Five terrible charts explain why Putin's Russia and communist China are proving more attractive than Britain

GB NEWS

An analysis from the Adam Smith Institute exposes the dire consequences of high taxation

Don't Miss

Most Read

Latest

The UK is haemorrhaging greater numbers of the super-rich than even Vladimir Putin's Russia and Communist China, the latest data shows, with five shocking graphs explaining this wealth flight.

Britain has experienced the world's largest exodus of billionaires over the past two years, with 18 ultra-wealthy individuals departing during 2023 and 2024, according to fresh data from New World Wealth. This mass departure has reduced the UK's billionaire population to just 72 by the end of 2024.

Notably, the figures place Britain ahead of China, which lost 12 billionaires, and India, which saw 10 departures during the same period. Russia experienced eight billionaire exits, representing the second-highest percentage loss after the UK.

These statistics exclude several high-profile departures that occurred after the data collection period. Steel magnate Lakshmi Mittal, chemicals tycoon Nassef Sawiris, and property investors Richard and Ian Livingstone have all left Britain since the beginning of 2025.

Five terrible charts show why Putin's Russia and communist China are more attractive than Britain

|Getty Images/House of Commons Library Briefings / Adam Smith Institute

These high-profile exits followed the Government's announcement of multiple tax increases targeting wealthy individuals, including the abolition of the non-dom regime, VAT on private school fees, and higher capital gains tax rates.

Marc Acheson, a global wealth specialist at Utmost Wealth Solutions, described these findings as "unsurprising" given recent decisions from consecutive Governments.

"This outflow began in March 2024 when the Conservatives announced the end of the resident non-dom regime and then accelerated at pace following the measures announced at the Autumn Budget," he continued, adding: "As an internationally mobile group, they have the means and most incentive to leave."

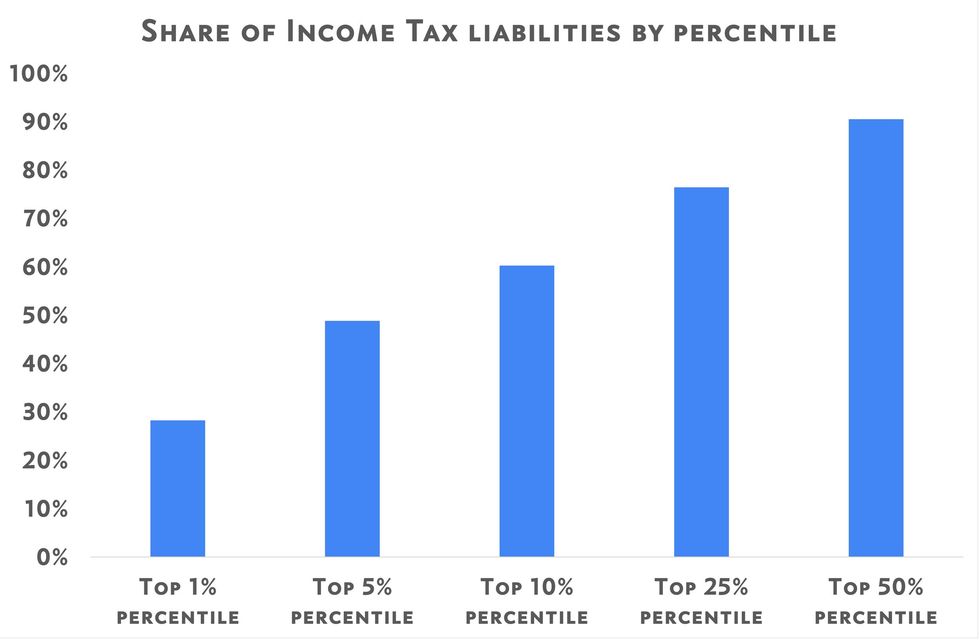

What else explains this?

HM Revenue and Customs (HMRC) figures pulled from the House of Commons Library Briefings and cited by the Adam Smith Institute, found that the top one per cent of Britons pay 29.1 per cent of all income tax in the UK (see chart below).

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Millionaires pay a significantly greater share of taxation than other taxpayers, specifically in income tax

|House of Commons Library Briefings / Adam Smith Institute

The exodus has heightened concerns about the potential impact of a wealth tax, which neither Keir Starmer nor his spokesman have ruled out. Chancellor Rachel Reeves had previously vowed in April not to impose new wealth taxes.

Tax Policy Associates boss Dan Neidle warned against implementing a wealth tax, pointing to unsuccessful attempts in other countries. He said it would be "arrogant" of the Labour Party to assume such a policy would succeed in Britain.

The Government faces pressure to address a roughly £20billion gap in public finances without increasing taxes on "working people". Tax lawyers and wealth advisers have issued numerous warnings that Britain is losing its wealthiest residents at unprecedented rates.

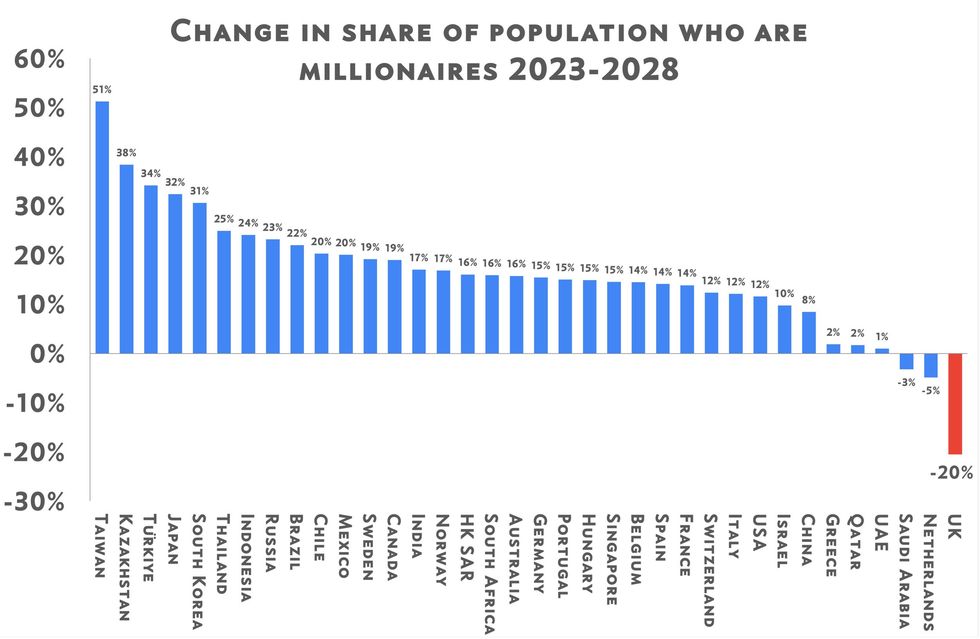

Adam Smith Institute analysis determined that the UK is set to see a 20 per cent slip in the share of the population who are millionaires between 2023 and 2028 (see chart below).

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

|

| ADAM SMITH INSTIUTE

Previous estimates from the Adam Smith Institute determined the recent abolition of the non-dom tax regime would cost the UK up to £111Billion by 2035, and 44,000 jobs by 2030.

Maxwell Marlow, the think tank's director of Public Affairs, explained: "The scale and pace of the exodus of wealth-creators is extremely alarming. What has been a trickle has now become a flood.

"This is going to have a severe impact on the UK economy. Fewer non-doms will mean reduced investment, a lower tax take, worse public services and fewer jobs. And, considering that the Government’s fiscal planning has been based on their assumption that abolishing the non-dom status will actually raise money, this could create a serious hole in the UK’s finances."

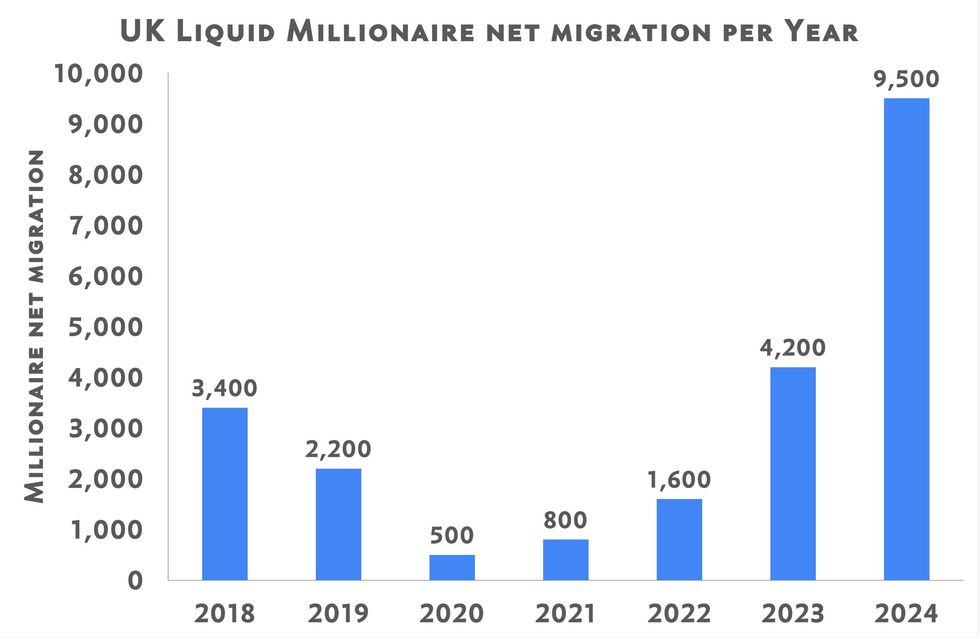

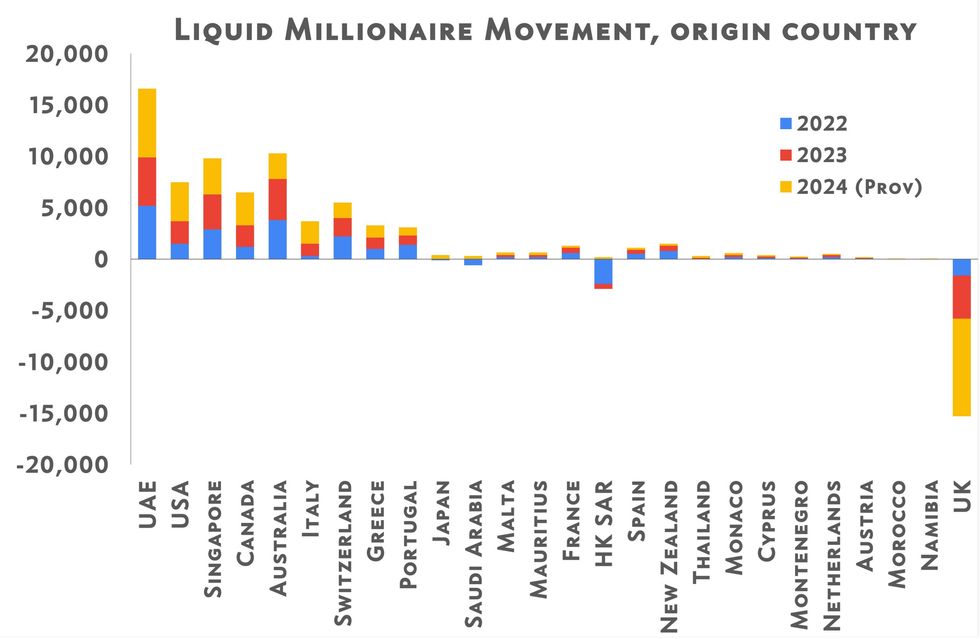

The two graphs below highlight the rapid increase in high-net-worth individuals leaving the UK to escape the existing strict tax regime imposed by HMRC.

Millionaires are fleeing the UK

|Henley Wealth Migration Dashboard 2024

UK-born millionaires are looking for other places to live and invest

|Henley Wealth Migration Dashboard 2024

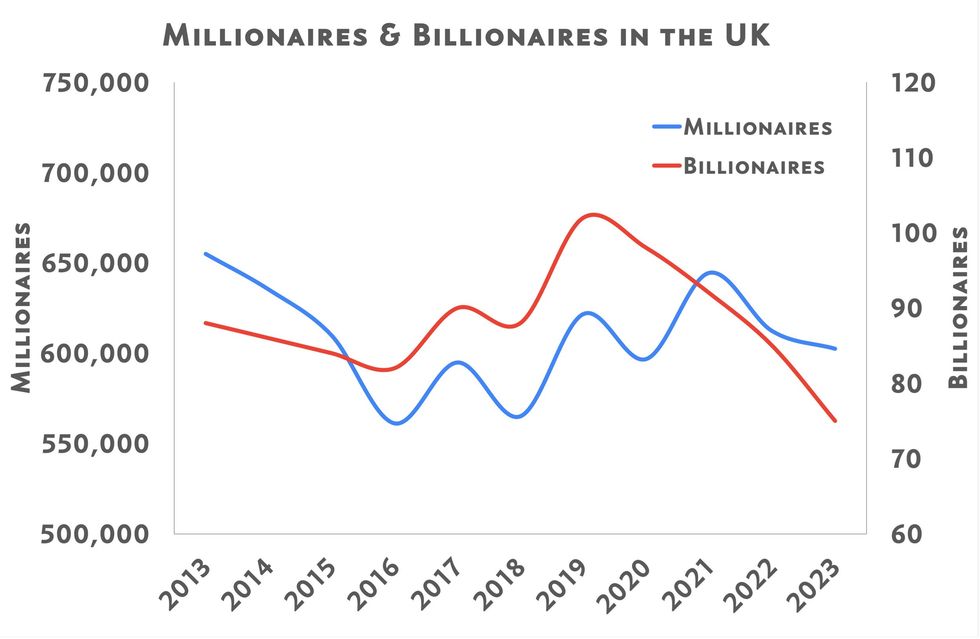

According to the think tank's research, there has been a significant increase in the number of billionaires leaving the country, dropping from 102 in the UK in 2019 down to 75 in 2023 (see chart below).

This represented a staggering 26 per cent drop in one year and is likely to fall further given previous trajectories, although we are unsure as to the extent.

LATEST DEVELOPMENTS:

The number of billionaires and millionaires operating in the UK

|Henley Wealth Migration Dashboard 2024