Stealth tax raid forces millions of Britons to 'effectively donate £100,000s to HMRC'

Britons are being warned about the impact of fiscal drag on their tax bill

Don't Miss

Most Read

A Freedom of Information (FoI) request has revealed that 5.6 million people across the UK paid more tax than necessary last year, with the total amount owed reaching a staggering £3.5billion.

Digital wealth manager Moneyfarm has responded by publishing fresh guidance aimed at helping taxpayers understand the consequences of frozen income tax bands.

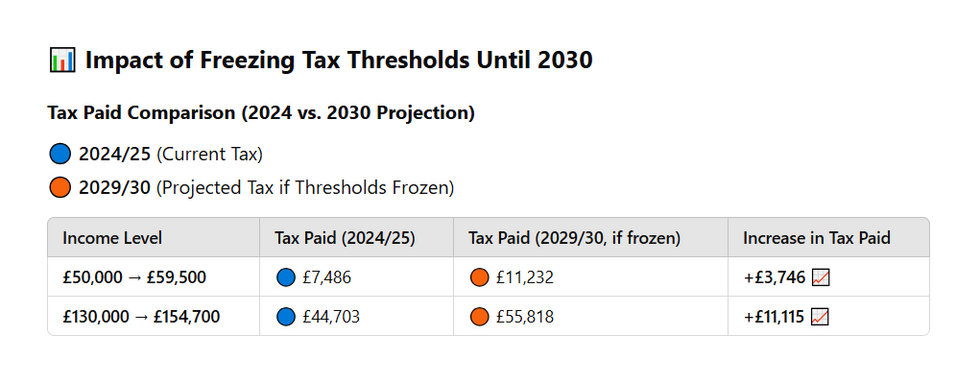

The Government has maintained the current thresholds for the 2025/26 tax year, with the 40 per cent higher rate kicking in at £50,270 and the 45 per cent additional rate applying to earnings above £125,140.

These bands will remain static until at least 2028, dragging increasing numbers of workers into higher tax brackets.

Britons are being warned about the impact of fiscal drag on their tax bill

|GETTY

As wages climb in line with inflation, workers find themselves automatically pushed into steeper tax bands without experiencing any genuine increase in purchasing power.

This effect, commonly referred to as fiscal drag, is now hitting millions of employees across the country. The phenomenon is no longer confined to traditionally wealthy earners.

Professionals, including teachers, nurses, and middle managers are discovering they have been pulled into the 40 per cent bracket or even face the punishing 60 per cent effective rate.

Those earning above £100,000 encounter a particularly harsh cliff edge, as their £12,570 personal allowance is clawed back at £1 for every £2 earned beyond this threshold.

What could frozen tax thresholds mean for you? | GBN

What could frozen tax thresholds mean for you? | GBNThis effective 60 per cent marginal rate persists until income reaches £125,140, and parents crossing the £100,000 mark also forfeit access to valuable childcare funding.

Moneyfarm has outlined three essential steps for managing tax obligations effectively.

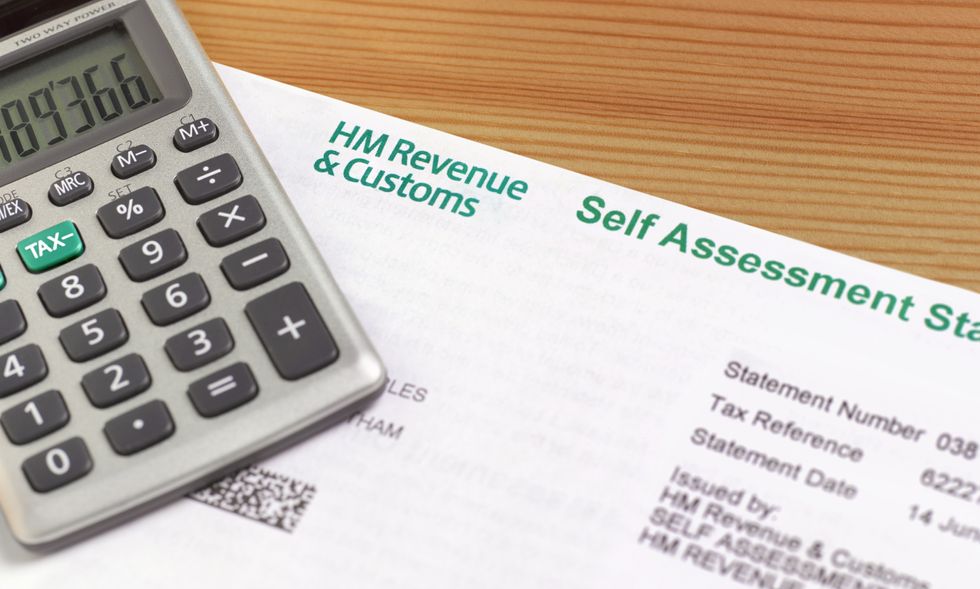

First, while pension contributions automatically attract 20 per cent relief at source, those in higher bands must file a self-assessment return to reclaim the additional 20 per cent or 25 per cent they are entitled to.

Second, charitable donations made through Gift Aid require similar action, as individuals must claim their higher rate portion separately through self-assessment.

LATEST DEVELOPMENTS

Third, taxpayers can preserve their personal allowance by keeping income below £100,000 through pension contributions, salary sacrifice arrangements, or distributing earnings across different tax years.

Carina Chambers, a pensions technical expert at Moneyfarm, said: "Many higher earners are failing to reclaim the additional tax relief they are due, particularly on pension contributions and charitable donations.

"With more people now pulled into higher and additional rate bands, the self-assessment process has become essential, not only to stay compliant, but to ensure you're not leaving significant sums you're entitled to unclaimed."

She added: "Without completing a self-assessment return, these individuals are effectively donating hundreds or thousands of pounds to HMRC that they could legally keep. We're urging anyone earning above £50,000 to review their position immediately."

Self-employed individuals need to file their tax returns | GETTY

Self-employed individuals need to file their tax returns | GETTYSpeaking to Newspage, founder and chief people strategist at Kate Underwood HR and Training, Kate Underwood, discussed the impact of frozen tax thresholds.

Ms Underwood shared: "Freezing income tax thresholds is a tax grab dressed up as 'stability'. It lets the Government pretend they have not raised taxes while quietly draining more out of every pay packet.

"For small businesses, it is grim. You are pushed to give pay rises because staff are hurting. You pay more in wages, National Insurance, and pensions. Then frozen thresholds swipe a bigger slice, so your team still feels skint, and you look tight.

"It kills goodwill, ramps up wage pressure and leaves less cash for hiring, training and keeping the lights on. So yes, it is controversial. The Government gets the headline. HMRC gets the money. Small businesses get the bill and the blame."

More From GB News