Britons' could get pension savings boost worth £6k under Labour's retirement overhaul - what you need to know

State pension age rise ‘almost inevitable’: Ann Widdecombe issues warning as Denmark raises the bar |

GB NEWS

How will Rachel Reeves's proposed changes to the pension system impact you?

Don't Miss

Most Read

Latest

The Government has announced pension reforms that could boost workers' retirement pots by £6,000 through the creation of pension megafunds managing at least £25 billion in assets.

This proposed shake-up, outlined in the Pension Schemes Bill on Thursday, relates to defined contribution pensions that invest workers' regular payments in stocks, shares and other assets.

Reforms propose that multi-employer defined contribution pension schemes and local government pension scheme pools operate at megafund level within the next five years.

The Government plans to double the number of UK pension megafunds by 2030, which could result in an investment of £50billion in infrastructure projects.

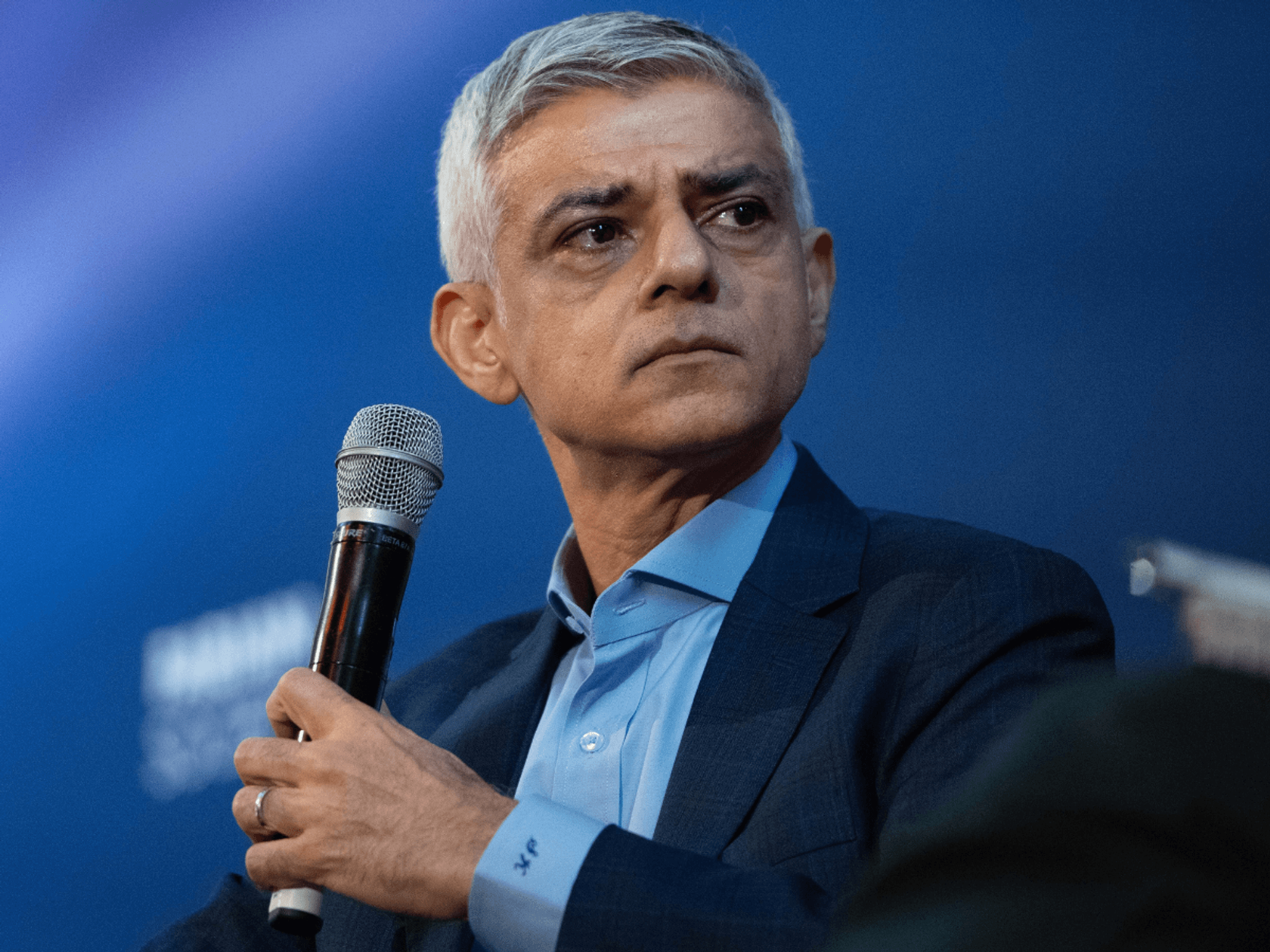

Rachel Reeves is making massive changes to the pension system

| GETTY/PAThe Treasury hopes will boost the economy and drive up higher returns for savers. The schemes are expected to save £1 billion a year through economies of scale and improved investment strategies.

Under the reforms, the local government pension scheme will be consolidated, reducing the current 86 administering authorities into six pools.

As part of the consolidation, as estimated £392billion local Government pension scheme is being targeted, which Deputy Prime Minister Angela Rayner described as having "enormous" untapped potential.

Chancellor Rachel Reeves said: "We're making pensions work for Britain. These reforms mean better returns for workers and billions more invested in clean energy and high-growth businesses – the plan for change in action."

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Deputy Prime Minster angela Rayner has backed the plans

| GB NEWSRayner said: "Through these reforms, we will make sure it drives growth and opportunities in communities across the country for years to come – delivering on our plan for change."

Sir Steve Webb, a former Liberal Democrat pensions minister who is now a partner at consultants LCP, described it as "truly a red letter day for pension schemes, their members and the companies who stand behind them".

He said the Labour Government had "clearly been bold in this area" when it comes to tackling issues related to retirement savings.

LATEST DEVELOPMENTS:

Former pensions minister Steve Webb described Labour's mega-fund plan as "bold"

| STEVE WEBBHowever, some experts express scepticism about the touted benefits to workers from the proposed shake-up.

Tim Box, chair of PMI Policy and Public Affairs Working Group, questioned whether greater scale would actually direct investments into the UK, noting that pension funds "will invest where opportunities align with long-term value and security".

Box warned that "the ambition in these proposals is large and the overall proposed timescales relatively short given the size of changes proposed".

He cautioned that "rushing change risks confusing savers and undermining confidence in the system", emphasising that industry bandwidth to support consolidation is finite and sequencing matters for successful implementation.

More From GB News