Car finance scandal compensation scheme announced as millions of drivers could be owed £700

WATCH: Millions of drivers could receive compensation from car finance scandal

|GB NEWS

The FCA said compensation payments could begin next year

Don't Miss

Most Read

Latest

The financial regulator has confirmed that a scheme will be launched to offer compensation to victims of the car finance scandal, which could see motorists receive £700 each.

The Financial Conduct Authority has today confirmed that there is sufficient legal clarity to go forward with a compensation scheme.

Once launched, the scheme will cover motor finance agreements taken out between April 6, 2007, and November 1, 2024.

This will impact motor finance agreements where commission was payable by the lender to the broker.

TRENDING

Stories

Videos

Your Say

However, the FCA warned that 14.2 million agreements, or 44 per cent of all agreements made since 2007, will be "considered unfair".

Despite this, successful claimants could receive around £700 per agreement, with the total cost of the scheme potentially reaching a staggering £8.2billion.

The regulator added: "We estimate around 85 per cent of eligible consumers would take part in the scheme, which would mean estimated redress of £8.2billion."

In the "very unlikely event" that 100 per cent of claimants join the scheme, the total compensation amount could cost up to £9.7billion.

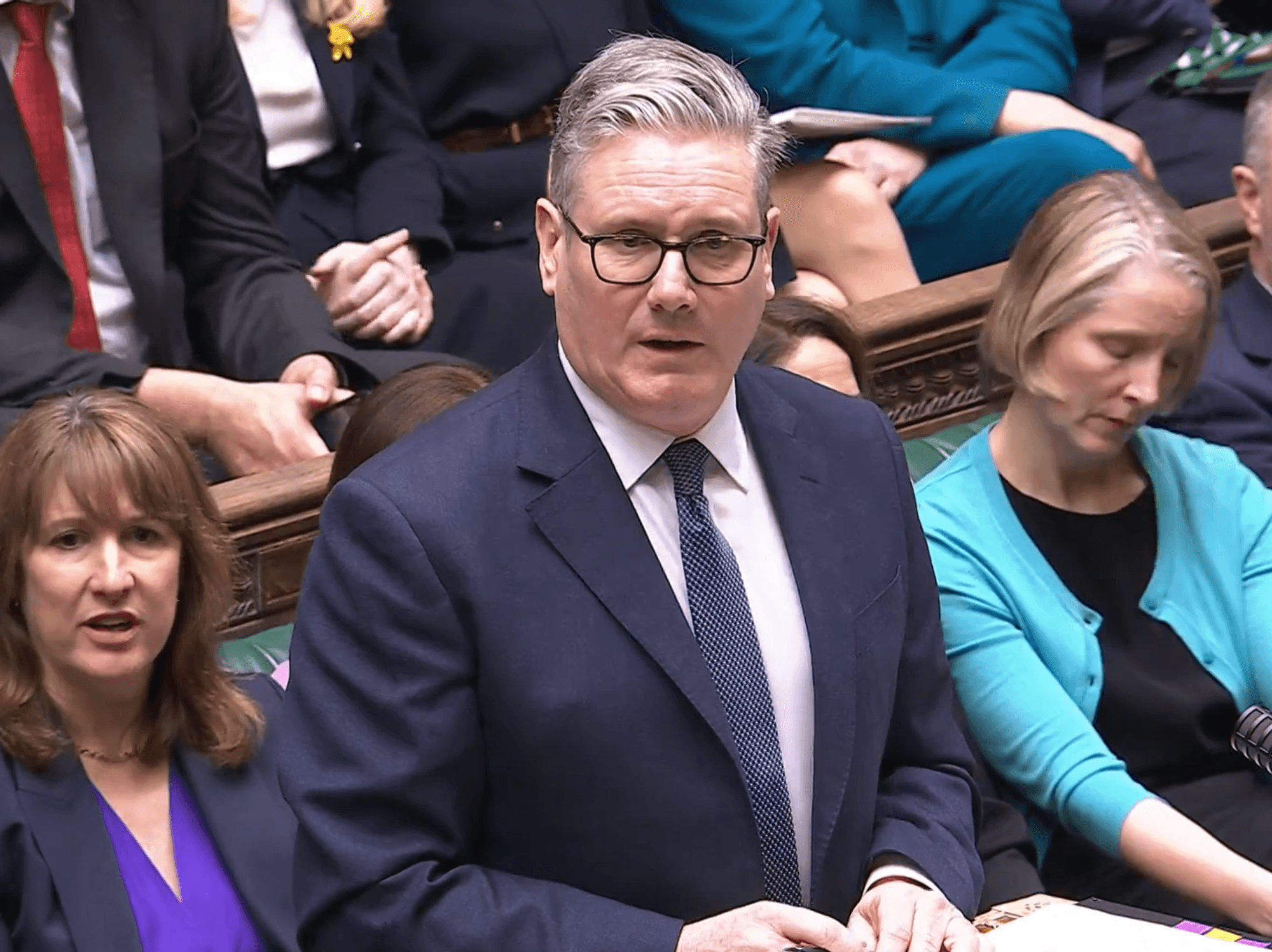

The FCA has set out the conditions around the compensation scheme for motorists impacted by the car finance scandal

| PA/GETTYMotor finance companies broke the law by failing to disclose important information to motorists when they were getting a car finance deal, with consumers being treated unfairly.

The FCA said a compensation scheme is the "best, most efficient way" of getting money back to those impacted by the scheme, especially those who would struggle to claim.

Nikhil Rathi, chief executive of the FCA, said: "We recognise that there will be a wide range of views on the scheme, its scope, timeframe and how compensation is calculated.

"On such a complex issue, not everyone will get everything they would like. But we want to work together on the best possible scheme and draw a line under this issue quickly.

The Supreme Court announced its car finance verdict at the start of August | PA

The Supreme Court announced its car finance verdict at the start of August | PALATEST DEVELOPMENTS:

"That certainty is vital, so a trusted motor finance market can continue to serve millions of families every year."

Research from the FCA found that more than eight in 10 drivers who considered making a claim stated that a compensation scheme would give them the confidence to do so.

The compensation scheme will be free to access for consumers, with the FCA stating that such a scheme would remove barriers and minimise delays in the process.

Once the proposed compensation scheme goes live, lenders will contact those who have already complained. Anyone who has already complained is likely to receive compensation at a quicker rate.

The car finance scandal is expected to be worth around £8.2billion

| GETTYPeople will only receive compensation under the proposed scheme if they weren't informed about at least one of three arrangements between the lender and the broker who sold the loan. This includes:

- A discretionary commission agreement - This allowed the broker to adjust the interest rate the customer paid to obtain a higher commission.

- A high commission arrangement - 35 per cent of the total cost of credit and 10 per cent of the loan.

- A contractual arrangement or tie between the lender and broker - This provided exclusive (or near exclusive) rights to lenders to provide credit.

Consumers can also choose not to take part in the FCA's compensation scheme. In this instance, the case would be taken to court, where they could get more or less compensation.