State pension crisis as TWO-THIRDS of retirees rely on DWP benefit for primary income post-divorce

New research is shining a light on the pension shortfall divorced individuals face compared to their married counterparts

Don't Miss

Most Read

Latest

Shocking new research has found that two-thirds of divorcees in the UK rely on the state pension from the Department for Work and Pensions (DWP) to supplement their savings in retirement.

Fresh research from interactive investor, Britain's second-largest investment platform for private investors, has uncovered the lasting financial consequences of divorce that persist well into retirement years.

Around 66 per cent of retired divorcees depend on the state pension as their primary retirement income, compared with just 45 per cent of married retirees and 54 per cent of those who never married.

The pension savings gap proves equally striking, with merely a quarter of divorcees anticipating pension pots exceeding £100,000 by retirement, while more than half of married individuals expect to reach this threshold.

Two-thirds of state pensioners are reliant on the DWP benefit post-divorce

|GETTY

Housing instability also features prominently, as 37 per cent of retired divorcees have relocated during their retirement years, versus 29 per cent of married pensioners.

Craig Rickman, the personal finance and pensions expert at interactive investor, explained: "Getting divorced can cast a long financial shadow, even into later life.

"Although it's possible to rebuild wealth after a divorce, getting back on the housing ladder or beefing up a pension can be tough, particularly for single parents."

The research demonstrates that divorcees face considerably greater challenges in accumulating retirement savings, with only one in four expecting to build pension wealth reaching six figures.

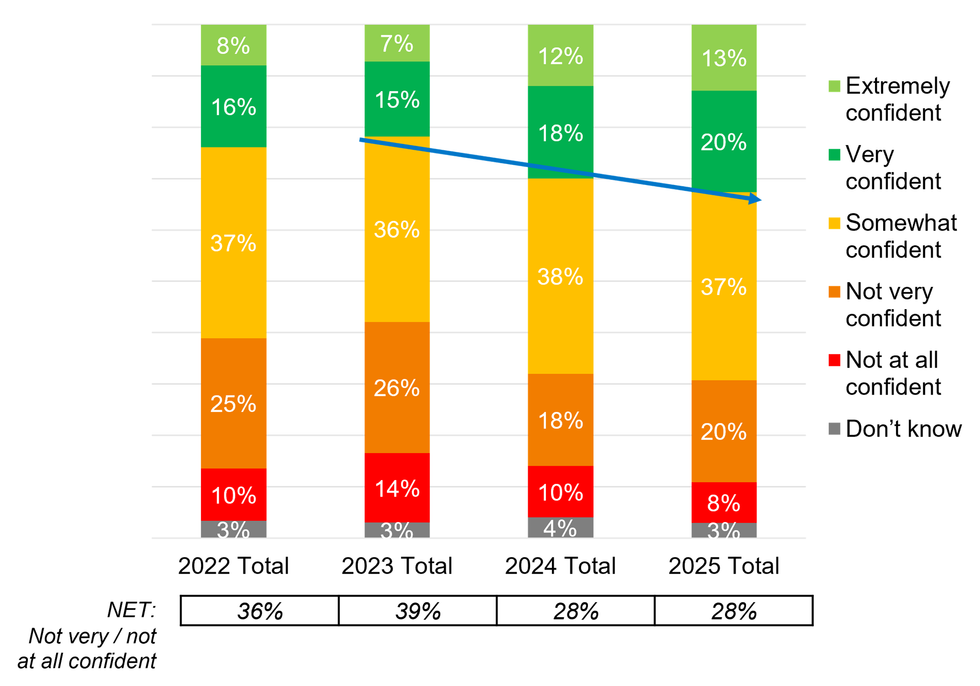

How confident are Britons about their pension savings? | AEGON

How confident are Britons about their pension savings? | AEGON Mr Rickman adds: "The unfortunate reality is that many individuals don't get a fair outcome during divorce negotiations. It's a perfect storm because they are often under immense emotional and financial strain, at a time when decisions and outcomes could affect their finances for years to come."

The interactive investor expert outlines several strategies for safeguarding finances regardless of relationship status.

He shared: "If you're in a relationship, being open about money with your partner from the beginning is essential.

"Not only does it help to avoid any awkward chats down the line, but knowing how much you both earn, spend, save and invest means you can plan your future with greater certainty."

LATEST DEVELOPMENTS

He emphasises that discussing major financial decisions early, such as purchasing property together or starting a family, positions couples to divide assets more equitably should separation occur.

Maintaining awareness of one's complete financial situation remains crucial, according to Mr Rickman, who recommends taking time to calculate total assets including savings, workplace pensions from current and previous employers, and any investments held.

Pensions frequently represent an individual's most valuable asset, potentially worth hundreds of thousands of pounds, yet Mr Rickman notes they often receive less attention than property during divorce proceedings.

He noted "Not understanding the value of your partner's pension could mean you lose out, leaving you financially vulnerable in retirement.

Are you affected by state pension age changes? | GETTY

Are you affected by state pension age changes? | GETTY"Instead, a pension sharing agreement, where the pension savings are divvied up between the two of you, is worth considering as it might be a fairer solution."

For those rebuilding their finances following marital breakdown, the expert advocates for consistent, modest contributions rather than dramatic changes.

According to Mr Rickman, investing £50 monthly could accumulate to approximately £7,700 over a decade, based on five per cent annual growth after fees.

As well as this, he recommends regualr budgeting reviews and incremental savings increases can substantially transform long-term financial outcomes.

More From GB News