Triple lock warning as calls grow to change payments for wealthier pensioners

Finance expert discusses the controversy of the pension triple lock

|GB NEWS

New research reveals huge generational split on state pension triple lock

Don't Miss

Most Read

A dramatic generational rift risks plunging the future of the state pension triple lock into uncertainty.

New research has found that while 82 per cent of those aged over-65 want the policy maintained, just 21 per cent of 18 to 24 year olds share the view.

The near fourfold disparity illustrates contrasting perspectives on economic security between Britain's youngest adults and pensioners.

The findings from finance firm PensionBee emerge as ministers prepare for the Autumn Budget amidst fiscal constraints, despite Government pledges to preserve the triple lock during this parliament.

The triple lock is a UK Government policy that guarantees the state pension rises each year by the highest of inflation, average earnings growth, or 2.5 per cent.

The mechanism was introduced in 2011 to protect pensioners’ income from losing value over time, ensuring that their payments keep pace with the cost of living or wage growth.

TRENDING

Stories

Videos

Your Say

The chasm in attitudes reflects not only different generational priorities, but also varying experiences of financial stability.

Although the triple lock maintains considerable backing, with nearly half of survey participants identifying its continuation as a pension priority, appetite for change is mounting.

More than a quarter of respondents favour limiting the mechanism to pensioners on modest incomes while reducing benefits for affluent retirees.

This suggests public openness to targeted measures that safeguard vulnerable pensioners.

A dramatic generational rift risks plunging the future of the state pension triple lock into uncertainty

| GETTYAdditionally, a third of those surveyed endorse abandoning the triple lock completely, preferring pension increases tied solely to inflation.

Such findings indicate substantial portions of the electorate are prepared to embrace alternative models should the current system prove unsustainable.

The willingness to consider means-testing or modified approaches signals recognition that protecting those genuinely in need might require departing from universal application.

Latest Developments

79 per cent of 18 to 24 year olds support scrapping the triple lock

|GETTY

Over a third of those aged 25 to 34 advocate implementing caps on the triple lock when inflation surges, recognising the need for fiscal restraint during economic turbulence.

Meanwhile, 26 per cent of 18 to 24 year olds believe the mechanism should activate solely during periods of robust economic expansion.

This contrasts starkly with just 2 per cent of over-65s supporting such conditionality.

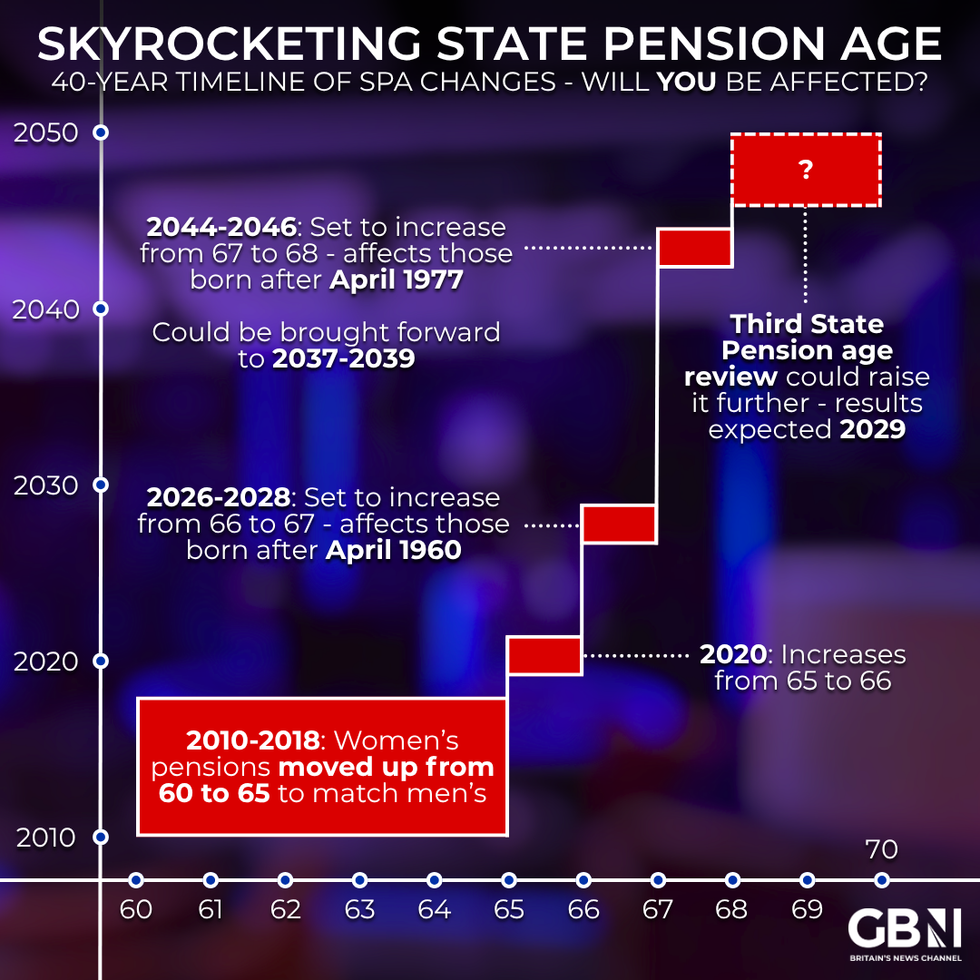

Skyrocketing state pension age - will you be affected?

|GB News

Lisa Picardo, chief business officer UK at PensionBee, said: "These figures expose a growing generational fault line around the triple lock. For many older savers, it is a lifeline that must be protected at all costs."

She acknowledged younger people's preference for modifications while noting the policy's immediate future remains secure.

"What is clear is that the debate has moved beyond whether the triple lock should exist. The real question now is how it can be made sustainable, fair, and fit for the future."

Ms Picardo added: "Policymakers must strike a careful balance: protecting the dignity of today's and tomorrow's retirees on one hand; and on the other, solving for sustainability and the weight of the tax burden borne by those contributing into the system now and in the future."

More From GB News