Taxpayers face £39billion bill for public sector pensions

Rising employer contributions have pushed annual costs much higher

Don't Miss

Most Read

British taxpayers are facing a £39billion bill to fund public sector pensions this year, according to official figures released today.

The cost marks a 26 per cent increase compared with 2023-24, following a rise in employer contribution rates introduced to address the growing expense of supporting existing retirees.

Employer contributions were increased by as much as eight percentage points from April 2024 across the main schemes.

Around 3.5 million workers employed across the NHS, the teaching profession, the civil service and the armed forces are members of public sector pension schemes.

TRENDING

Stories

Videos

Your Say

The increase comes as public finances remain under pressure, with the long-term cost of pension commitments continuing to draw scrutiny.

Figures taken from official scheme reports published last month show employer contributions across the four largest public sector pension schemes are projected to reach £38.7billion in 2025-26.

Public sector employees themselves contribute around a quarter of the total cost of their pensions.

The remaining majority of funding is met by taxpayers.

Rising employer contributions have pushed annual costs much higher

|GETTY

Data also highlights a widening gap between public and private sector pay growth, with Office for National Statistics (ONS) figures showing public sector wages rose by an average of 7.9 per cent in the year to October.

This compares with growth of 3.6 per cent in the private sector over the same period.

Think tanks have raised concerns about the sustainability of the current system. Karl Williams, a researcher at the Centre for Policy Studies, said: "These pension costs are completely unsustainable given the pace of economic growth."

He said employer contribution rates had risen far faster than the wider economy.

Mr Williams said: "Economic growth of around 2.3 per cent between mid-2023 and late 2025 cannot support employer contributions increasing at more than ten times that rate."

LATEST DEVELOPMENTS

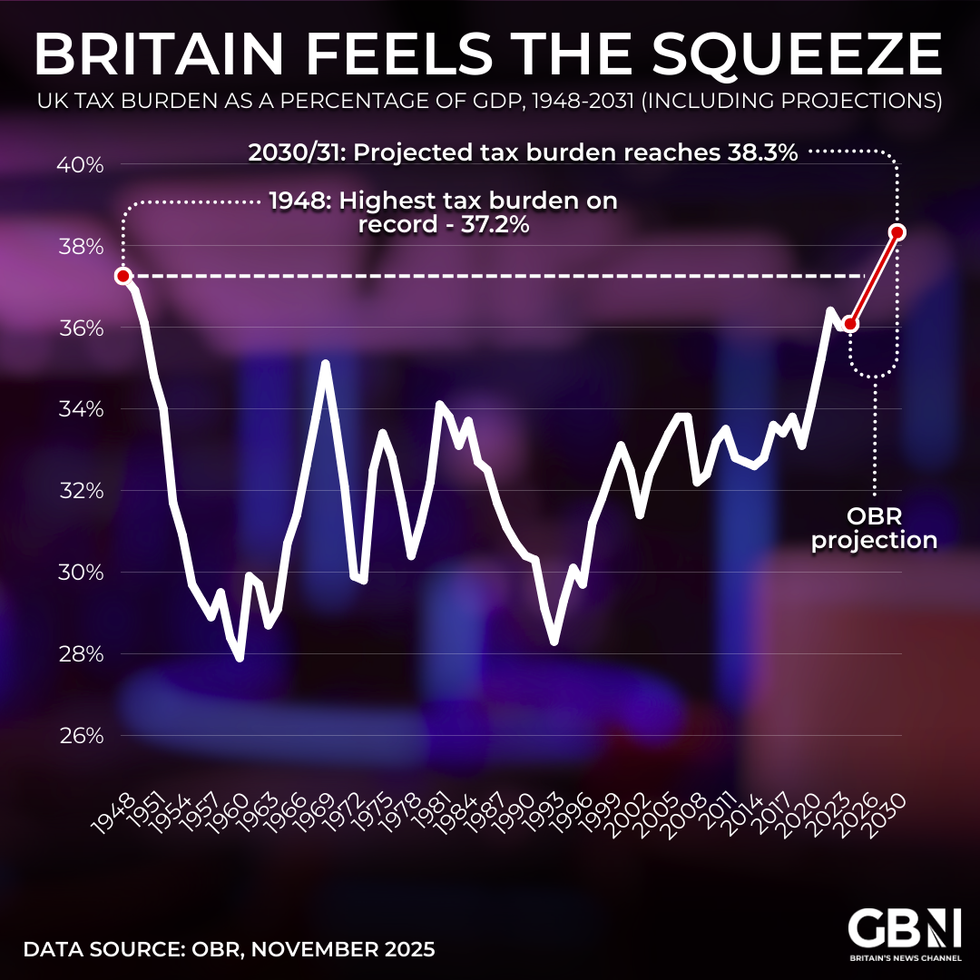

£26billion in tax raids has seen the UK's tax burden projected to rise to a post-war record 38 per cent of GDP by 2030, according to the OBR | GB NEWS/OBR

£26billion in tax raids has seen the UK's tax burden projected to rise to a post-war record 38 per cent of GDP by 2030, according to the OBR | GB NEWS/OBRJoanna Marchong, head of research at the Adam Smith Institute, also commented on the figures. She said: "The scale of this increase is astronomical.

"These largely unfunded schemes mean that today’s taxpayers are footing the bill for promises made decades ago."

A breakdown of the figures shows NHS workers, teachers and civil servants are expected to receive £33.7billion in pension payments.

Those workers are projected to contribute £11.6billion themselves.

Armed forces personnel account for the remaining £4.9billion of pension payments, who don't make personal contributions to their pension scheme.

The rise in employer payments follows changes to contribution rates across all four major schemes.

Rates increased by between 1.7 and 8.1 percentage points from April 2024.

The changes were implemented to meet rising pension costs linked to longer life expectancy and past benefit promises.

Employee contribution rates remained largely unchanged.

Neil Record, formerly an economist at the Bank of England, also criticised the current arrangements. He said: "Employer contributions are now at a level much higher than is justified by the real cost of these pensions."

He said the funding mechanism placed an ongoing burden on public finances.

"This taxpayer money is simply spent each year in the Government’s general budget."

Separate Treasury forecasts indicate Britain is expected to pay £56.8billion to public sector retirees this year.

Estimates suggest current and former state workers have built up pension promises worth £5.8trillion, the majority of which stem from historic final salary schemes.

Those schemes were closed to new accruals in 2015 following the recommendations of the Hutton Review, which proposed sweeping reforms aimed at reducing long-term costs.

However, the McCloud Judgment later ruled that certain transitional protections were unlawful.

The Treasury has previously estimated that remedying the issue will cost taxpayers £17billion

|GETTY

As a result, many workers were allowed to retain access to more generous pension terms until 2022.

The Treasury has previously estimated that remedying the issue will cost taxpayers around £17billion.

A spokesman said the Government had already taken steps to improve affordability: "The OBR has forecast that spending on public service pensions is already falling in the long term as previous reforms have put them on a more sustainable and affordable footing, while ensuring a fair and reliable retirement income for staff like our nurses and teachers who deliver essential public services."

More From GB News