Nationwide Building Society offering 'rewarding' free £175 cash bonus - but who is eligible?

Savers urged to be careful of tax on savings interest |

GB NEWS

High street banks and building societies, including Nationwide, are offering new customers free cash if they switch over to their current account deals

Don't Miss

Most Read

Nationwide Building Society has unveiled a new switch incentive worth £175 for customers who transfer their current accounts starting from September 18.

The offer from the UK's largest building society includes access to its FlexDirect account, which provides a market-leading five per cent AER on deposits up to £1,500.

New FlexDirect customers will also benefit from one per cent cashback on purchases made with their debit cards, though this is limited to £5 monthly.

Both the interest rate and cashback benefits apply for the initial twelve months. The incentive requires completion of a full transfer through the Current Account Switch Service (CASS), and previous recipients of Nationwide switching offers cannot participate.

Nationwide Building Society has unveiled a new cash offer

|GETTY / NATIONWIDE

Tom Riley, the director of Group Retail Products at Nationwide Building Society, said: “It's never been more rewarding to be a Nationwide member and that’s why we want to help more people benefit by offering this switching offer!”

The building society offers three account types for switchers who are looking for a more competitive deal from their bank or building society.

These include the FlexPlus account, a packaged account costing £18 monthly that includes worldwide family travel coverage, mobile phone protection and breakdown assistance.

As well as this, switchers can take advantage of Nationwide's FlexDirect account, the online account featuring the five per cent interest rate and cashback rewards; and FlexAccount account, a fee-free standard banking option available both digitally and in branches.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The £175 switching incentive is available to customers who complete a full switch using the Current Account Switch Service | PA

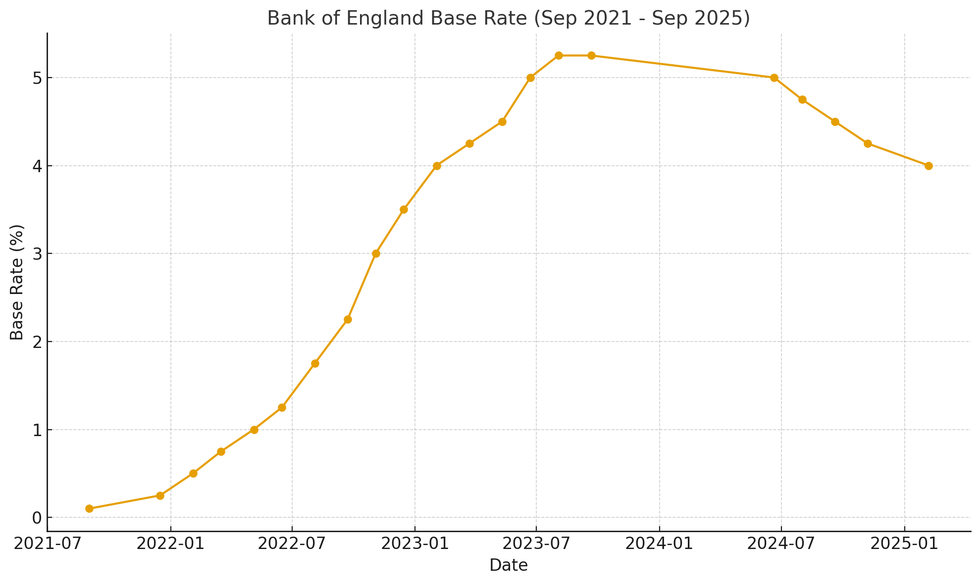

The £175 switching incentive is available to customers who complete a full switch using the Current Account Switch Service | PAThe timing of Nationwide's new offer coincides with declining returns across the savings market following the Bank of England's base rate reduction in August.

Last month, the central bank's Monetary Policy Committee (MPC) voted to clash interest rates from 4.25 per cent to four per cent; a win for borrowers but a blow to savers.

Analysts are warning that competitive savings accounts could see their attached rates slashed in line with the direction of the base rate.

However, yesterday's confirmation that the consumer price index (CPI) inflation rate for the 12 months to August 2025 stayed at 3.8 per cent suggests interest rates will likely remain frozen for the time being.

MEMBERSHIP:

- REVEALED: Embattled Keir Starmer to face voters in 24 hours as pressure mounts on him to resign

- Nigel Farage on collision course with Ed Miliband's climate agenda as new poll reveals surprising results

- Keir Starmer just put the final nail in his party's coffin. But hold off popping the cork - Carole Malone

- EXCLUSIVE: Keir Starmer 'rumbled' before state visit as Donald Trump's team handed embarrassing private letter

- POLL OF THE DAY: Do the courts have too much power in blocking migrant deportations? VOTE NOW

Finance expert Rachel Springall from Moneyfactscompare.co.uk highlighted that savings rates have entered a downward trajectory, with the average rate now standing at 3.46 per cent, representing a 0.34 per cent decrease compared to twelve months ago.

Major high street banks are delivering particularly poor returns, averaging merely 1.52 per cent on easy access accounts according to Ms Springall's analysis.

She warned that "savers pay the price of cuts to the Bank of England Base Rate, and the 0.25% reduction in August has been no exception".

The average easy access rate has dropped below three per cent, prompting Ms Springall to advise immediate action for those holding variable rate accounts that no longer deliver adequate returns.

LATEST DEVELOPMENTS:

How has the Bank of England base rate changed in recent years? | CHAT GPT

How has the Bank of England base rate changed in recent years? | CHAT GPT She noted that merely a quarter of all savings accounts currently exceed four per cent, demonstrating how remaining loyal to providers fails to benefit customers and may result in real-term losses when inflation is considered.

"Now is the time for savers to ditch and switch elsewhere, such as to mutuals or challenger banks that are paying attractive rates," Springall stated.

She suggested that frustrated savers might consider fixed-rate bonds or ISAs offering guaranteed returns above four per cent.

The Bank of England is scheduled to announce its latest decision regarding the base rate later today at around 12pm.

More From GB News