State pension declared 'UNAFFORDABLE' as Labour told to tackle triple lock and retirement age 'sacred cows'

Analysts are calling for state pension reform amid concerns about the retirement benefit's long-term sustainability

Don't Miss

Most Read

State pension payments are "unaffordable in the longer-term" and the Labour Government must tackle the "sacred cows" of the triple lock and the retirement age, analysts warn.

Stewart Hastie, the Association of Consulting Actuaries' (ACA) chair, is urging the upcoming Pensions Commission to achieve a more sustainable retirement system for all Britons.

Speaking at the Claridge’s Annual Dinner of the ACA, which was attended by guests from across the pensions industry, Mr Hastie praised the recent Pension Schemes Bill, which is currently making its way through Parliament.

This piece of legislation will allow allow trustees of well-funded defined benefit pension schemes to share surplus funds with sponsoring employers and double the number of retirement savings megafunds operating in the UK.

Retirement industry experts are declaring the state pension 'unaffordable'

|GETTY

However, the trade body's chair called on the recently launched Pensions Commission to specifically tackle multiple issues impacting retirement prospects, including the triple lock and state pension age.

According to the Commission, the triple lock and retirement age will not be specifically addressed in this findings with a separate State Pension Age review being conducted by Dr Suzy Morrisey.

Under the triple lock, state pension payment rates are hiked every year based on one of three metrics; the rate of consumer price index (CPI) inflation, average wage growth or 2.5 per cent; whichever is higher.

As it stands, the state pension age sits at 66 years old and is expected to rise to 67 for thousands from next year. Both the triple lock and age threshold have been highlighted as areas of potential reform due to concerns over the retirement benefit's cost.

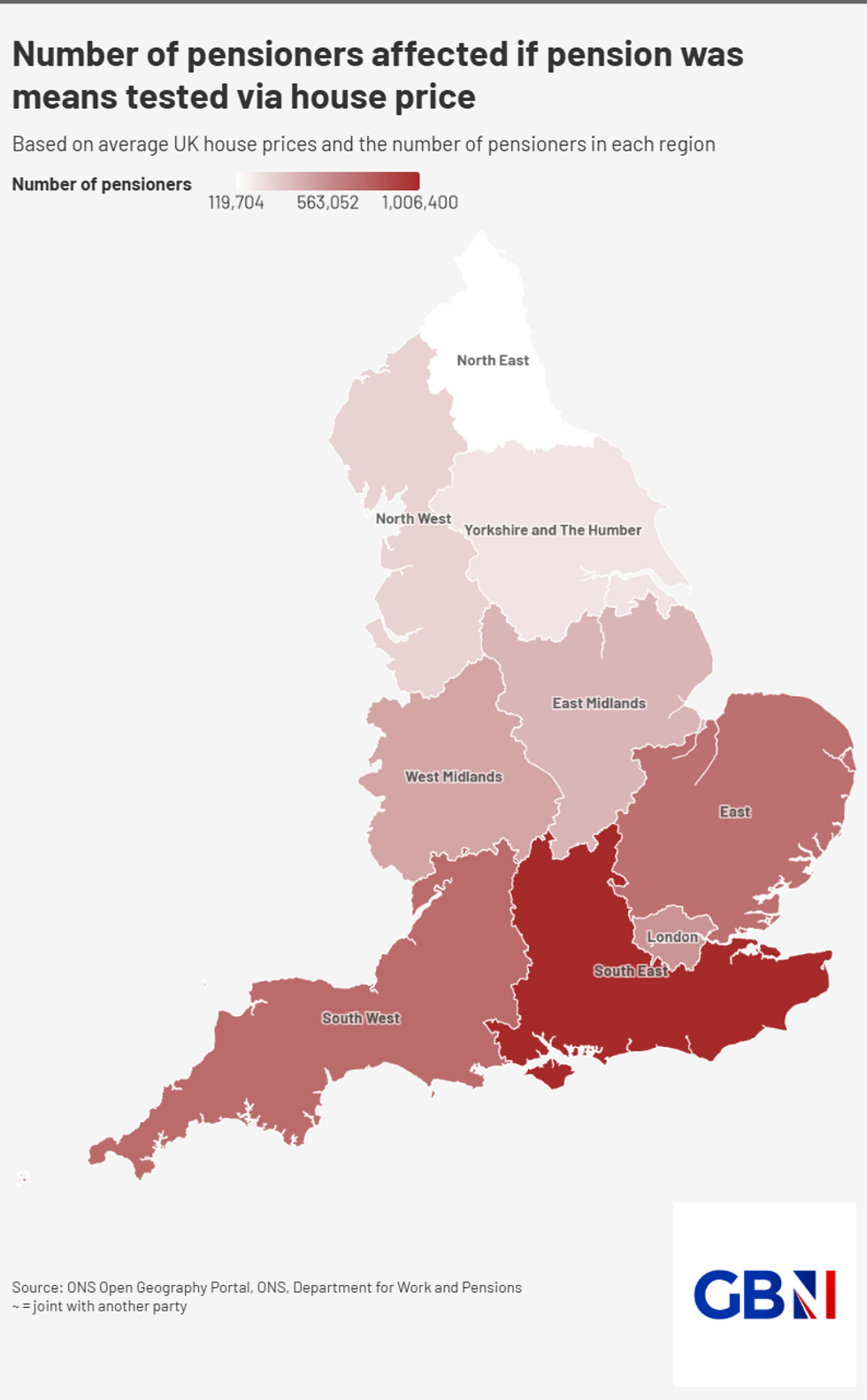

Number of pensioners affected if pension was means tested via house price | GBN

Number of pensioners affected if pension was means tested via house price | GBNA recent report from the Office for Budget Responsibility (OBR) cited that the state pension triple lock is estimated to be costing the UK taxpayer around £10billion more than initially projected.

The Pensions Commission's findings will not be released until 2027 and will focus on why people are not saving enough for retirement, as well as the gender pension gap.

Mr Hastie said: "Surely it is inevitable that these reviews will come up with what we already know. That is, as a society, we need to save more, and we need to work productively for longer – even though these may not be palatable to the political and business world and the public at large.

"My hope is that despite the limitations given to the reviewers, that they will look at some ‘sacred cows’ like: the triple lock that is unaffordable in the longer-term, or a minimum level of compulsory private savings in pensions and/or sidecars."

The ACA chair also suggesting "combining a more significant rise in state pension age and redistribution to those that most need it, including the ever-growing group of individuals unable or struggling financially to purchase their own home and the longer-term security this often offers in later years".

Based on the OBR's findings, the state pension is expected to cost the UK Government around £15.5billion annually by 2030 with the Institute of Fiscal Studies warning this figure could jump to £40billion per year by 2040.

A review into the state pension age recommended raising the threshold to 68 between 2044 and 2046, however some analysts have suggested this should be brought forward.

One recommendation from the International Longevity Centre hinted that the state pension age would need to be hiked to 71 based on life expectancy data and falling birth rates.

LATEST DEVELOPMENTS:

DWP minister Liz Kendall has spearheaded drastic reform to the welfare system | PA

DWP minister Liz Kendall has spearheaded drastic reform to the welfare system | PA On the new Pensions Commission, Department for Work and Pensions (DWP) Secretary Liz Kendall said: "People deserve to know that they will have a decent income in retirement – with all the security, dignity and freedom that brings.

"But the truth is, that is not the reality facing many people, especially if you’re low paid, or self-employed. The Pensions Commission laid the groundwork, and now, two decades later, we are reviving it to tackle the barriers that stop too many saving in the first place."

Chancellor Rachel Reeves added: "We’re making pensions work for Britain. The Pension Schemes Bill and the creation of pension megafunds mean an average earner could get a £29,000 boost to their pension pots.

"Now we are going further to ensure that people can look forward to a comfortable retirement."

More From GB News