Rachel Reeves facing fresh tax raid as UK borrowing costs for June soar to second highest on record

Government borrowing jumped to a higher-than-expected £20.7billion in June, according to the ONS

Don't Miss

Most Read

UK Government borrowing soared to its second-highest level on record in June according to the latest figures from the Office for National Statistics.

There are fears Rachel Reeves risks being boxed-in and forced to hike taxes later this year after Government borrowing jumped to a higher-than-expected £20.7billion in June, with debt interest payments skyrocketing.

The ONS highlighted borrowing over the period was £6.6billion higher than a year prior.

This represents the second highest June borrowing since records began, only behind that the figures seen in 2020 which came during the height of the Covid-19 pandemic.

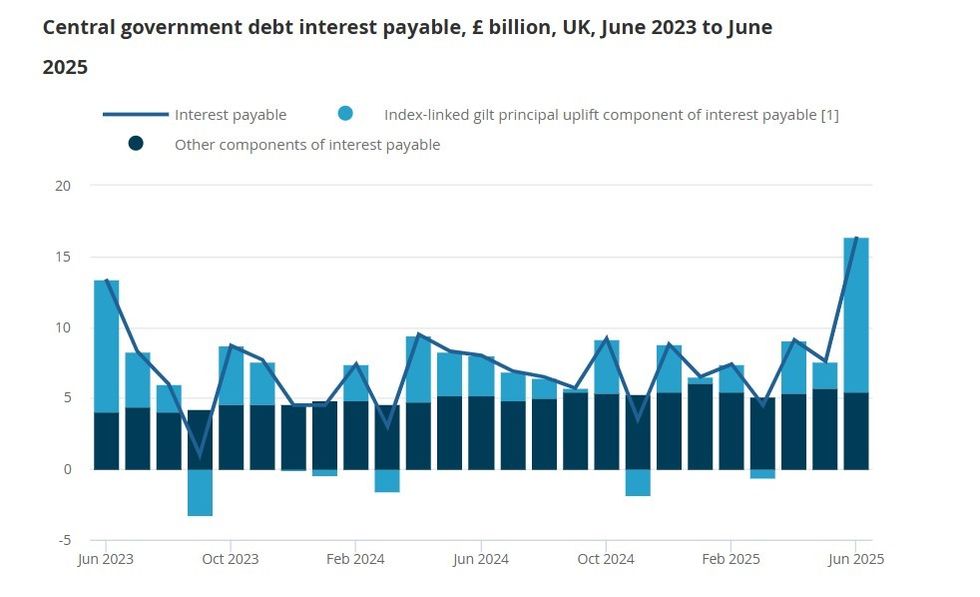

Notably, the ONS noted that interest payable on debt increased to £16.4billion in part due to large rise in Retail Prices Index inflation impacting index-linked government bonds.

Prior to the publication of today's figures, economists had predicted that June borrowing would come to around £17.6billion expected by most economists.

Rachel Reeves is under more pressure as borrowing costs surge

| GETTYBorrowing for the first three months of the financial year to date stood at £57.8 billion, which is £7.5billion more than the same three-month period in 2024.

Darren Jones, the chief secretary to the Treasury, said: "We are committed to tough fiscal rules, so we do not borrow for day-to-day spending and get debt down as a share of our economy.

"This commitment to economic stability means we can get on with investing in Britain’s renewal, including fixing our NHS, strengthening our national defence and building hundreds of thousands of affordable homes through our plan for change."

Shadow chancellor Mel Stride added: "Rachel Reeves is spending money she doesn’t have. Debt interest already costs taxpayers £100billion a year – almost double the defence budget – and it’s forecast to rise to £130billion on Labour’s watch.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Darren Jones has claimed the Government is committed to 'tough fiscal rules'

| GB NEWS“Labour’s jobs tax and reckless borrowing is killing growth and fuelling inflation – paving the way for more tax hikes and more borrowing in the autumn. Make no mistake – working families will pay the price for Labour’s failure and costly U-turns.

"Only the Conservatives, under new leadership, will break this cycle. Only the Conservatives believe in sound money and low taxes."

Professor Joe Nellis, an economic adviser at MHA, the accountancy and advisory firm, broke down the dilemma facing the Chancellor going forward as she attempts to balance the books.

Nellis said: "UK public sector borrowing has risen to £20.68billion for June, further deepening the fiscal hole that the Chancellor will need to fill in the Autumn Budget and intensifying the immediate need to raise taxes or cut spending.

"The Chancellor’s fiscal strategy has been reliant on sustainable economic growth that is yet to appear — persistently high bond yields and an apparent inability to negotiate necessary spending cuts with her own party have made the current strategy even less viable.

LATEST DEVELOPMENTS:

What is the stake of UK Government borrowing for June?

|ONS

"The OBR’s July Fiscal Risks and Sustainability Report paints a worrying picture of the UK’s long-term debt trajectory.

"At 94 per cent of GDP, UK debt is already the sixth-highest of advanced economies across the globe.

"On the current trajectory, this is set to rise to over 270 per cent of gross domestic product (GDP) by the early 2070s. This is clearly not sustainable."

More From GB News