Benefits, pensions and Universal Credit update for February - everything YOU need to know

February's benefit and state pension payment dates have been confirmed

Don't Miss

Most Read

Benefit and pension recipients will see their payments arrive as normal in February, with no bank holidays scheduled to disrupt payment dates this month.

The absence of bank holidays means all Department for Work and Pensions (DWP) and HM Revenue and Customs (HMRC)-administered benefits will be paid on their usual days.

Payments due in February include Universal Credit, the state pension, pension credit and child benefit.

Other benefits paid as normal include personal independence payment (PIP), disability living allowance and attendance allowance.

TRENDING

Stories

Videos

Your Say

Carer’s allowance, employment and support allowance, income support and jobseeker’s allowance are also unaffected.

For people receiving the basic state pension, payments continue to be made directly into bank accounts every four weeks, with the specific day determined by the final two digits of an individual’s National Insurance number.

When to expect your state pension

The DWP has confirmed that this schedule will remain unchanged throughout February.

Attention is now shifting to April, when a series of benefit and pension rate changes are due to take effect.

Universal credit standard allowances are set to rise by around 6.2 per cent as part of the annual uprating process.

Everything you need to know for February

|GETTY

For single claimants aged over 25, the weekly standard allowance will increase from £92 to £98, while couples where at least one partner is over 25 will see their allowance rise from £145 to £154 — an uplift of roughly £9 per week.

The state pension will also increase from April, with the Government confirming a 4.8 per cent rise in line with annual earnings growth under the triple lock.

This will take the full new state pension to £241.05 per week.

Most other working‑age and disability benefits will rise by 3.8 per cent, reflecting the September inflation figure used for uprating.

Payments affected include personal independence payment, disability living allowance, attendance allowance and carer’s allowance.

Not all April changes involve increases.

LATEST DEVELOPMENTS:

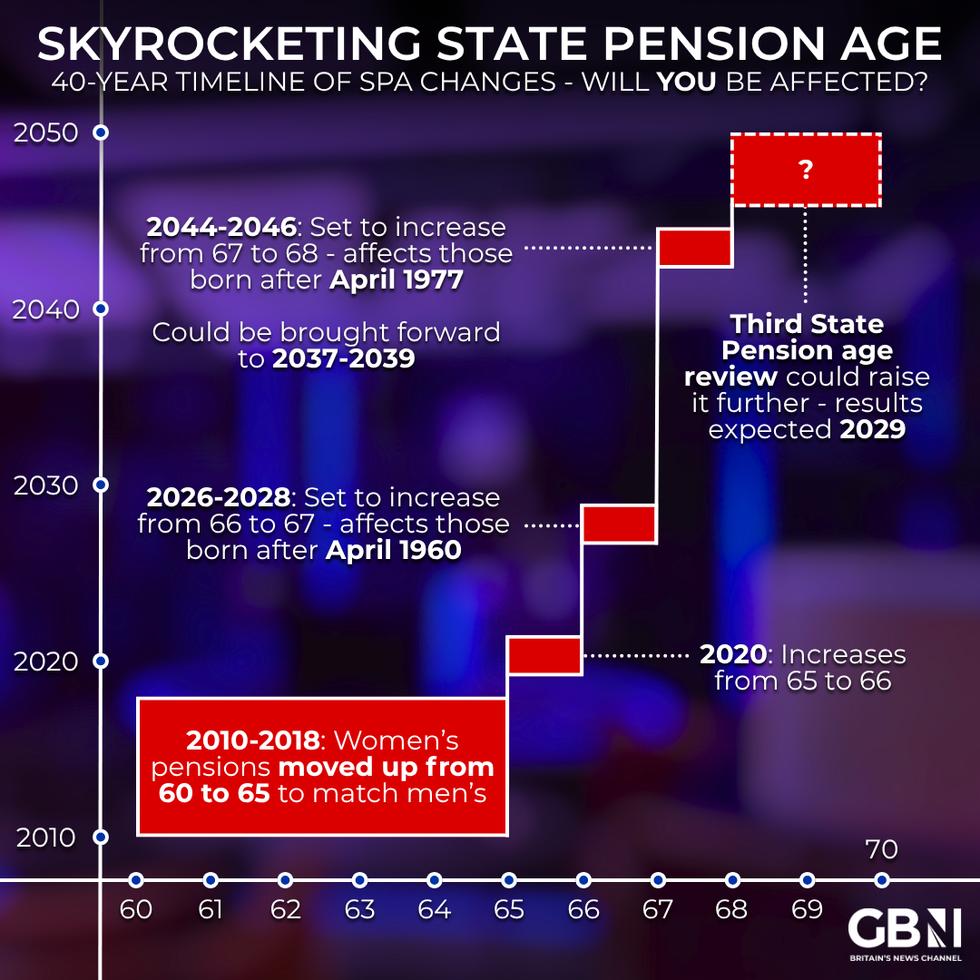

Are you affected by state pension age changes? | GETTY

Are you affected by state pension age changes? | GETTYNew claimants applying for the health‑related element of universal credit will see a significantly lower rate introduced, with the monthly payment falling from £105 to £50 — a reduction of more than £200 per month compared with the current rate.

Existing claimants will not see their payments cut, but their rate will be frozen with no annual increases planned until 2029.

The DWP said these adjustments form part of a wider reform of sickness and disability benefits.

Cold weather payments have also been triggered during the winter period, after sub‑zero temperatures across parts of the UK activated the scheme in several areas.

The £25 one‑off payment is issued when temperatures fall to zero degrees Celsius or below for seven consecutive days.

More than one million households across over 800 postcode areas in England, Wales and Northern Ireland are set to receive support, with eligibility linked to certain benefits such as pension credit and income‑based payments.

The DWP confirmed that payments are made automatically

| GB News

Additional financial help remains available for people facing short‑term difficulties.Universal credit claimants can apply for interest‑free budgeting advance loans, repayable through future benefit payments, with maximum amounts set at £348 for single claimants, £464 for couples and up to £812 for households with children.The household support fund also continues to operate through local councils, offering cash payments and help with essential costs such as food, energy bills and household items.The Government has confirmed the fund will remain in place until March 2026.

More From GB News