State pension alert: HMRC 'working' to ensure payments avoid stealth tax raid

Tax authority officials have told MPs that HMRC is looking to shield state pensioners from a potential raid

Don't Miss

Most Read

Latest

HM Revenue and Customs (HMRC) has confirmed its collaboration with the Treasury to shield pensioners who rely solely on state pension payments from income tax, even when their payments surpass the personal allowance threshold.

Tax authority officials verified this week that approximately one million individuals receiving only the state pension, without any private pension arrangements, will avoid the 20 per cent basic rate levy on their income.

The protection measures will be formally incorporated into the next Finance Bill, scheduled to follow the Chancellor's 2026 Budget. These safeguards are designed to become operational from April 2027, ensuring pensioners are protected before the state pension exceeds the current tax-free threshold.

Ms Reeves's November budget extended the freeze on personal tax thresholds until April 2031, a decision that raised immediate concerns about the impact on retired individuals.

HMRC is understood to be 'working' to ensure no tax is paid on state pensions for certain Britons

|GETTY

From April, the full state pension will rise by more than £500 annually to reach £12,547.60, falling just £22.40 short of the £12,570 personal allowance.

This narrow margin means the state pension would almost certainly breach the threshold the following year, potentially forcing large numbers of pensioners to complete tax returns.

Estimates suggested the freeze could pull at least 500,000 pensioners into the tax-paying bracket, prompting criticism of the policy before Rachel Reeves clarified her intentions.

Appearing before the Treasury select committee on Tuesday, January 13, HMRC director Cerys McDonald provided assurances about the implementation timeline.

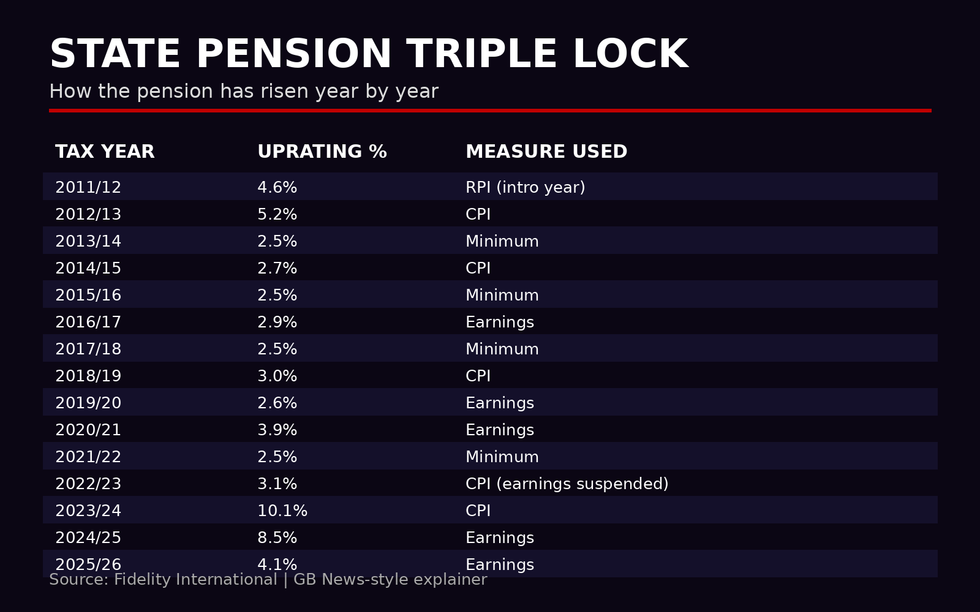

How much has the state pension risen by thanks to the triple lock? | GB NEWS / FIDELITY INTERNATIONAL

How much has the state pension risen by thanks to the triple lock? | GB NEWS / FIDELITY INTERNATIONAL "I can reassure the committee that we are working hand-in-glove with the Treasury on these options to make sure that the final decision is operable from April 2027," Mr McDonald stated, noting that discussions with the Chancellor were ongoing.

Crucially, Mr McDonald indicated that pensioners would not need to take any action themselves to receive the protection.

"I do not expect there to be any customer requirement here or to apply for this. We should be able to automate it," she told MPs.

Additional details would be published in due course, Mr McDonald confirmed.

The tax exemption applies exclusively to those whose only retirement income comes from the state pension, with the relief not extending to individuals who also receive private pension payments.

For retirees drawing both state and private pensions, the existing PAYE system will continue to manage their tax obligations without requiring self-assessment returns.

"HMRC typically collects tax owed by adjusting the tax code on the private pension, using the pay as you earn system," explained Lily Megson-Harvey, policy director at My Pension Expert.

Speaking to Martin Lewis in November, Ms Reeves pledged that state pension-only recipients would neither pay tax nor file returns during this parliamentary term.

The Chancellor told Martin Lewis state pensions will not be taxed during this Parliament

| PAMs Reeves said: "If you just have a state pension, you don't have any other pension, we are not going to make you fill a tax return. I make that commitment for this Parliament.

"2027 looks like the time that it [full, new state pension] will cross over. We are working on a solution, as we speak, to ensure that we're not going after tiny amounts of money."

When pressed by the host of the Martin Lewis Money Show Live on whether retirees will need to pay tax on state pensions alone, she added: "In this Parliament, they won't have to pay the tax.

The Chancellor is due to give her Spring Statement, which will outline further changes to the economy, on March 3.

More From GB News