State pension payments could rise by £2,400 a year WITHOUT triple lock - what you need to do

Britons are being reminded of the benefits that come from deferring state pension payments

Don't Miss

Most Read

State pension payment rates can be boosted by an extra £2,400 annually, or £50 a week, for Britons if they choose to make a significant retirement choice, a major financial services firm has revealed.

New figures obtained through a Freedom of Information (FoI) request reveal that nearly 42,000 individuals collected a state pension they had previously chosen to postpone during the 2023/24 financial year.

The data, secured by Royal London, shows precisely 41,938 people finally began receiving their delayed pension payments, benefiting from enhanced weekly amounts as a reward for waiting.

This represents a significant downturn compared to the preceding year, when more than 54,000 people made similar claims. Among those who eventually claimed, roughly one quarter had held off for at least five years, while 4,435 individuals had waited a decade or longer before accessing their entitlement.

State pension payments could be boosted by £50 a week, or £2,400 a year, for those who defer

|GETTY

Perhaps most striking are the "super-postponers", which is the term used to describe individuals who waited more than three decades before finally drawing their state pension.

The FoI data revealed that 591 people had not touched their entitlement for 20 years or more after becoming eligible. The 25 longest deferrals averaged an extraordinary 32 years, meaning these pensioners first qualified for payments back in 1991/92.

At that time, men could claim at 65, while women became eligible at 60. Given these timelines, the majority of these extreme postponers would now be in their nineties, with some potentially having reached their centenary.

Those who delayed before April 2016 benefited from considerably more generous terms, receiving a 10.4 per cent annual uplift compared to the current rate of 5.8 per cent.

Are you affected by state pension age changes? | GETTY

Are you affected by state pension age changes? | GETTYLATEST DEVELOPMENTS

What has the impact of the state pension triple lock been on the public's finances | OBR

What has the impact of the state pension triple lock been on the public's finances | OBR Under the current deferral framework, the state pension grows by one per cent for every nine weeks someone delays claiming, translating to 5.8 per cent annually under current rules.

Those who postponed for the average period of four years gained roughly £50 additional weekly income. However, the financial wisdom of delaying depends heavily on individual tax circumstances and longevity.

Someone putting off their pension for twelve months from January 2026 would sacrifice nearly £12,000 in missed payments, assuming full entitlement to the new state pension.

In return, they would receive £243.60 weekly upon claiming in 2027, equating to £694.72 extra annually before any triple lock increases. Basic rate taxpayers would need to survive until approximately 82 to break even, whilst higher earners paying tax on income exceeding £50,270 would recoup their losses by age 79.

How much will the state pension triple lock cost the British taxpayer? | OBR

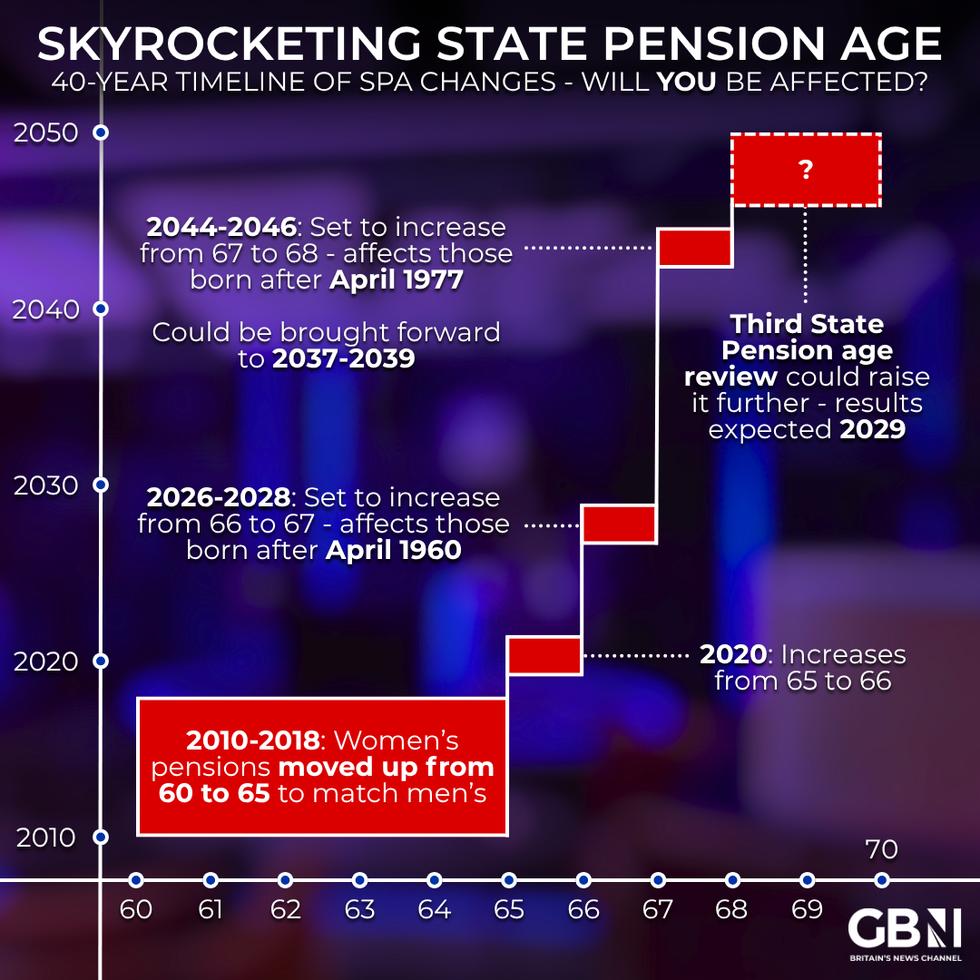

How much will the state pension triple lock cost the British taxpayer? | OBR Sarah Pennells, a consumer finance specialist at Royal London, said: "With the state pension age now at 66 and due to start rising to 67 from April, many people are only too keen to claim their State Pension.

"However, our figures show that some people, for whatever reason, are delaying getting their state pension payments. The numbers deferring in 2023/24 have fallen quite dramatically from the previous year, which could be because fewer pensioners are able to manage without the state pension."

She noted that with the new state pension expected to rise to just below the personal allowance from April, more people with additional income streams might consider deferring to reduce their tax burden.

"If you're thinking of delaying claiming your state pension, then it's a good idea to assess whether it is right for you," Ms Pennells advised, adding that the less tax someone pays, the less beneficial postponement becomes.

More From GB News