How to shave more than £13,000 off your mortgage and pay it off three years early

Interest rates cut: Recession warning as top economist says Bank of England move falls short - ‘I would have welcomed more’ |

GBNEWS

Sam Fox is the founder of the UK Mortgage Centre

Don't Miss

Most Read

Not everyone is in the fortunate position to overpay on their mortgage.

However, an increasing number of people are choosing to do just that each month.

According to data released by Barclays in May, nearly one in four (23 per cent) mortgage holders now make regular overpayments.

What is mortgage overpayment?

Put simply, it means paying more than your agreed monthly repayment.

You can do this in two ways:

• By making one-off lump sum payments• Or by regularly adding a fixed extra amount each month

TRENDING

Stories

Videos

Your Say

Overpaying reduces your outstanding mortgage balance more quickly, which in turn lowers the total interest you pay overtime.

What are the benefits of overpaying?

There are several advantages:

- Interest savings – By reducing your balance faster, you shorten the mortgage term and pay less interest overall.

- Increased equity – Overpaying means you own a larger portion of your home sooner, bringing you closer to outright ownership.

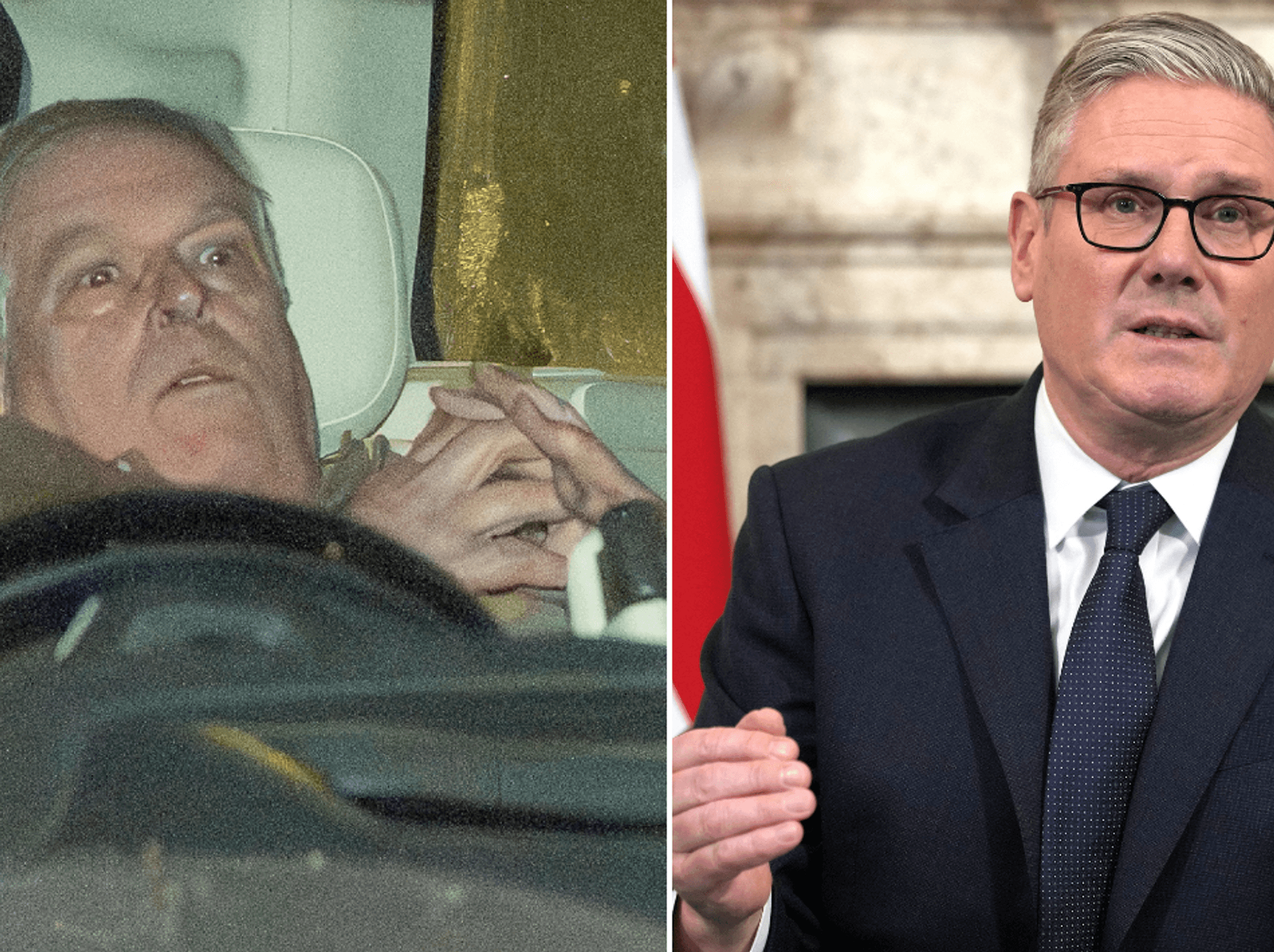

Sam Fox, co-founder of the UK Mortgage Centre | Sam Fox

Sam Fox, co-founder of the UK Mortgage Centre | Sam FoxBetter use of money – For most people, overpaying on a mortgage delivers better returns than leaving money in a savings account or ISA, as the interest saved usually exceeds what you’d earn through saving.

But overpaying isn’t always the best move

There are some important considerations before committing to overpayments:

Reduced cash flow – Overpayments reduce your available cash. It’s wise to maintain an emergency fund in case of unexpected expenses or a change in financial circumstances, such as job loss.

Latest Development

How to shave more than £13,000 off your mortgage and pay it off three years early |

How to shave more than £13,000 off your mortgage and pay it off three years early | GETTY

Outstanding debts – Mortgage interest rates tend to be lower than those for other types of debt.

If you have high-interest debts, like credit card balances, it’s generally better to clear those first.

Early repayment charges (ERCs) – Most lenders allow overpayments of up to 10 per cent of your mortgage balance annually without penalty. If you exceed this, you could face an ERC, which can cost you thousands.

Mortgage interest rates tend to be lower than those for other types of debt

| GETTYHow much could you save?

Let’s take an example:

Suppose you have a 25-year mortgage on a £150,000 property with a 10% deposit. Your monthly repayment might be around £734 (depending on your interest rate).

If you overpay by just £66 a month, you could pay off your mortgage three years and five months early, and save approximately £13,090 in interest payments alone.

That’s more than enough for a well-earned holiday to celebrate being mortgage-free.

More From GB News