UK house prices have ALREADY crashed 12% and the worst is 'yet to come'

House prices have already fallen 12 per cent in real terms - and a much bigger drop is increasingly likely

|PA

Many mortgage deals have already been pulled and replaced with higher-cost offerings

Don't Miss

Most Read

Latest

House prices have already fallen 12 per cent in real terms - and a much bigger drop is increasingly likely, a leading property expert has warned.

Jonathan Rolande, from the National Association of Property Buyers, has issued a warning that the sector is staring over the precipice.

Speaking exclusively to GB News, he said: "After proving itself more resilient than expected by many, the property market could be set to finally come back down to earth after its ever-upward journey for nearly a decade.

"Aspiring home buyers, landlords and owners are set to be hit with another round of interest rate hikes just as many thought that the worst was behind us.

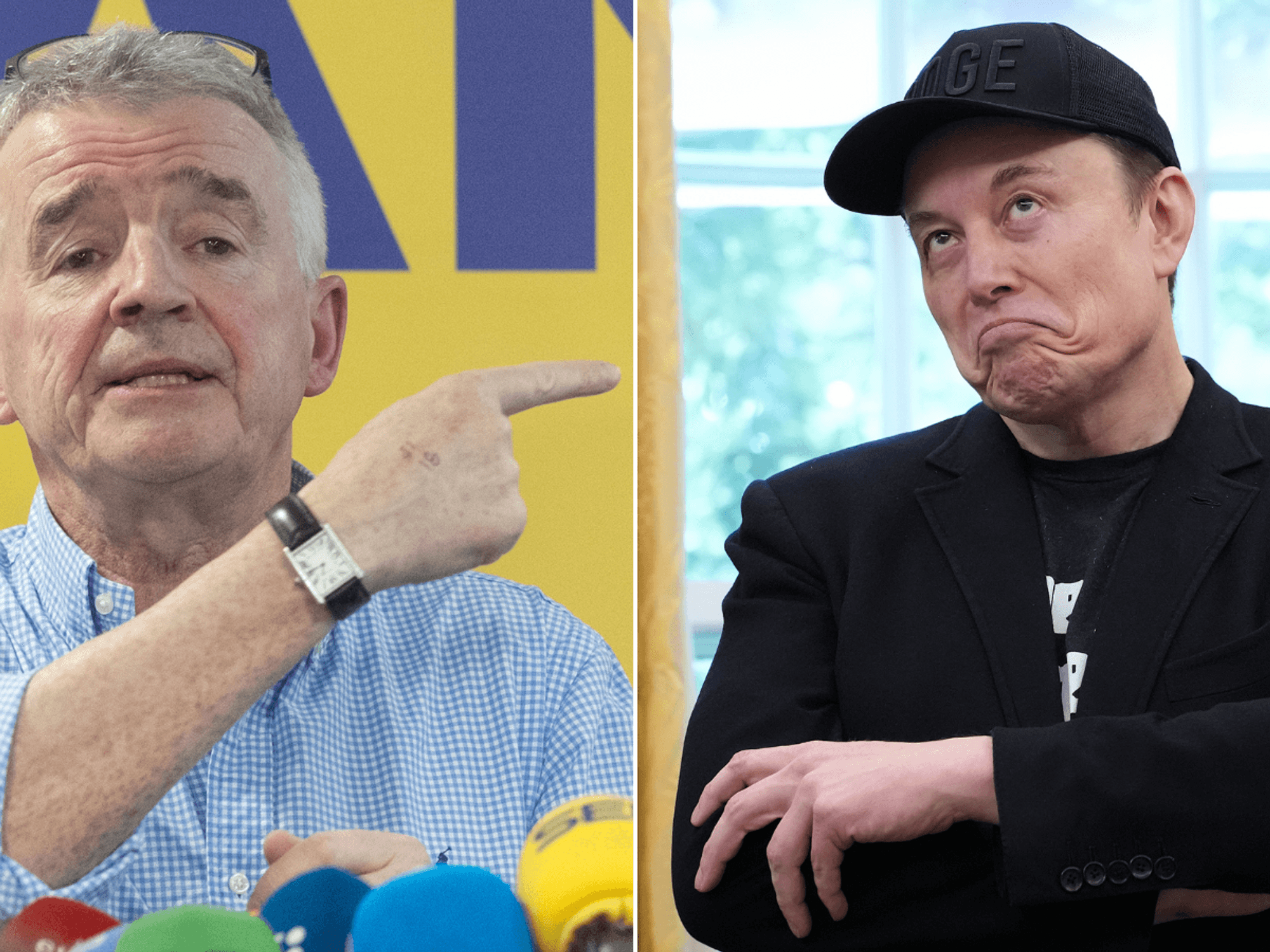

Jonathan Rolande has issued a warning that the housing sector is staring over the precipice

| Jonathan Rolande"Stubborn inflation at nearly nine per cent - a long way from the two per cent target - may lead to a Bank of England rate increase later this month and mortgage lenders have started preparing for it.

"Many mortgage deals have been pulled and replaced with higher-cost offerings.

"A £250,000 mortgage is currently some £400 more expensive than it would have been a year ago."

It comes after the annual house price growth turned negative for the first time since 2012 in May.

Across the UK, the typical property value fell by 0.3 per cent month-on-month, taking it to £286,896 in April, Halifax said.

Rolande added: "Factor in an exodus of landlords increasing the supply of property on the market and the general cost of living and tax burden that is already taking money out of pockets and it's clear to see just why the market is looking over a precipice.

"But will it fall? Sadly, it has already begun.

"Although the headline drop is only around 3 per cent the reality is much worse for sellers. Those that have a pressing reason to sell – divorce, probate, financial problems – may struggle and have to reduce further."

The annual house price growth turned negative for the first time since 2012 in May

| PARecent inflation data has sparked a surge in market interest rates.

Investors were left scrambling to price in more increases in borrowing costs ahead of an expected hike from the Bank of England.

Property expert Rolande added: "What’s more, as real prices are increasing at 9 per cent, the reduction compared to fuel or shopping basket prices is more like 12 per cent already.

"The current set of circumstances means that, in my view, further price falls are very likely. We are not yet in the territory of a full house price crash, but it is the direction of travel unless there is action to avoid it."