Triple lock alert: DWP confirms exact amount state pensions will increase by in 2026

The triple lock increases the state pension by inflation, wage increases or 2.5 per cent

Don't Miss

Most Read

Millions of pensioners across the United Kingdom will receive higher weekly payments from April 6 after the Department for Work and Pensions confirmed a 4.8 per cent increase to the state pension.

The uplift will apply to both the new state pension and the basic state pension due to the implementation of the triple lock.

Under the changes, the new state pension will rise to £241.30 per week, up from the current rate of £230.25.

The new state pension applies to individuals who reached state pension age on or after April 6, 2016.

Those receiving the basic state pension under the previous system will see their weekly payments increase to £184.90, up from £176.45.

The rise will take effect from the start of the 2026/27 tax year.

Recipients of Pension Credit will also benefit from the uprating, with payment levels increasing in line with the revised pension rates.

The annual increase follows the triple lock mechanism, which guarantees that the state pension rises each year by the highest of three measures.

These measures are the Consumer Prices Index inflation rate recorded in September of the previous year, average earnings growth measured between May and July, or a minimum increase of 2.5 per cent.

For the 2026/27 financial year, the Average Weekly Earnings index recorded growth of 4.8 per cent during the May to July 2025 period.

That figure exceeded the September 2025 CPI inflation rate of 3.8 per cent, meaning earnings growth determined the size of the increase.

Pensioners are set to receive higher weekly payments under Triple Lock

|GETTY

Pensions Secretary Pat McFadden is legally required to carry out an annual review of benefit and pension rates.

The review assesses whether payment levels remain appropriate when measured against changes in earnings and prices.

The triple lock was introduced in 2010 by the coalition Government of Conservatives and Liberal Democrats.

Its purpose is to prevent the value of the state pension from falling behind either the cost of living or the incomes of people still in work.

Pensioners who receive additional state pension payments, previously known as SERPS or the State Second Pension, will see that element uprated by CPI inflation rather than earnings growth.

LATEST DEVELOPMENTS

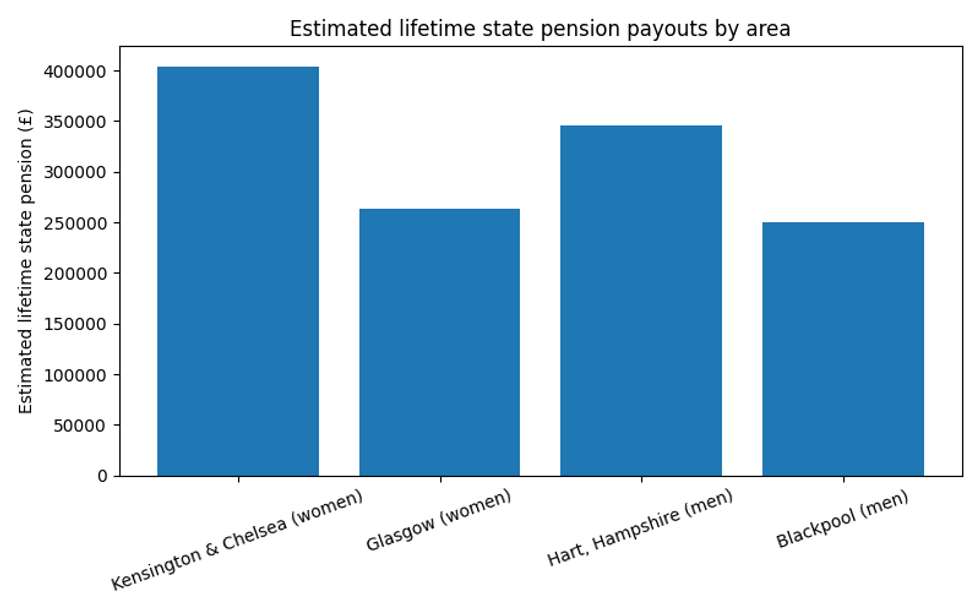

Estimated lifetime state pension payouts by area | ONS/CHATGPT

Estimated lifetime state pension payouts by area | ONS/CHATGPTThe Chancellor confirms pension and benefit rates at the Autumn Budget ahead of the following tax year.

Steve Webb, former Pensions Minister and partner at pension consultants LCP, said the annual uprating plays an important role in protecting incomes.

Mr Webb said: "With households continuing to face a high cost of living and further increases in bills such as Council Tax, these annual upratings are vital to make sure that pensioner living standards are protected against inflation."

The state pension forms the main source of income for many retired households.

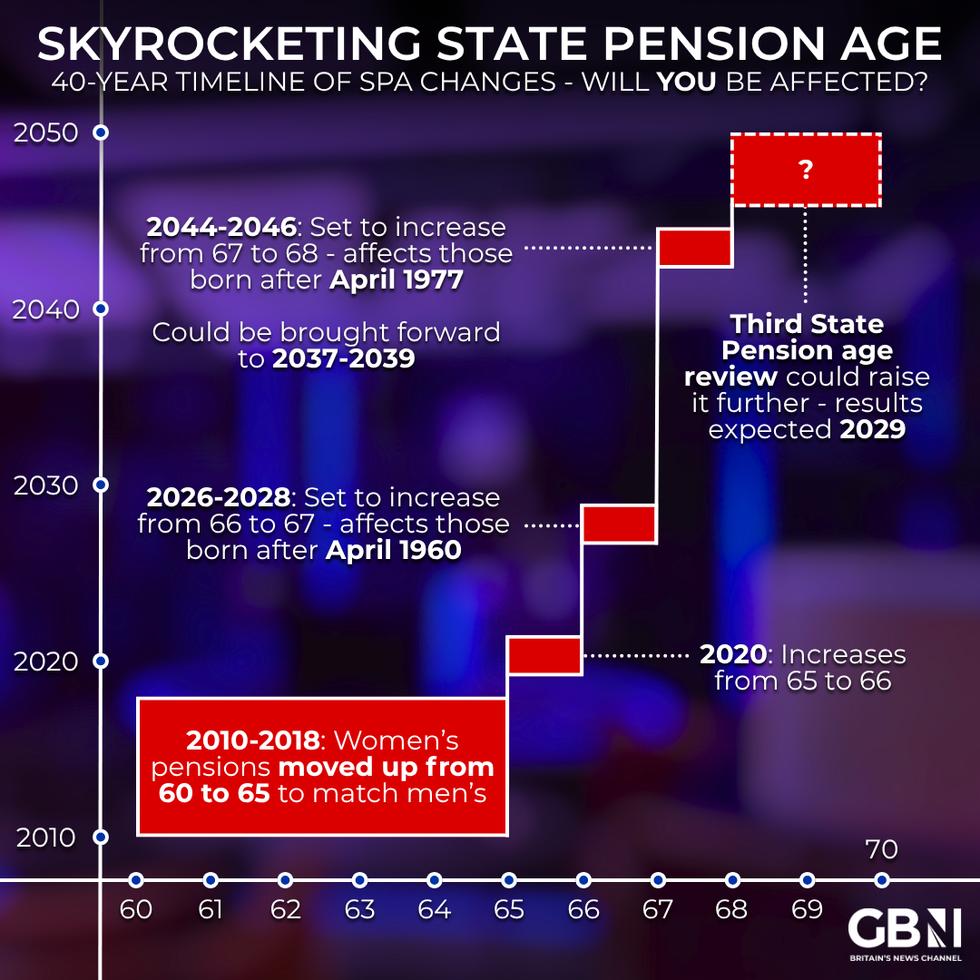

Are you affected by state pension age changes?

|GETTY

Changes to payment levels are closely watched by pensioners and financial advisers, particularly during periods of economic volatility.

The 4.8 per cent increase reflects wage growth recorded across the wider economy during the measurement period.

The Government has previously stated that it remains committed to maintaining the triple lock for the duration of the current Parliament.

Full details of the revised payment rates will be published by the DWP ahead of the April implementation date.