State pension 'unaffordable' for future retirees but Britons refuse reform to DWP payment

The British public are resistant to state pension changes

Don't Miss

Most Read

Latest

A majority of Britons believe state pension payments for future retirees are "unaffordable" in their current reform but reject measures to reduce the benefit's expense on public spending, according to new poll.

YouGov's latest survey found that 52 per cent of British people do not think the current state pension status quo will be affordable for current working-age people in their 30s and 40s.

In contrast, 19 per cent of the 2,063 adults polled believe the state pension will remain affordable for future generations while 29 per cent do not know the benefit will or not.

This latest polling from YouGov surveyed multiple European counties, including France, Germany, Spain, Italy, Poland and the UK to determine the general public's thoughts about retirement.

Britons believe the state pension is unaffordable but are not in favour of reforms to the benefit

|GETTY

While the majority of people in each country believe the state pension's future is not guaranteed, reforms to bring down the benefit's cost, such as raising the retirement age, are widely opposed.

Notably, pensioners in the UK appeared to be more optimistic about the Government's capability to fund the Department for Work and Pensions (DWP) benefit going forward.

Some 62 per cent of British retirees consider the state pension to be affordable going forward, while only 27 per cent of non-retired individuals were of the same opinion.

Despite acknowledging the benefit's current fiscal unsustainability, majorities of between 53 per cent and 83 per cent in all nations polled think retirees do not receive enough from payments.

How much will the state pension triple lock cost the British taxpayer? | OBR

How much will the state pension triple lock cost the British taxpayer? | OBR Pensioners are more likely to share this train of thought with between 72 per cent to 88 per cent of retirees believing the state pension does not provide enough support.

Concerningly, most retirees in Europe appear to rely on a state pension for their retirement income and majorities in each country polled are not confident they will have a comfortable retirement.

There was particular opposition among survey respondents to raising the state pension age, hiking taxes on working-age people and reducing the amount offered by payments.

Each proposal has been previously suggested by economists and analysts to make the state pension more affordable for future generations.

What has the impact of the state pension triple lock been on the public's finances | OBR

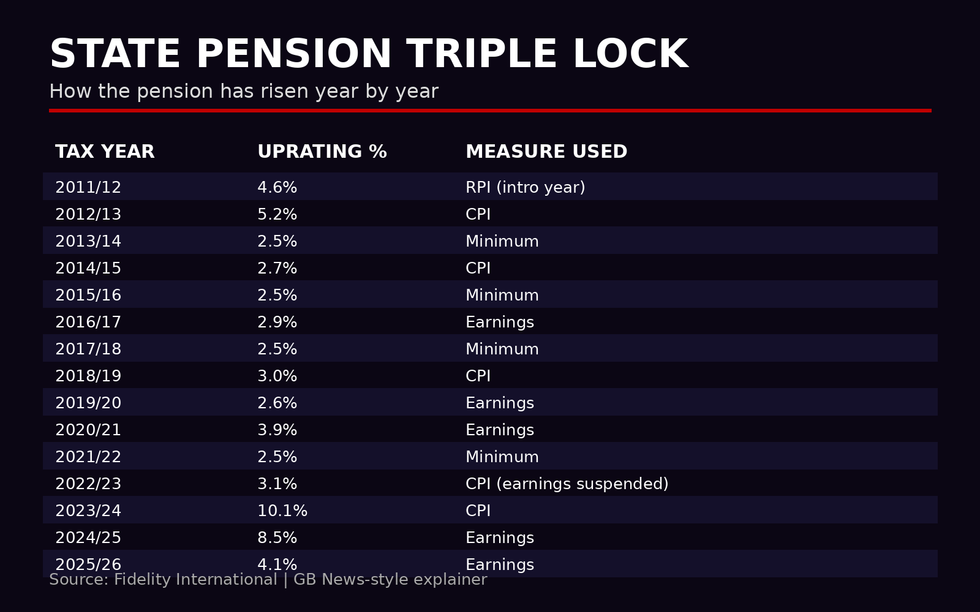

What has the impact of the state pension triple lock been on the public's finances | OBR The Office for Budget Responsibility (OBR) has previously forecast that the state pension triple lock will cost the taxpayer £10billion more than initially forecast by 2029.

Under the triple lock, state pension payment rates are raised by the consumer price index (CPI) rate of inflation, average wage growth or 2.5 per cent; whichever is highest.

Chancellor Rachel Reeves pledged to keep the triple lock in place until at least the end of this Parliament in 2029 during her Budget statement in November last year.

In reaction to this, Mike Ambery, retirement savings director at Standard Life, said: "The commitment to keep the triple lock stays, for now, but there are significant questions around its long-term sustainability.

LATEST DEVELOPMENTS

How much has the state pension risen by thanks to the triple lock? | GB NEWS / FIDELITY INTERNATIONAL

How much has the state pension risen by thanks to the triple lock? | GB NEWS / FIDELITY INTERNATIONAL "The state pension is funded by the workers of today, and its costs are set to swell over the coming years as more of our ageing population reach state pension age.

"Any future reforms or changes to the triple lock will need to carefully balance its long-term affordability with the sizable political risks associated with changing a policy affecting millions of people.

"The state pension age review alongside the revived Pensions Commission, presents a unique opportunity to look at the pension system as a whole, including whether the triple lock continues to serve its intended purpose effectively."

More From GB News