Bank of England warned of 'underlying inflationary pressure' that could delay interest rate cuts

EJ Antoni warns Bank of England 'should be worried' over exit of gold to US |

GBNEWS

Economists are divided on the pace of future rate cuts

Don't Miss

Most Read

Latest

The Bank of England is expected to cut interest rates to 4.25 per cent on Thursday, marking the fourth reduction since August.

However, an expert has cautioned against lowering interest rates too quickly.

Most economists anticipate a 0.25 percentage point cut from the current 4.5 per cent rate, with the Monetary Policy Committee likely to vote 8-1 in favour of the reduction.

Sandra Horsfield, an economist for Investec, described the cut as a "near-certainty" with financial markets already pricing in the move.

The decision comes as inflation dropped faster than expected to 2.6 per cent in March from 2.8 per cent in February, creating room for policymakers to ease borrowing costs.

Despite the encouraging inflation figures, a former Bank of England ratesetter has urged caution on lowering interest rates too quickly.

New Bank of England data is shining a new light on the impact of recent stamp duty changes | GETTY

New Bank of England data is shining a new light on the impact of recent stamp duty changes | GETTY Jonathan Haskel, who served as an external member of the Bank's monetary policy committee between 2018 and 2024, told The Times there remained "a lot more underlying inflationary pressure" in the UK economy.

He pointed specifically to still-high services inflation and persistent wage growth as areas of concern.

Haskel, now a professor of economics at Imperial College London, suggested the central bank should be very cautious in its approach amid these stubborn inflationary pressures.

Services inflation, a measure of domestic price pressures closely watched by the MPC, declined to 4.7 per cent from five per cent in March. This drop was larger than the panel had expected and has been viewed as a positive sign for the economy.

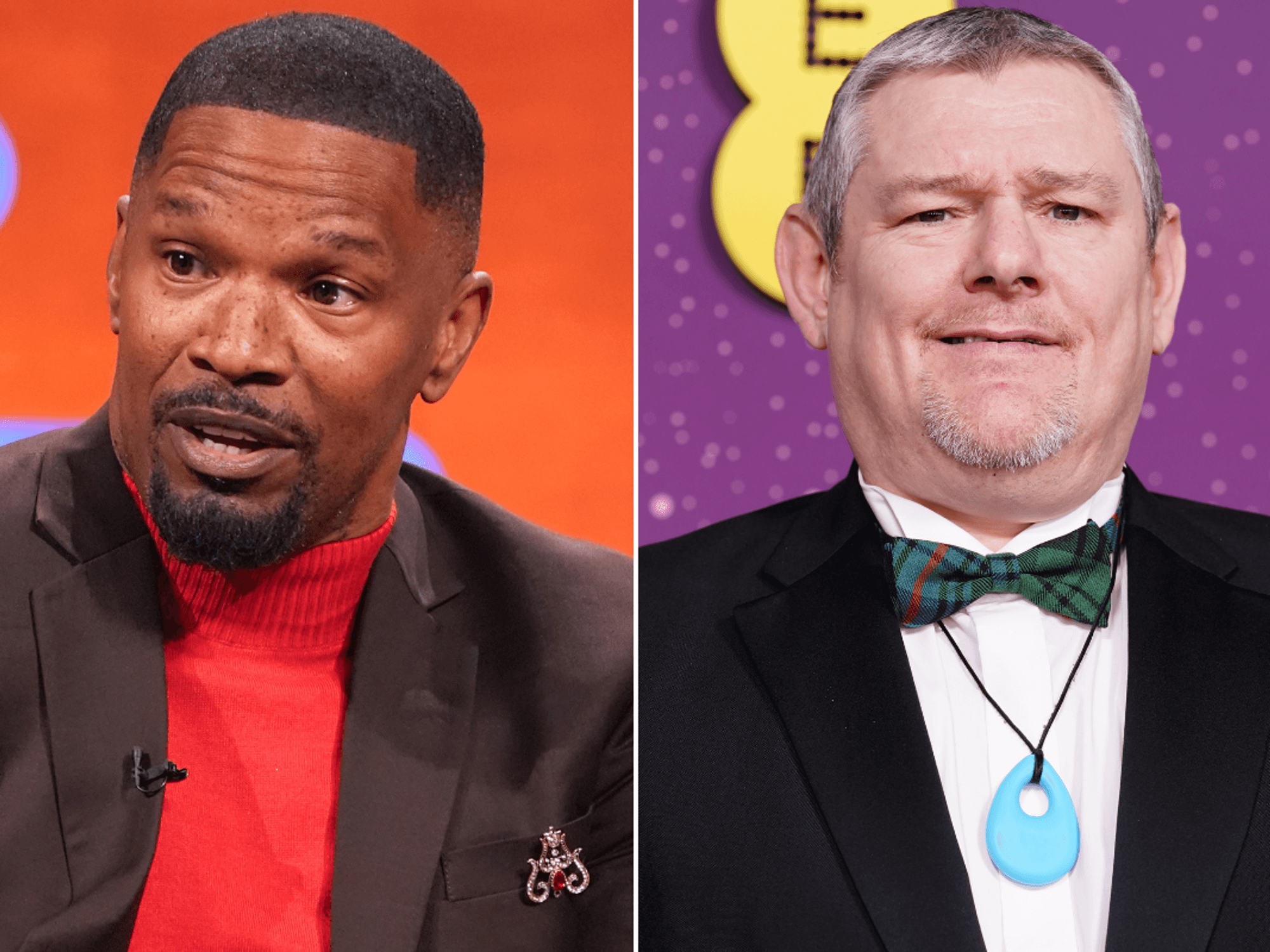

Governor Andrew Bailey has suggested more base rate cuts from the Bank of England are on the way | PA

Governor Andrew Bailey has suggested more base rate cuts from the Bank of England are on the way | PAThis metric has been a key consideration for the Bank of England when assessing underlying inflationary pressures in the economy.

However, a significant factor complicating the Bank's decision-making is uncertainty over President Trump's tariff plans.

Haskel noted that it remains difficult to judge how quickly the Bank of England should cut rates given the uncertainty around whether Trump will fully implement his reciprocal tariff proposals.

He suggested that if Trump pushes through his protectionist trade policies, it would be "very pessimistic for the economy" and likely force the Bank into cutting borrowing costs.

Economists have speculated that products originally bound for the US may be diverted to UK and European markets, potentially increasing supply and putting downward pressure on inflation.

Financial experts suggest several ways pensioners can mitigate their tax burden | GETTY

Financial experts suggest several ways pensioners can mitigate their tax burden | GETTY"The trade diversion argument strikes me as having quite a lot of force," Haskel said. His cautious stance contrasts with views from current MPC members on Trump's tariffs.

He warned that "headline inflation numbers might be flattered" by goods inflation being "very low, possibly even negative" due to the influx of diverted goods.

Current panelist Megan Greene has taken a different position, stating that the levies "represent more of a disinflationary risk than an inflationary risk".

Similarly, external member Swati Dhingra has suggested that "trade diversion away from the US would reduce global price pressures for the UK".

This divergence highlights the complex economic calculations facing the Bank as it navigates post-pandemic inflation and global trade tensions.