State pensioner 'reuses bath water to flush the toilet' as poverty crisis deepens

Age UK warns poverty crisis among over-65s

Don't Miss

Most Read

Latest

Pensioners across Britain are resorting to extreme cost-cutting measures this winter, with one in 20 going without meals and approximately one in seven washing less often to manage their finances.

Age UK finds a third of over 65s reducing their electricity consumption during the coldest months and 35 per cent lowering their heating to make ends meet.

Around 1.9 million pensioners currently live in poverty, representing roughly one in six of the retired population.

The charity warned this figure is expected to exceed two million within the coming years unless circumstances improve, describing the situation as a "crisis hiding in plain sight".

TRENDING

Stories

Videos

Your Say

Roger Cliffe-Thompson, an 82-year-old from Merseyside, embodies the resourcefulness many older people have been forced to adopt.

Despite his age, he continues working five days a week as an activities coordinator at a care home supporting dementia patients.

While he finds the role fulfilling, he says he simply cannot survive on his state pension combined with a modest private pension.

The divorced teacher faces ongoing mortgage repayments on an interest-only loan that will continue until he reaches 99.

Age UK warns poverty crisis among over-65s

|GETTY

After installing a water meter, he has developed inventive ways to reduce his bills.

"If I have a bath, I save the money rather than pull out the plug," he explained.

"That way I can use it to flush the cistern."

Rising energy costs present another significant challenge for him, who attempts to cap his daily usage at £1.80, although recent freezing temperatures pushed this to £2.10.

LATEST DEVELOPMENTS

Chancellor Rachel Reeves has been criticised for not providing enough support to the elderly

|GETTY

He relies on a heated blanket overnight, which costs just 3p per hour to run, but expresses frustration at paying standing charges before consuming any energy.

His car insurance proved particularly shocking, with quotes jumping from under £1,000 to £5,200 upon turning 80.

Shopping around brought this down to £1,200 annually, although it remains a substantial expense.

"I think most pensioners are thrifty like me," Mr Cliffe-Thompson said, adding companies increasingly require internet access for the best deals.

"But going on the internet takes a lot of effort.

"What society doesn't understand is that we are not all used to gadgets and gizmos. It can be confusing."

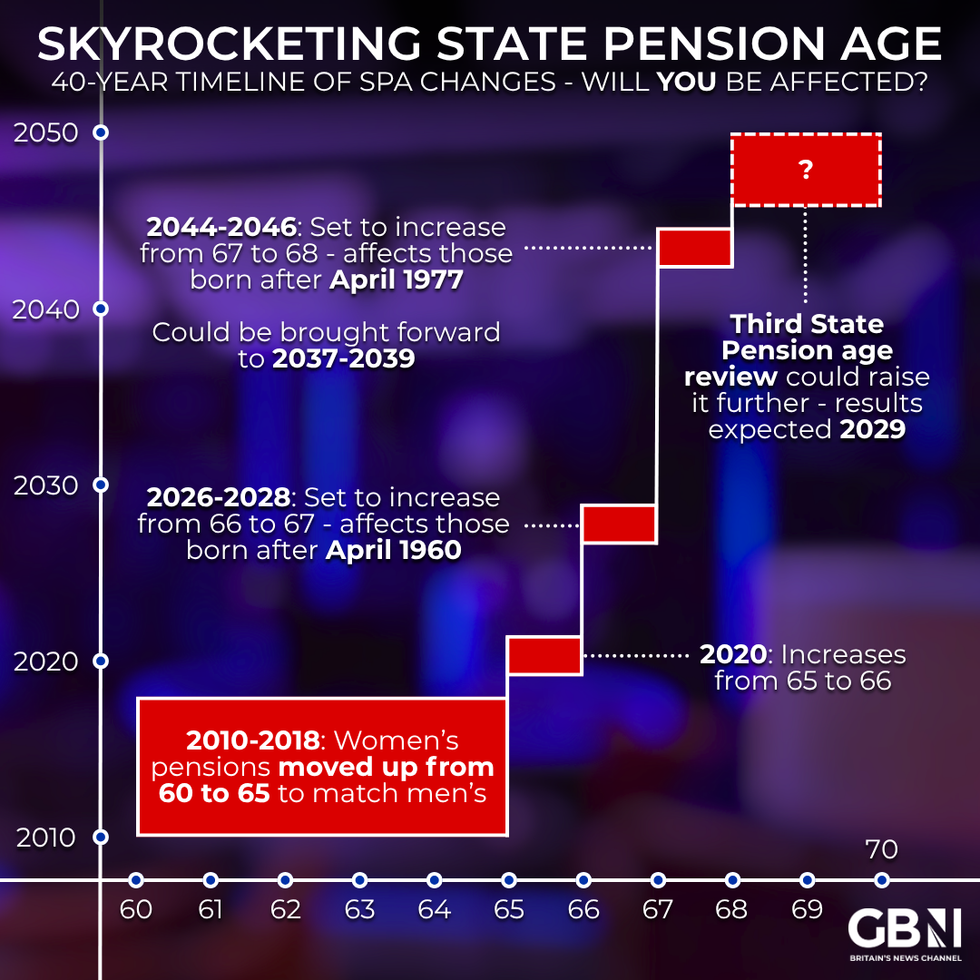

Skyrocketing state pension age - will you be affected? | GB News

Skyrocketing state pension age - will you be affected? | GB NewsAge UK's "Crisis Hiding in Plain Sight" campaign is encouraging pensioners to verify whether they qualify for additional financial assistance, including pension credit, which provides income top-ups and opens doors to further support.

The charity notes many older people fail to claim benefits because they assume they are ineligible or find the application process overwhelming without assistance.

Caroline Abrahams, charity director at Age UK, said: "As a country, we need to do a lot more to tackle poverty among older people, a social ill set to worsen as our population ages we fear, unless something changes and soon."

Last year, the charity's advice line assisted more than 6,000 pensioners with benefit applications, identifying over £36million in unclaimed support, averaging £5,900 per person.

Our Standards: The GB News Editorial Charter

More From GB News