Bank of England expected to hold interest rates at 3.75 per cent as labour market weakens

Policymakers are expected to keep borrowing costs unchanged

Don't Miss

Most Read

The Bank of England is expected to hold interest rates at 3.75 per cent when it announces its latest policy decision on Thursday as officials weigh conflicting signals from across the UK economy.

Investors will be watching closely for any guidance on the future direction of monetary policy, with the central bank widely anticipated to signal that further rate reductions remain possible in the months ahead.

Recent data have highlighted a complex backdrop for policymakers, with indicators of stronger business activity sitting alongside continued deterioration in labour market conditions.

Commercial activity has improved following the November Budget, yet employment trends have continued to soften, adding to uncertainty over the appropriate path for borrowing costs.

The unemployment rate rose to 5.1 per cent in November, marking its highest level since early 2021 and underscoring growing pressures within the jobs market.

The Monetary Policy Committee (MPC) lowered interest rates by a quarter percentage point to 3.75 per cent in December after signs that inflation was easing, although officials cautioned that future decisions would be more finely balanced.

Members of the committee remain divided over whether the current economic conditions justify further easing in the near term.

Some policymakers argue that weakening employment and declining hiring intentions are likely to curb inflationary pressures naturally, strengthening the case for lower interest rates.

Others take a more cautious stance, warning that signs of improving economic momentum could complicate efforts to bring price growth back under control.

Bank of England expected to hold interest rates on Thursday

| PAConsumer price inflation stood at 3.4 per cent in December, down from a summer peak of 3.8 per cent, but remains above the Bank’s two per cent target.

The challenge for rate-setters is how to reconcile evidence of rising unemployment with surveys pointing to improved business confidence and relatively resilient pay growth.

This tension has become a central feature of the committee’s deliberations as policymakers assess whether the current easing cycle is approaching its conclusion.

Figures published by the Office for National Statistics (ONS) showed payrolled employment fell by 155,000 in November 2025 compared with the same month a year earlier.

The redundancy rate increased to 4.9 per thousand workers, up from 3.8 previously, reinforcing concerns about weakening labour demand.

LATEST DEVELOPMENTS

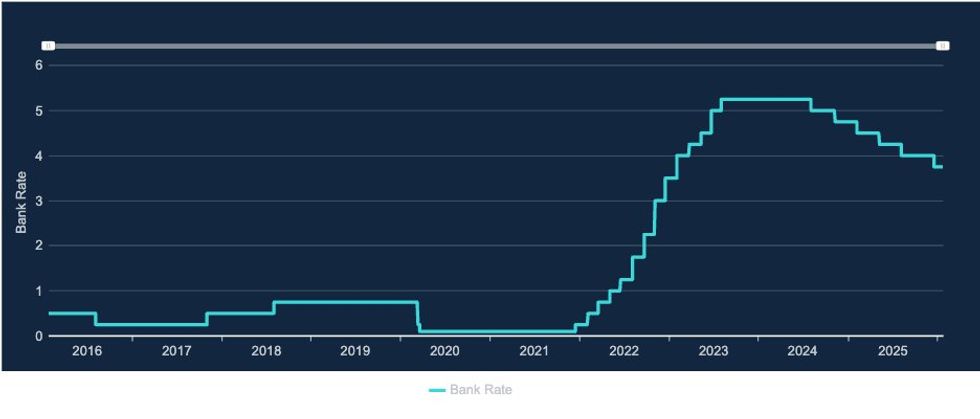

The Bank Rate in recent history | Bank of England

The Bank Rate in recent history | Bank of EnglandPrivate sector pay growth excluding bonuses, which the Bank closely monitors as a gauge of underlying inflationary pressure, eased to 3.6 per cent in the three months to November.

This marked a slowdown from 3.9 per cent in the previous three-month period and suggested some cooling in wage momentum.

Despite this moderation, the overall picture on pay remains mixed, according to the Bank’s latest surveys.

The central bank’s poll of business decision makers pointed to expected pay rises of 3.7 per cent this year, exceeding the level policymakers view as consistent with inflation returning to target.

Separate research from the Bank’s regional agents indicated average pay settlements of around 3.5 per cent.

Alongside labour market weakness, policymakers are also assessing signs of stronger private sector activity following the Budget.

The S&P PMI index, which tracks corporate activity, rose to 53.9 in January, its strongest reading since April 2024.

Official data also showed GDP expanded by 0.3 per cent in November, adding to evidence of near-term economic resilience.

The Bank is expected to factor Budget measures such as postponed fuel duty increases and a freeze on rail fares into its latest economic forecasts.

These projections are likely to show inflation returning to target or potentially undershooting it over the medium term.

Such an outlook would give policymakers scope to keep open the option of another rate cut as early as March.

Bank of England chief Andrew Bailey previously said he is optimistic interest rates could return to two per cent targets by the spring

| PAHowever, some economists have cautioned that the policy outlook becomes less clear if borrowing costs fall closer to levels considered neutral for the economy.

Should interest rates be reduced to 3.5 per cent, borrowing costs would be approaching levels that neither stimulate nor restrain economic activity.

Andrew Wishart, an economist at Berenberg Bank, said: "Although the incoming data do not justify an imminent further rate cut, we expect the story to change as the year progresses."

"It will be difficult for spending and activity to maintain momentum," while forecasting a rate reduction in April.

Rob Wood, an economist at Pantheon Macroeconomics, said the committee was likely to restate its existing guidance while acknowledging the easing cycle may be nearing an end.

He said: "We expect the MPC to reiterate its previous guidance that another Bank Rate cut is likely but the rate cycle is probably close to an end."

Our Standards: The GB News Editorial Charter