Savers face ‘bigger threat than inflation’ as those benefitting from high interest rates could be hit by tax

Savers are facing an increasing risk of being hit by a tax charge

|GETTY

Inflation appears to be retreating from the very high levels seen in 2022 and 2023

Don't Miss

Most Read

Latest

Savers are facing an increasing risk of being hit by a tax charge which poses a “bigger threat than inflation”.

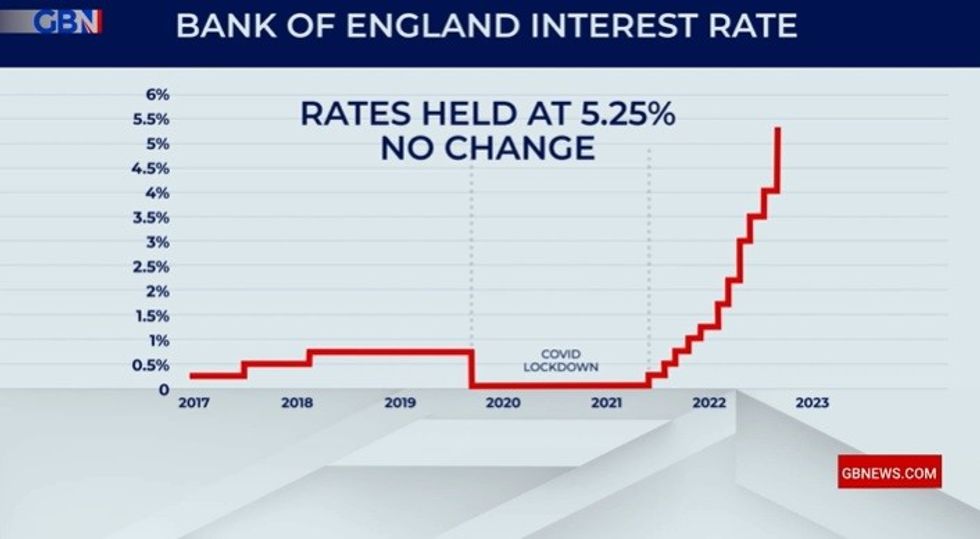

The Bank of England’s 14 consecutive base rate hikes - introduced in a bid to ease inflation - have meant savers have been able to benefit from improved interest rates, but experts are warning those benefitting from “significantly” better rates could be dragged into the savings interest tax net.

Alice Haine, personal finance analyst at the DIY investment platform and coaching service Bestinvest, said: “Savers are enjoying significantly better savings rates thanks to rapidly rising interest rates, though their money is still losing value in real terms once inflation is factored in.

“With headline inflation now in retreat, the bigger threat to people’s carefully built-up savings is the tax charges applied on the interest they earn.”

The Bank of England base rate has increased 14 consecutive times in nearly two years

|GB NEWS

The high savings rates mean people are more at risk of breaching their annual personal savings allowance, which has remained frozen since it was introduced in 2016.

Basic rate taxpayers are entitled to £1,000 tax-free cash interest on savings outside of ISAs via the personal savings allowance and the higher 40 per cent income tax rate allowance is £500.

There is no personal savings allowance for additional rate taxpayers who pay the 45 per cent income tax rate.

Those with relatively modest savings could be affected due to the interest rates being offered having substantially risen.

Basic rate taxpayers who have secured one-year fix at 6.12 per cent – which is currently market-leading – could put just £16,340 into the account before it’s taxed, according to calculations from Bestinvest.

The amount is even lower for higher rate taxpayers, at £8,170.

Ms Haine said: “All this means that hunting out the best savings rates to secure bumper returns might sound like a good idea, but many are unaware their savings are liable for tax on any interest over the allowance at their marginal rate of tax unless it is sheltered in a tax-free ISA wrapper.

“Nobody wants to pay tax on their rainy-day fund, so savers with significant cash sums stashed in a high-interest savings account must consider the tax-efficiency of their savings pot very carefully.”

The personal finance analyst highlighted that the point at which a nest egg is liable for tax will depend on how the interest rate is applied to the account, warning “savers with more attractive savings rates might find they become liable to a tax payment at a much lower level of savings than they had anticipated”, while many don’t realise they could be affected by the levy at all.

Ms Haine said NS&I last week withdrawing its lucrative one-year Guaranteed Growth Bonds and Guaranteed Income Bonds, which paid 6.2 per cent in interest, could be a signal for savers who want to lock in the best interest rates to act “fast”.

LATEST DEVELOPMENTS:

She added: “With interest rates either at or near their expected peak, the best savings rates may not stick around for long.

“However, with rates still as high as 5.20 per cent for easy-access accounts and 6.12 per cent for fixed-term accounts, the size of pot at which savers must pay tax on the interest is still lower than it has been for years.”

How much savers can keep in savings accounts before interest is taxed

October 11, 2023

Top one-year fix at 6.12 per cent

- Basic rate taxpayer - £16,340

- Higher rate taxpayer - £8,170

- Additional rate taxpayer - £0

Top easy access account at 5.2 per cent

- Basic rate taxpayer - £19,231

- Higher rate taxpayer - £9,616

- Additional rate taxpayer - £0

October 2, 2022

Top one-year fix at 4.11 per cent

- Basic rate taxpayer - £24,331

- Higher rate taxpayer - £12,166

- Additional rate taxpayer - £0

Top easy access account at 2.35 per cent

- Basic rate taxpayer - £42,554

- Higher rate taxpayer – £21,277

- Additional rate taxpayer - £0

Calculations by Bestinvest.