NS&I withdraws ‘market-leading’ 6.2% savings option after 225,000 benefited from high interest rates

NS&I has withdrawn the one-year Guaranteed Growth Bonds and Guaranteed Income Bonds

|NS&I

NS&I launched the new issues of these two savings products on August 30

Don't Miss

Most Read

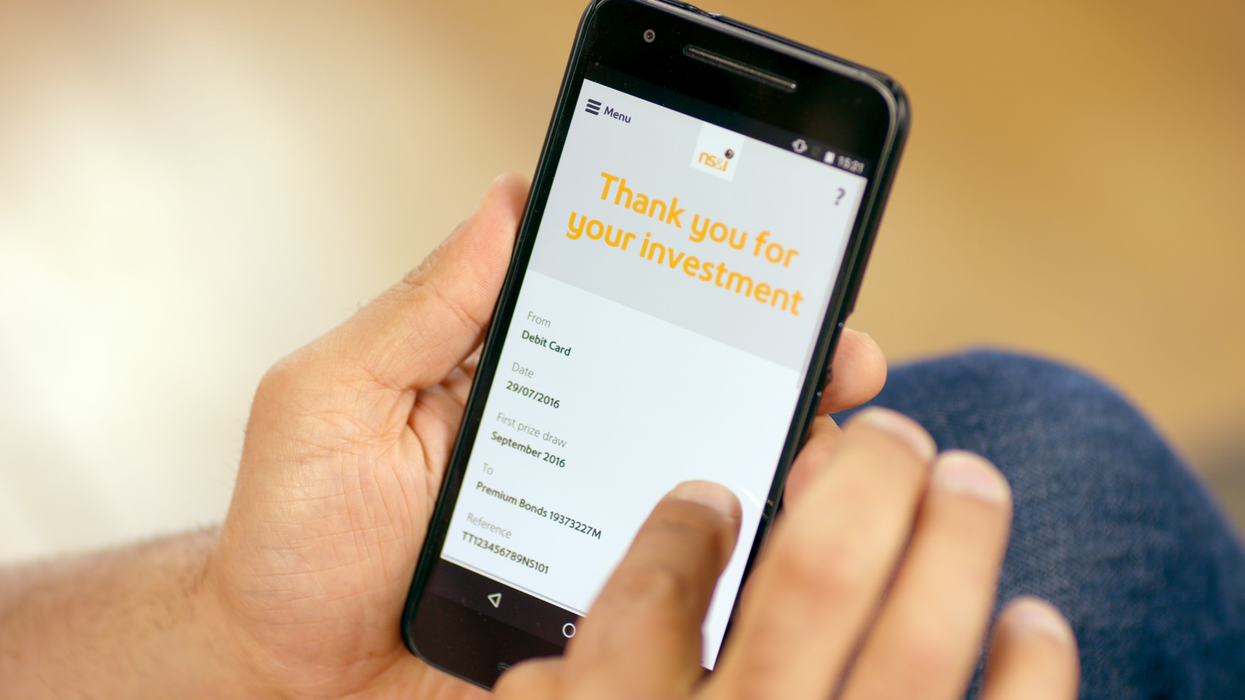

NS&I has withdrawn two savings accounts offering a 6.2 per cent interest rate from sale.

The one-year Guaranteed Growth Bonds and Guaranteed Income Bonds have been offering an interest rate of 6.2 per cent since going on sale more than five weeks ago.

Close to a quarter of a million savers invested in the two savings options, which were paying the highest interest rates NS&I has ever offered on these products.

The Government-backed savings provider said in withdrawing them from sale, NS&I remains on track to meet its Net Financing target for 2023-24.

NS&I Chief Executive, Dax Harkins, said the one-year fixed-rate Bonds have been a 'great success'

|NS&I

NS&I Chief Executive, Dax Harkins, said: “This summer’s new one-year fixed-rate Bonds have been a great success.

"I am pleased we were able to keep them on sale for over five weeks, enabling more than 225,000 savers to benefit from the highest interest rates we have ever offered on these products.”

NS&I said the Bonds were available to buy until Thursday October 5, and postal applications received for a reasonable period will be honoured.

The Guaranteed Growth Bonds and Guaranteed Income Bonds one-year fixed rate Issues were open to savers wishing to fix for one year at a guaranteed rate.

Savers need a minimum investment fo £500 and can put a maximum of £1million in each Issue.

After a year, savers have the choice to withdraw their cash or reinvest.

The NS&I website now states: "Sorry, our One-year Guaranteed Growth Bonds and Guaranteed Income Bonds are no longer on sale."

NS&I is currently offering a 5.7 per cent gross/AER rate on the three-year fixed Green Savings Bonds (Issue 5).

LATEST DEVELOPMENTS:

In terms of top fixed rate savings accounts, Al Rayan Bank and Raisin UK’s 1 Year Fixed Term Deposit now takes joint top spot alongside Al Rayan Bank’s 12 Month Fixed Term Deposit with an expected rate of 6.12 per cent, according to money comparison website Moneyfactscompare.co.uk.

Oxbury Bank’s Personal 1 Year Bond Account - Issue 32 is just behind, offering 6.11 per cent AER.

In terms of one year fixed cash ISAs, UBL UK is offering an 5.86 per cent interest rate on the One Year Fixed Rate Cash ISA.

Virgin Money's One Year Fixed Rate Cash ISA Exclusive Issue 6 pays 5.84 per cent, with the term ending on September 30, 2024.