State pension alert: DWP issues update on calls for 'universal' £586 a week payments

State pension age rise ‘almost inevitable’: Ann Widdecombe issues warning as Denmark raises the bar |

GB NEWS

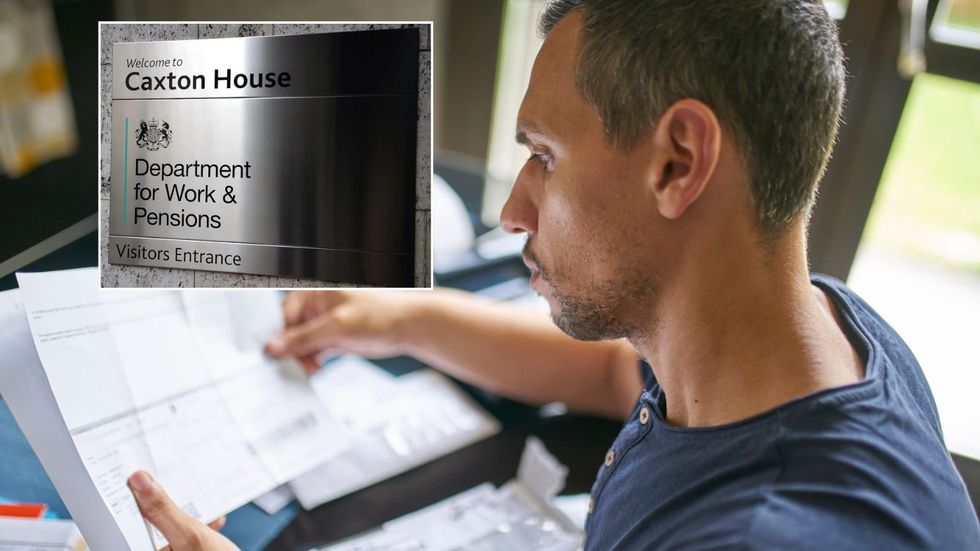

DWP says linking payments to 48-hour week at living wage would cost tens of billions

Don't Miss

Most Read

Ministers have firmly rejected demands for a radical overhaul of Britain's state pension system that would see payments nearly triple to £586 weekly.

The Department for Work and Pensions (DWP) confirmed it has no intention of reducing the retirement age to 60 or implementing the dramatic payment increase.

The Government's stance comes in response to a parliamentary petition that has attracted more than 18,800 signatures nationwide.

The proposal would see annual pension payments soar to £30,476, a substantial leap from the current maximum of approximately £11,000.

TRENDING

Stories

Videos

Your Say

In its official response, the DWP stated: "The Government has no plans to make the State Pension available from the age of 60 or for it to equal 48 hours a week at the National Living Wage."

The petition, created by Denver Johnson, proposes linking state pension payments to 48 hours of work at the National Living Wage rate of £12.21 per hour.

This calculation would provide pensioners with £2,344 every four-week payment period.

The proposal would benefit more than 12 million current state pension recipients and extend eligibility to all individuals aged 60 and above.

Ministers have decisively dismissed calls for a sweeping reform of Britain’s state pension system that proposed raising weekly payments to £586

|GETTY/PA

The scheme would also apply to approximately 453,000 retirees living abroad whose pensions have been frozen due to the absence of reciprocal agreements with their countries of residence.

If the petition reaches 100,000 signatures, the Petitions Committee would consider bringing the proposals forward for parliamentary debate.

The campaign represents one of the most ambitious calls for pension reform in recent years.

The Government defended its position by highlighting its commitment to the triple lock mechanism, which it says will benefit over 12 million pensioners throughout this Parliament.

Ministers forecast that maintaining this protection will result in state pension spending rising by approximately £31billion annually by the end of the current parliamentary term, compared with 2024/25 levels.

Latest Development

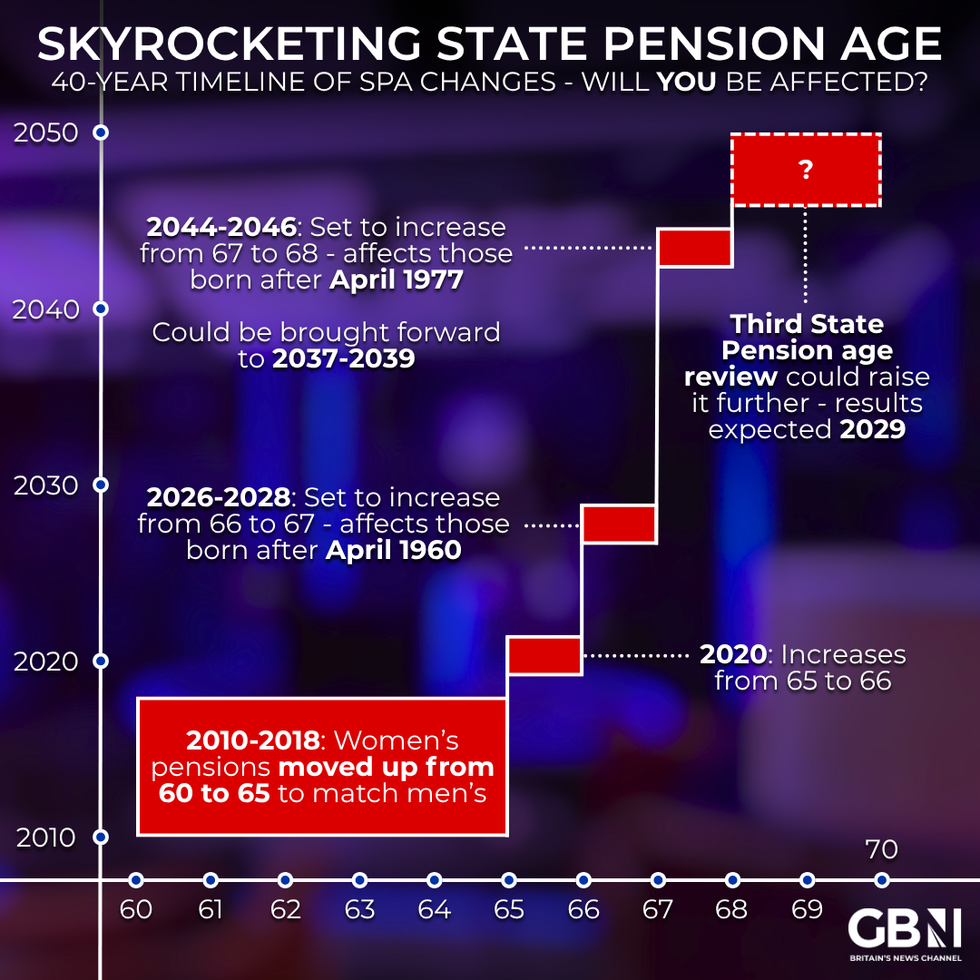

Skyrocketing state pension age - will you be affected?

|GB News

The DWP emphasised that Britain's retirement income system combines state, private and workplace pensions to provide security in later life.

Officials pointed to the New State Pension, introduced in 2016, describing it as a "simpler, clearer, sustainable foundation" for private savings, including workplace pensions supported through Automatic Enrolment.

The department also referenced the recently launched Pensions Commission, tasked with ensuring the system delivers adequate living standards for future retirees in the coming decades.

Ministers outlined the comprehensive support already available to pensioners beyond the basic state pension.

The DWP highlighted that Pension Credit guarantees minimum income levels for those on low incomes while providing access to additional benefits including council tax assistance, help with fuel bills and free TV licences for those aged over 75.

The Government confirmed that Winter Fuel Payments will continue for pensioners over 66 with incomes at or below £35,000, with the DWP stating: "This extends eligibility to the vast majority of pensioners, with over three quarters benefitting."

Additional support includes the Warm Home Discount for energy bills, Housing Benefit for rental costs and Discretionary Housing Payments.

Pensioners with long-term health conditions or disabilities may qualify for Attendance Allowance, Disability Living Allowance or Personal Independence Payment.

Chancellor Rachel Reeves will confirm the annual uprating for state pensions and benefits at the Autumn Budget on November 26

| GETTYThe triple lock mechanism is expected to deliver a 4.7 per cent increase based on earnings growth, potentially raising the full New State Pension to £241.05 weekly from April.

This would bring the annual amount to £12,534, while the Basic State Pension would rise to £184.75 weekly or £9,607 annually.

Chancellor Rachel Reeves will confirm the annual uprating for state pensions and benefits at the Autumn Budget on November 26.

The Government maintains that gradual increases to the state pension age, legislated since 1995, have been necessary to ensure fairness between generations as life expectancy has risen.

The DWP concluded: "As longevity has increased and our society aged, State Pension age rises have maintained fairness between generations and protected the public finances."

More From GB News