Martin Lewis issues state pension update as Britons 'concerned payments will start to be taxed'

Fiscal drag and the triple lock could pull more pensioners into paying tax, analysts warn

Don't Miss

Most Read

Martin Lewis has issued an update regarding growing anxiety amongst pensioners who fear their state pension could become subject to income tax in the coming year.

The Money Saving Expert founder disclosed that he has received numerous enquiries from worried individuals concerned about potential tax liabilities on their retirement income.

The issue stems from the personal tax-free allowance remaining fixed at £12,570, resulting in fiscal drag with state pension payments expecting to cross this threshold within the next few years.

Chancellor Rachel Reeves has indicated this freeze will persist through to 2028, though some financial analysts speculate it could extend beyond that date due to the nation's ongoing fiscal challenges.

Martin Lewis has issued an update on how the state pension will be liable for tax

|GETTY / ITV

Mr Lewis explained that this "fiscal drag" phenomenon means retirees must pay income tax on state pension payments exceeding £12,570.

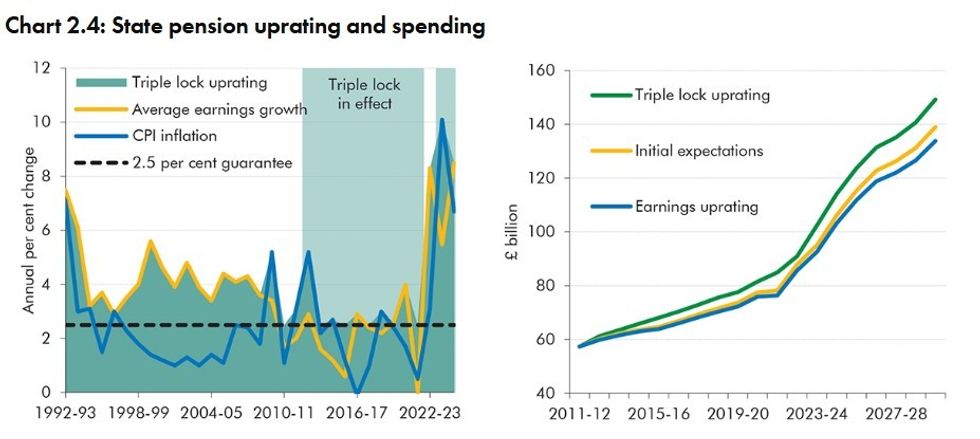

The state pension's triple lock mechanism, which ensures annual increases based on whichever is highest amongst 2.5 per cent, consumer price inflation, or wage growth, could push pension income beyond the tax-free threshold.

Currently, the full new state pension stands at £11,973 annually. With continued triple lock increases, this amount may surpass the frozen personal allowance within several years, resulting in pensioners whose only income source is their state pension becoming liable for income tax on the excess amount.

A parliamentary petition demanding an increase in the personal tax threshold has garnered substantial public support, accumulating 281,792 signatures before closing to new entries last week.

How much is the state pension triple lock? | ONS

How much is the state pension triple lock? | ONS The petition ranked as the second most popular on the parliamentary website, surpassed only by one calling for a General Election which has exceeded three million signatures.

Specifically, the campaign urged Chancellor Reeves to elevate the tax-free threshold from £12,570 to £20,000.

Petitioners argued that taxing pensioners on state pension income exceeding the personal allowance was "abhorrent" and maintained that raising the threshold would enable low-income workers to reduce their reliance on benefits whilst stimulating economic growth through increased consumer spending.

Mr Lewis provided several clarifications to address widespread misconceptions about state pension taxation.

He shared: "I'm getting quite a few people getting in touch concerned 'the state pension will start to be taxed" on the back of newspaper articles. I thought it worth making a few simple points to clear up possible confusion.

"The state pension is already taxable and always has been in my memory, in other words it counts towards your taxable income. Many state pensioners who have other income too already pay income tax.

"The £11,973 a year quoted is somewhat misleading. It’s the amount someone on the full new state pension would get.

"Yet most pensioners, all who hit state pension age before April 2016, are on the OLD pension, which has a lower basic amount. And many don’t get the full pension as they don’t have enough National Insurance year"

LATEST DEVELOPMENTS:

How much will the state pension triple lock cost the British taxpayer? | OBR

How much will the state pension triple lock cost the British taxpayer? | OBR Mr Lewis added: "One way politicians could prevent this would be to raise the personal allowance for everyone or just for state pensioners.

"However, it's worth noting that another solution could be to abolish the triple lock, so the state pension doesn't increase as much! I'm not trying to make any political point here. Just attempting to explain how it works as I've had quite a lot of questions."

The Labour Government has committed to keeping the triple lock mechanism in place until at least the end of this parliament.

Concerns have been raised about the policy's expensing with the Office for Budget Responsibility (OBR) claiming the payment uprate mechanism is costing the UK £10billion more than initially projected.

More From GB News