UK economy records biggest ever budget surplus after Rachel Reeves rakes in billions more than expected on capital gains tax

January surplus hits record £30.4billion as capital gains tax receipts surge

Don't Miss

Most Read

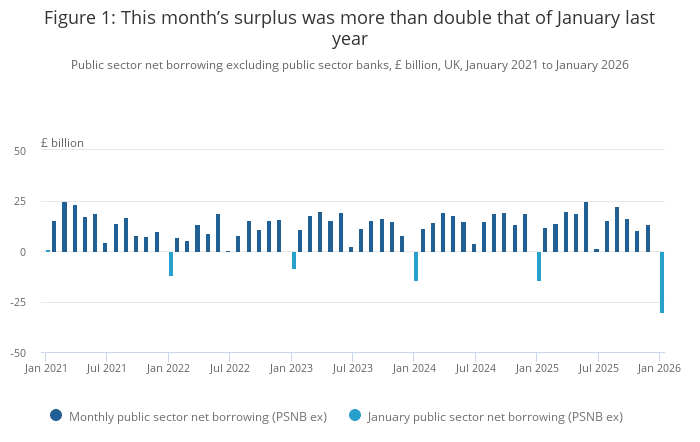

The UK Government recorded an unprecedented £30.4billion surplus in January, marking the strongest monthly performance since official records commenced in 1993.

The figure exceeded forecasts from the Office for Budget Responsibility (OBR) by £6.3billion.

The January surplus, where the Government takes in more money in taxes than it spends, represented a dramatic improvement on the previous year, coming in £15.9billion higher than the £15.4billion recorded in the same month of 2025.

City analysts had anticipated a surplus of approximately £23.8billion, making the actual result significantly better than market expectations.

TRENDING

Stories

Videos

Your Say

UK posts record £30.4billion January surplus as tax receipts beat forecasts

|GETTY

January typically produces stronger Government finances due to self-assessed tax payments flowing into Treasury coffers, though this year's figure was exceptional by historical standards.

A surge of £17billion in capital gains tax payments to HMRC proved instrumental in pushing the surplus to record levels, according to the Office for National Statistics (ONS) figures.

The Treasury's decision to freeze income tax thresholds also contributed substantially, generating an additional £3.6billion compared with the previous January as rising wages pulled more earners into higher tax brackets.

Lower debt interest costs provided further relief to the public purse, helping to counterbalance increased expenditure on public services and benefits.

Over the ten months to January, total borrowing stood at £112.1billion, representing an 11.5 per cent reduction on the equivalent period last year.

The ONS noted this remained the fifth-highest borrowing figure for that timeframe on record, despite the monthly improvement.

Separate figures showed retail sales rebounded strongly last month, climbing 1.8 per cent following December's modest 0.4 per cent gain.

The increase marked the largest monthly rise since May 2024, far outstripping economist predictions of just 0.2 per cent growth.

Online retailers experienced particularly robust demand for jewellery and sports supplements, with artwork and antiques also performing well.

The ONS reported that the total volume of goods purchased rose substantially, measuring the actual quantity bought rather than spending value.

Surplus figures were better than expected

|ONS

Looking at a broader timeframe, sales edged up 0.1 per cent across the three months to January.

The statistics office also revised its November estimate downward, now showing a 0.4 per cent decline rather than the 0.1 per cent fall previously reported.

Chief Secretary to the Treasury James Murray responded to the figures by stating: "We have the right plan to build a stronger, more secure economy.

"We have doubled our headroom, we are bringing inflation down, we are making sure that taxpayers' money is spent wisely, and borrowing this year is forecast to be the lowest since before the pandemic."

Mr Murray added: "We know there is more to do to stop one in every £10 the Government spends going on debt interest, and we will more than halve borrowing by 2030-31 so that money can be spent on policing, schools and the NHS."

Paul Dales, chief economist at Capital Economics, said the data would give Chancellor Rachel Reeves "something positive to point to" ahead of her Spring Statement on March 3.

However, Mr Dales cautioned that retail gains from sports supplements may prove temporary as new year fitness enthusiasm wanes, particularly given slowing wage growth and unemployment reaching a five-year peak.

More From GB News