State pension: Major change next year could see you waiting longer for payments

Pension costs currently stand at £125billion

Don't Miss

Most Read

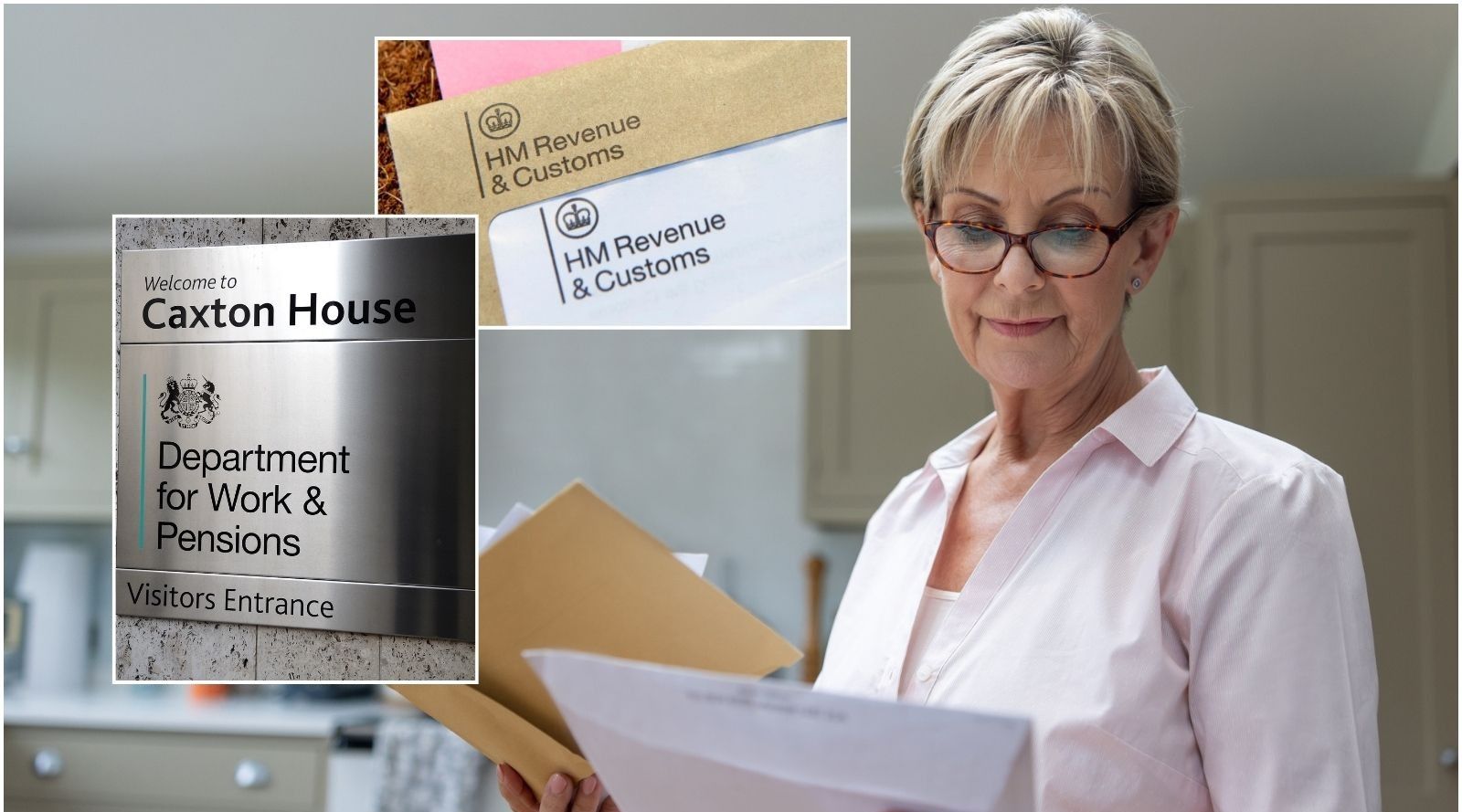

Millions of people approaching retirement will need to wait longer to receive their state pension following changes taking effect in the spring.

From April 6, 2026, the qualifying age for claiming the state pension will start climbing from 66 towards 67.

Rather than an immediate jump, the increase will be phased in gradually over a two-year period, with the process concluding in April 2028.

The shift comes as the Treasury faces mounting pressure from rising pension costs, currently standing at approximately £125billion annually.

With life expectancy continuing to grow, expenditure on the state pension is projected to increase further in the coming years.

The triple lock guarantee alone is forecast to cost £15.5billion per year by 2030.

The change will not affect everyone equally, with the impact depending on when individuals were born.

Those with birthdays falling between 6 April 1960 and 5 March 1961 will see their pension age set somewhere between 66 years and one month and 66 years and 11 months.

The exact qualifying age within this range is determined by the specific date of birth.

Anyone born on or after 6 March 1961 will face a pension age of 67.

The exact qualifying age within this range is determined by the specific date of birth

|GETTY

People born after 1961 can expect to wait even longer before accessing their payments.

Between 2044 and 2046, the threshold is scheduled to climb to 68.

This means anyone currently aged around 48 years and three months or younger will have a state pension age of 68.

However, a review initiated earlier this year could accelerate these timelines significantly.

The government assessment, originally scheduled for 2029, has been moved forward to 2027.

This earlier review opens the possibility that the pension age could eventually reach 69 or even 70.

LATEST DEVELOPMENTS

An increase to state pension age from 66 to 67 is set to happen in the next few years

| GETTYRahel Vahey, head of public policy at AJ Bell, said: "An increase to state pension age from 66 to 67 is already slated to happen between 2026 and 2028. But it's less clear what will happen after that.

"There is also an increase to age 68 pencilled in for 2046, but a faster increase is definitely on the cards.

"The first two reviews of the state pension age advocated bringing this forward, but successive governments have treated the issue like a hot potato."

Despite the uncertainty around future changes, pensioners will see their payments increase from April thanks to the triple lock mechanism.

Those qualifying for the full new state pension will receive £241.30 per week

|GETTY

Those qualifying for the full new state pension will receive £241.30 per week, equivalent to £12,547.60 over the year.

Individuals who reached retirement before April 2016 and remain on the basic state pension system will see their annual payments rise by roughly £439 to £9,614.80.

For some, the prospect of delayed access to these funds is deeply concerning.

Nicola Jones, 58, left her mental health role to care full-time for her partner Tracy, 54, who has MS.

"We're really struggling as it is, and we would rely on the pension coming in and just easing our life really and just making it less stressful, and now it's going to get pushed back and back. I mean, I've heard it could be going up to 70," she said.