Yorkshire Building Society launches savings account with 'inspiring' 6% interest rate

Savers urged to be careful of tax on savings interest |

GB NEWS

One of the country's biggest building societies is offering customers a competitive savings interest rate

Don't Miss

Most Read

Latest

Yorkshire Building Society has brought back its £50 Regular Saver for UK Savings Week, marking the second year running for this initiative.

The account provides a six per cent variable interest rate and permits monthly deposits of up to £50 across a year-long term.

Customers can access the account through branches, agencies or digital channels. The terms include three penalty-free withdrawals throughout the period, with additional flexibility for those who need to close their account early.

The relaunch demonstrates the building society's ongoing efforts to foster consistent saving patterns amongst customers, particularly during the national awareness campaign focused on financial habits.

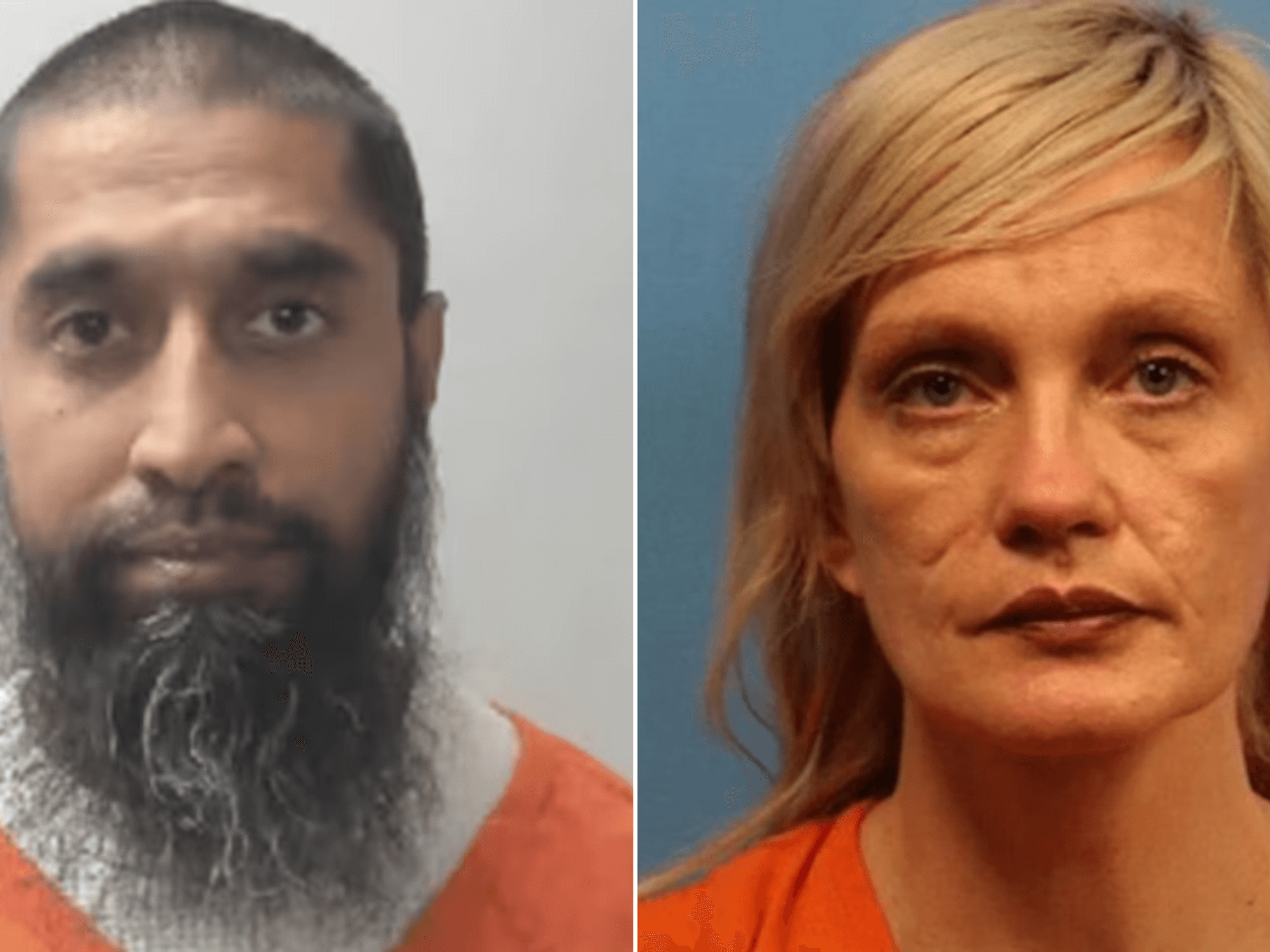

Yorkshire Building Society has launched a new savings account

| GETTYResearch from the University of Bristol's Personal Finance Research Centre, commissioned by Yorkshire Building Society, reveals that consistent savers experience significantly enhanced life satisfaction.

The findings indicate that individuals who save regularly are 66 per cent more likely to report elevated satisfaction with their lives, irrespective of their earnings level.

Pete Lewis, senior savings manager at Yorkshire Building Society, emphasised the importance of developing financial resilience through consistent saving practices.

"We want to inspire a save-first, buy-later mindset helping people put money aside before they spend, so they can reach their goals without falling into debt," he stated.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Britons are looking to boost their savings | GETTY

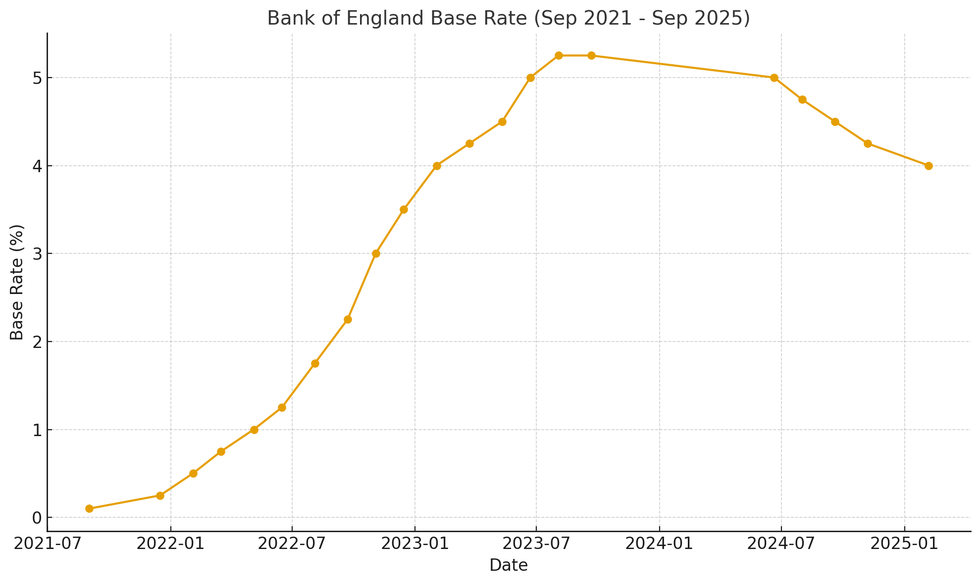

Britons are looking to boost their savings | GETTYSavers have enjoyed an extended period of high interest rates thanks to recent decision-making from the Bank of England over the years.

The central bank's decision to hike the base rate in its fight against inflation has seen savings account on the market offer more competitive deals.

Financial experts are urging savers to secure favourable rates whilst they remain available as interest rates are expected to drop in the months ahead.

Claire Jones, savings expert at Flagstone, warned that prospects for additional base rate reductions this year appear limited given persistent inflation levels.

MEMBERSHIP:

- REVEALED: Embattled Keir Starmer to face voters in 24 hours as pressure mounts on him to resign

- Nigel Farage on collision course with Ed Miliband's climate agenda as new poll reveals surprising results

- Keir Starmer just put the final nail in his party's coffin. But hold off popping the cork - Carole Malone

- EXCLUSIVE: Keir Starmer 'rumbled' before state visit as Donald Trump's team handed embarrassing private letter

- POLL OF THE DAY: Do the courts have too much power in blocking migrant deportations? VOTE NOW

Fixed-term savings accounts are a saver's best defence against stubborn inflation," Ms Jones advised.

She recommended that individuals commit to the longest fixed terms feasible to maintain protection during uncertain economic conditions.

With the Consumer Price Index at 3.8 per cent, opportunities to exceed inflation remain accessible.

Ms Jones highlighted that Flagstone currently lists 92 retail sterling accounts offering returns above this threshold, providing savers with genuine options to preserve their purchasing power.

LATEST DEVELOPMENTS:

How has the Bank of England base rate changed in recent years? | CHAT GPT

How has the Bank of England base rate changed in recent years? | CHAT GPT The £50 monthly saving limit makes the Yorkshire account particularly accessible for those beginning their financial journey.

Mr Lewis highlighted how the product enables customers to establish positive money management routines through manageable amounts.

"Our £50 regular saver offers people a simple, powerful way to take control of their finances and feel good doing so," he explained.

Ms Jones's recommendation to secure rates exceeding 3.8 per cenct, while maintaining a monthly saving routine offers households a comprehensive approach to preserving wealth during challenging economic periods.

More From GB News