people to start reprioritising planning, rather than just getting by.”

PensionBee hosts an inflation calculator, which lets users see the effects of different rates of inflation over time on the value of their pension pots.

Users need to input details such as the current value of their pension pot, age and intended retirement age. They can also add in annual pension pot additions, and change the inflation scale.

The tool assumes investment growth of five per cent and pension fees of 0.7 per cent each year, although investment returns aren’t guaranteed.

Lily Megson, policy director at My Pension Expert, warned that despite the fall in inflation, households "continue to grapple with serious economic challenges".

She said: "Ultimately, the cost of living is still rising, which throws into question how people are able to spend, save and invest their hard-earned money. There’s a pressing need for more robust support for those approaching or in retirement.

"If not, we will continue to see the worrying trend of people in their 50s, 60s and 70s either delaying their retirement, or unretiring to top up their pension pots.

“We have to hope that next week's Autumn Statement provides clear, decisive actions to address the financial concerns of pension planners across the UK, and improving access to regulated, affordable advice must be central to this.

"Knowledge is power, and providing better access to advice will empower consumers to navigate the economic landscape far more effectively.”

Prime Minister Rishi Sunak said today’s data meant the Government has met its pledge to halve inflation by the end of this year.

LATEST DEVELOPMENTS:

Mr Sunak is understood to be basing this target against the CPI reading for November 2022, which was 10.7 per cent.

Suren Thiru, economics director at the Institute of Chartered Accountants in England and Wales, said: “While the Prime Minister has achieved his target to halve inflation this year, this owes more to the downward pressure on prices from falling energy costs and rising interest rates than any Government action.”

Liberal Democrat Treasury spokesperson Sarah Olney MP said: "Rishi Sunak congratulating himself over today’s figures will be cold comfort for all the hard-working people still bearing the brunt of this Conservative chaos.

"For months on end, people across the country have been watching as their pay cheque gets squeezed from all sides, draining every spare penny. From the ever-increasing cost of the weekly shop to skyrocketing mortgage payments.

"Enough is enough. With next week’s Autumn Statement the Government must properly help families and pensioners struggling with the cost-of-living crisis and give our NHS the funding it desperately needs.”

The Bank of England increased the base rate 14 consecutive times over the past two years to try to ease inflation, with the central bank voting to hold the base rate at 5.25 per cent since August.