'Good news' as Bank of England HOLDS interest rates after 14 hikes in a row

The Bank of England Base Rate is currently at its highest level in 15 years

|PA

The Bank of England Base Rate is currently at its highest level in 15 years

Don't Miss

Most Read

Latest

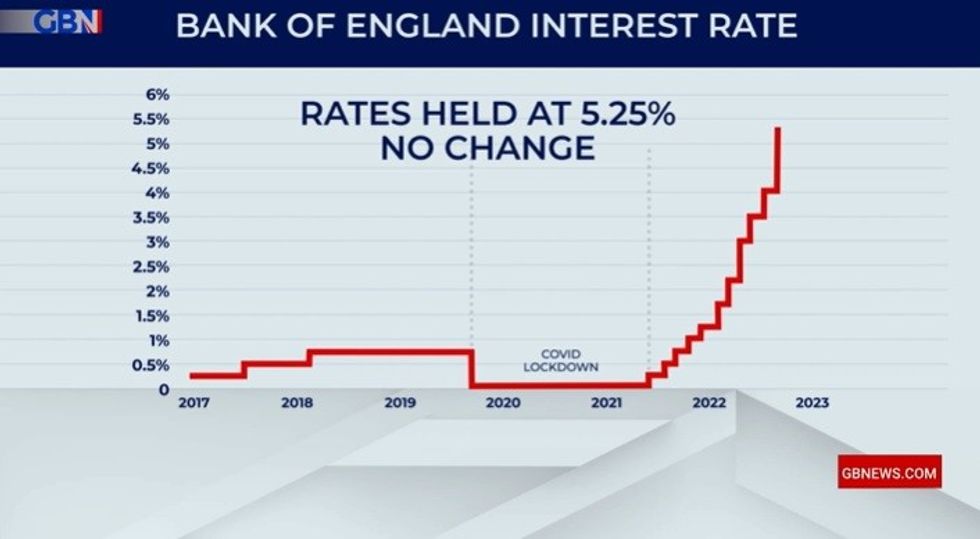

The Bank of England’s Monetary Policy Committee has voted to hold the base rate at 5.25 per cent.

It's the first time the central bank has left the base rate unchanged in nearly two years. It follows 14 consecutive rate hikes in a bid to try to ease inflation.

Five of the nine-person MPC voted to hold the rate while four voted to raise rates to 5.5 per cent.

Andrew Bailey, governor of the Bank of England, said: “Inflation has fallen a lot in recent months and we think it will continue to do so. That’s welcome news. But there is no room for complacency.

WATCH NOW: Liam Halligan explains what base rate decision means

“We need to be sure inflation returns to normal and we will continue to take the decisions necessary to do just that.”

Interest rates decision: What it could mean for mortgages

GB News’ Economics and Business Editor Liam Halligan said, in his view, it was "good news", explaining people with mortgages may soon see cheaper deals.

Mr Halligan told GB News: “So-called two-year swap rates will change so mortgage companies quite quickly will start competing and offering cheaper loans.

“We’ve already had mortgage rates coming down over recent weeks because of an expectation that this would be the peak in interest rates if indeed there was a rate rise.”

Savings expert and CEO of My Community Finance, Tobias Gruber, said borrowers can finally "breathe a small sight of relief" - particularly if they are on a variable rate mortgage. However, he said it's "far too soon to forecast how soon we'll see interest rates drop back to the levels we witnessed two years ago".

Mr Gruber said there is still an opportunity for savers to boost their earnings, but warned, they should "act now" to take advantage of high interest rates "while they're still here".

He added: “To get the best return on your savings, compare your options across traditional high street banks, building societies, online banks and credit unions. Similar to how you’d switch car insurance providers to find the best price, you need to apply the same principle to your savings."

Interest rate decision: What it could mean for pension savers

Becky O’Connor, Director of Public Affairs at PensionBee, said that for pension savers and retirees, the decision offers “welcome stability, if not higher returns”. She added: “Savings and annuity rates have improved significantly and there is a lot of competition for those looking for a home for cash, or stable income in retirement.

For Lily Megson, policy director at My Pension Expert, it is a "week of good news". She said: "There is a sense that we may, at last, have turned a corner with both inflation and interest rates both swinging in favour of Britons’ finances. However, this optimistic turn isn’t necessarily prompt celebration. Inflation remains high, people are still adapting to higher interest rates, and last week’s heated discussions surrounding the future of the triple lock will all contribute to a continuing uneasiness among consumers about their financial planning, particularly for retirement.

“What can we expect in the pensions market? Even though there was no base rate hike today, some pension planners may still consider annuities as the right option for their retirement fund – understandably so, given that they recently reached their highest rates in 20 years. However, it’s crucial that pension planners are not swayed by the headlines and recognise that not everyone shares the same financial objectives in retirement. Despite attractive rates, annuities may not be the golden ticket for everyone."

Official statistics published yesterday showed Consumer Price Index (CPI) inflation unexpectedly fell slightly in the year to August 2023, rising by 6.7 per cent - down from 6.8 per cent in July.

It marked the sixth consecutive monthly fall in the headline rate, defying expectations of a modest increase to seven per cent.

LATEST DEVELOPMENTS:

The Bank of England base rate remains unchanged at 5.25 per cent

|GB NEWS

Inflation is at the lowest level since February last year but is still far higher than the Bank of England's target of two per cent.

In January, the Government pledged to halve inflation from 10.7 per cent to around 5.3 per cent by the end of the year.

Chancellor of the Exchequer, Jeremy Hunt said this afternoon: “We are starting to see the tide turn against high inflation, but we will continue to do what we can to help households struggling with mortgage payments.

"Now is the time to see the job through. We are on track to halve inflation this year and sticking to our plan is the only way to bring interest and mortgage rates down.”

However, shadow chancellor Rachel Reeves today said inflation still remains high and households coming off fixed-rate mortgages will still be worse off because of the Conservatives’ “disastrous” mini-budget last year.

She said: “Households coming off fixed-rate mortgages will be paying an average of £220 more a month and inflation remains high because of the Conservatives’ disastrous mini-budget.

“Labour’s plan for the economy is about returning stability and boosting growth so we can cut household bills, create better-paid jobs and make working people in all parts of the country better off.”