UK pensioners could be owed nearly £6billion in tax refunds - man repaid £18,500 due to overpaid stamp duty

Peter Loyal and his wife got a refund of £18,500

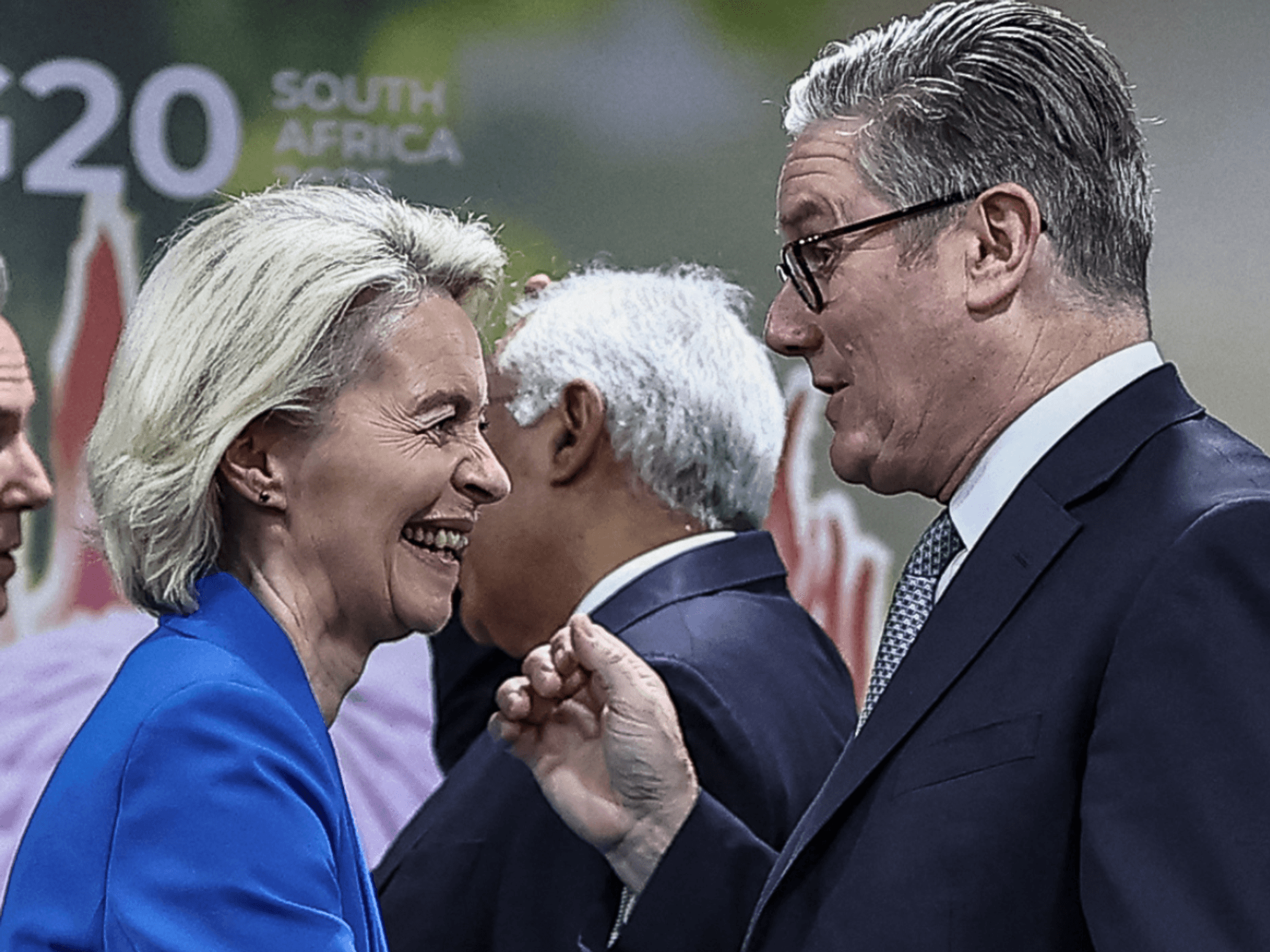

|PETER LOYAL

A couple were able to get thousands back after they overpaid stamp duty land tax

Don't Miss

Most Read

UK pensioners could be owed nearly £6billion in refunds from HMRC due to being misadvised on stamp duty transactions, according to leading property tax specialists, Cornerstone Tax.

They argue that pension-related transactions have appeared to be an area where stamp duty errors seem to happen, as businesses regularly sell their properties to their pension funds as part of retirement planning.

Cornerstone Tax said: “By conducting a thorough analysis, seeking professional advice, and understanding the applicable regulations, you can minimise the risk of overpaying SDLT.

“However, if an overpayment does occur, initiating a review promptly allows you to rectify the situation, gather evidence and pursue appropriate actions to claim a refund or make adjustments as required.”

Peter Loyal held property in a property investment partnership and transferred the property into a connected pension trust scheme

|PETER LOYAL

Peter Loyal from Leicester was helped by Cornerstone Tax. He held a property in a property investment partnership and transferred the property into a connected pension trust scheme.

He said: “I was introduced to Cornerstone by my accountant, who notified me that there was a possibility I had been overcharged on stamp duty when transferring my property into my pension.

“Cornerstone investigated my transaction and found that I had overpaid on stamp duty, and they were successful in reclaiming a refund for me from HMRC. Both my accountant and Cornerstone were a pleasure to deal with and were efficient at gaining the refund for me.”

The property was transferred at market value on 4 May 2016 for an estimated value of £580,000 and Stamp Duty Land Tax of £18,000 was paid.

Following an investigation, it was established that since the transaction was a transfer from a partnership to a connected pension trust scheme, there was no Stamp Duty payment required.

Property tax specialists working with Mr and Mrs Loyal requested the stamp duty payment made by Mr Loyal to be refunded. On January 2020, HMRC responded by asking that an overpayment relief claim should be made.

They were able to successfully get £18,500 refund for him, which included accrued interest.

Cornerstone Tax first noticed the problem in early 2019 and approached several members of the pensions industry with their concerns.

LATEST DEVELOPMENTS:

They estimate that there are between 3,000-5000 cases, meaning 45000-75000 cases since 2007.

With that, they say those affected could be owed up to £80,000 each, and it has taken over two years and the involvement of Baroness Ros Altmann, who has highlighted this issue.

Meanwhile, a spokesperson for HM Revenue & Customs said: “SDLT is due when property is transferred to a pension fund in most cases. There are only very specific and limited circumstances when it is not due.

“People should be cautious of repayment agents offering SDLT refunds when property is transferred to a pension scheme. Some will make incorrect claims so they can charge a fee.”