Bank of England interest rate predictions: UK inflation cools hopes for significant cuts

The Consumer Price Index has risen to 3.4 per cent as the Bank of England faces a fresh dilemma

Don't Miss

Most Read

Latest

Expectations of an early interest rate cut in 2026 have weakened after official figures showed inflation rose to 3.4 per cent in December, interrupting the steady decline seen in recent months and keeping price growth well above the Bank of England’s two per cent target.

Data published on Wednesday by the Office for National Statistics (ONS) revealed that consumer price inflation increased from 3.2 per cent in November, marking the first monthly rise since June.

The unexpected uptick has prompted analysts to reassess the likelihood of the Bank delivering another cut when its Monetary Policy Committee meets in early February.

David Hollingworth, associate director at L&C Mortgages, said the increase was “not unexpected but is a larger bump than many anticipated”, adding that it “could be enough for the Bank of England to pause any thought of another cut when they meet in February”.

Susannah Streeter, chief investment strategist at Wealth Club, added that a February reduction “hangs in the balance”, but suggested a cut in March “may be more likely”.

The MPC ended 2025 by lowering the base rate to 3.75 per cent in December, the fourth cut of the year after policymakers reduced borrowing costs from 4.75 per cent in response to weak economic growth and rising unemployment.

Even so, the most recent decision was finely balanced, with the committee splitting 5–4 and nearly half of members voting to keep rates at four per cent.

The next interest rate decision is due on February 5.

Bank of England interest rate cuts predicted to slow

| GETTYMost economists still expect one or two further cuts during 2026, but the timing has become more uncertain following the latest inflation data.

Labour market conditions also remain a key concern for the Bank.

Unemployment reached 5.1 per cent in the three months to November, the highest level in five years, while private sector payrolls fell by 55,000 over the same period.

Headline pay growth slowed from 4.6 per cent to 4.5 per cent, and private sector wage growth dropped to 3.6 per cent between September and November, the weakest increase in six years.

LATEST DEVELOPMENTS

Mortgage holders will be hoping for a strong cut on February 5

|GETTY

Public sector pay rose by 7.9 per cent, pushing the overall figure higher.

Economic growth continues to look fragile.

GDP expanded by 0.3 per cent in November, partly due to Jaguar Land Rover restarting production after a cyber attack.

Some economists expect growth of just 0.1 per cent in the final quarter of 2025, while the Bank itself is forecasting flat output.

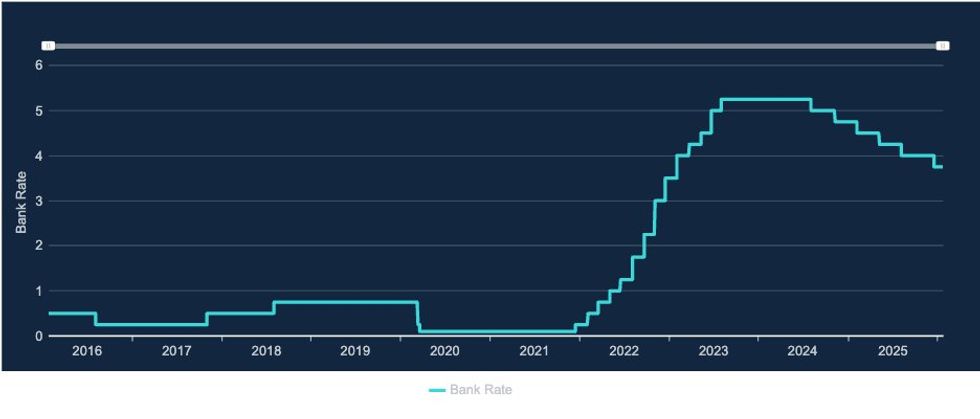

The Bank Rate in recent history

|Bank of England

Financial markets are currently pricing in one or two rate cuts this year, which would take the base rate to between 3.25 per cent and 3.5 per cent.

More optimistic forecasts have also emerged, with economists at Morgan Stanley and Capital Economics predicting rates could fall to three per cent by the end of 2026.

Despite December’s rise, inflation is still expected to ease later in the year.

The Office for Budget Responsibility (OBR) forecasts CPI will average around 2.5 per cent in 2026 and return to the Bank’s two per cent target in early 2027.

The Bank uses interest rates as its primary tool for controlling inflation, and policymakers will have greater scope to lower borrowing costs once price pressures show clearer signs of retreating.