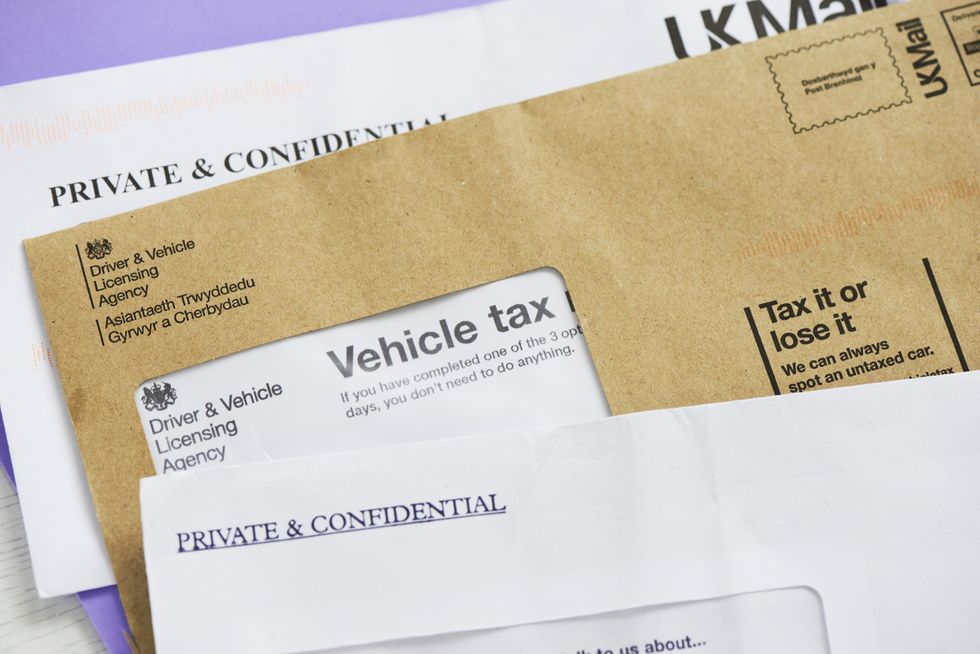

One in three petrol and diesel drivers to struggle amid car tax hikes

Drivers concerned about impact car taxes will have on overall costs

Don't Miss

Most Read

One out of three drivers have shared their concern about the rise in road taxes which is making owning a vehicle more difficult.

According to the latest data, 30 per cent of drivers were worried about upcoming tax hikes which will make it more expensive to travel in the UK.

Other concerns included the rising cost of car insurance with many desperately looking for ways to reduce prices.

Research revealed that 52 per cent of drivers are worried about increasing bills associated with owning a car.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

Fuel prices have been increasing all year

| PACar insurance was ranked the second biggest concern for drivers in the next 12 months behind rising fuel prices (53 per cent).

Other concerns include MOT / servicing costs (37 per cent) and the cost of purchasing a new car (30 per cent).

Due to the price hikes, one in 10 drivers are now asking people to contribute to the cost of petrol when giving them a lift while 39 per cent have had to cut back on how often they drive their car.

Lisa Watson, Director of Sales at Close Brothers Motor Finance, said: “As a motorist it can often feel like you’re being financially hit from all angles."

She detailed that with costs high, drivers are concerned, "whether that’s insurance hikes or the price at the pumps".

“This, combined with the cost of maintaining a vehicle, as well as schemes such as Ulez means simply driving your vehicle from A to B feels like an added luxury rather than an essential part of life,” Watson warned.

She added that to cut costs, many drivers are now having to explore other measures to stretch their finances further.

This includes shopping around for cheaper fuel, car sharing or even getting people to help contribute towards fuel costs.

Watson explained: “As drivers look to make cutbacks this could have a knock-on effect on their next car purchase and in turn, change the type of vehicle they want to purchase.

“For motor dealers it’s essential they ensure they’re stocking the right stock to meet this changing demand. Continuing to utilise insights and tools to monitor trends will be important to ensure they’re stocking the right vehicles for their customers.”

As petrol and diesel drivers continue to get hit with harsh prices, one option to level the playing field is to start taxing electric cars per mile.

Pay-per-mile road tax would replace the current Vehicle Excise Duty. Under the measures, drivers would pay tax based on the number of miles they drive each year instead of paying one lump sum.

LATEST DEVELOPMENTS:

Electric cars to start paying VED next year

| GETTYA pay-per-mile scheme has been unpopular with drivers, but experts at PwC warned this could be the only option.

Other attempts to introduce a pay-per-mile scheme have been met with heavy public criticism with a petition garnering 1.8 million signatures against the idea.

Electric cars will already face new tax laws next year when drivers start paying VED, something they previously were exempt from.