DWP hires 5,000 new inspectors in biggest benefit fraud crackdown in decades

Emily Carver fumes at a convicted fraudster from the Czech Republic avoiding deportation because his children don't speak Czech. |

GB News

Ministers say the measures will recover £9.6billion over five years as welfare fraud falls slightly

Don't Miss

Most Read

Britain's welfare system faces its most comprehensive anti-fraud offensive in decades as ministers deploy 5,000 new investigators to pursue those defrauding taxpayers.

The initiative forms part of sweeping reforms that promise to recover £9.6billion over five years, according to Office for Budget Responsibility (OBR) projections.

Andrew Western, the parliamentary under-secretary for work and pensions, declared the Government would "bear down" on anyone "ripping off the public purse", whether through benefit fraud or tax evasion.

The enforcement surge represents Westminster's determination to protect public finances from systematic exploitation.

TRENDING

Stories

Videos

Your Say

These measures arrive as annual benefit fraud shows modest improvement, declining from £9.7billion to £9.5billion.

The crackdown targets both welfare cheats and tax dodgers in equal measure.

The Public Authorities (Fraud, Error and Recovery) Bill represents what Mr Western termed the "biggest package" of anti-fraud measures "in recent history".

Speaking to MPs, the minister emphasised that these powers would enable authorities to "keep pace with offenders who exploit the social security system".

Ministers have launched the most sweeping anti-fraud crackdown on Britain’s welfare system in decades

|GETTY

The legislation emerged following questions from Conservative MP John Cooper about welfare fraud prevention.

Mr Western assured the Dumfries and Galloway representative that the Government had "committed to significant measures to counter welfare fraud, error and debt".

The Department for Work and Pensions, which distributes benefits to roughly 23.7 million people across Great Britain, will gain enhanced capabilities to pursue fraudulent claims.

This figure includes 13 million pensioners receiving state pension and millions more claiming various welfare benefits.

Latest Developments

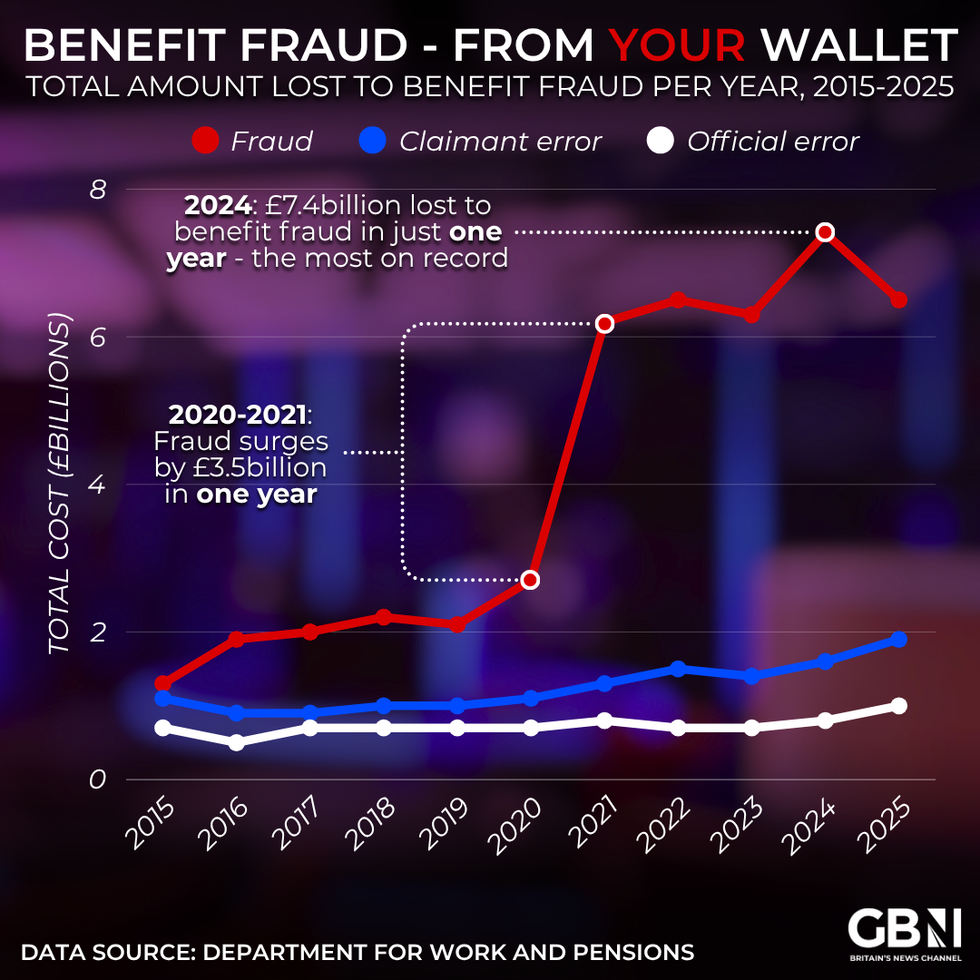

Benefit fraud - from your wallet: Total amount lost to benefit fraud per year

|GB NEWS

The annual fraud and error report reveals that incorrect payments totalled £9.5billion in 2024/25, representing 3.3 per cent of total benefits spending.

This marks a reduction from the previous year's £9.7billion, which accounted for 3.6 per cent of expenditure.

While overpayments have decreased, the level of underpayments to legitimate claimants has remained static at £1.2billion, or 0.4 per cent of total spending.

The Department acknowledges that accurate benefit calculations depend on claimants providing correct information about their circumstances.

Officials explained that changes in personal situations must be reported promptly to ensure proper payment levels.

Without accurate information, the Department cannot determine correct entitlements, potentially leaving some recipients without increases they might deserve.

Chris Kane, Labour MP for Stirling and Strathallan

|MPs and Lords - UK Parliament

Parliamentary debate revealed cross-party recognition of fraud's corrosive impact on public trust.

Chris Kane, Labour MP for Stirling and Strathallan, challenged Conservative concerns by noting their party's "decade of rising poverty, record benefit delays, and billions lost to fraud and error".

Mr Kane emphasised that tackling welfare fraud must coincide with addressing "the huge issue with tax avoidance and evasion", citing recent Public Accounts Committee findings.

His intervention underscored Labour's dual approach to financial misconduct.

The minister's response confirmed that the 5,000 additional investigators would pursue both benefit fraudsters and tax evaders.

The Department will examine six benefits for "unfulfilled eligibility" during the current financial year ending April 5 2026.

Officials distinguished between three categories of incorrect payments: fraud, claimant error and official error.

Fraud requires three conditions: the claimant possesses undeclared capital exceeding statutory limits, fails to report changes affecting entitlement, and demonstrates intent to deceive.

Claimant error involves providing incorrect information without fraudulent intent, while official error stems from departmental mistakes.

The Department for Work and Pensions confirmed that findings from this comprehensive review will be published in May 2026.

More From GB News