Skipton Building Society launches ‘first-of-its-kind’ savings account with ‘best buy’ interest rate

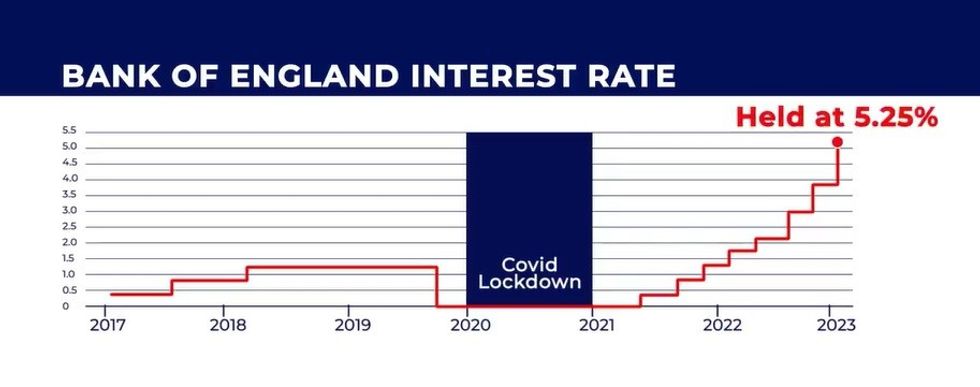

Britons react to Bank of England base rate decision

|GB NEWS

Skipton Building Society’s new savings account will track the Bank of England base rate for two years

Don't Miss

Most Read

Skipton Building Society has launched an “innovative” savings account which currently offers a competitive rate of 5.25 per cent.

The building society said their new Tracker Bond is the “first-of-its-kind” and will track at the Bank of England base rate for two years.

Amid a downward trend on savings rates as providers predict interest rate cuts later this year, Skipton Building Society said this product will let customers “enjoy a high rate of return”.

The account will offer 5.25 per cent until at least the Bank of England’s next Base Rate announcement, after the central bank voted to hold rates at the 15-year high of 5.25 per cent again last week.

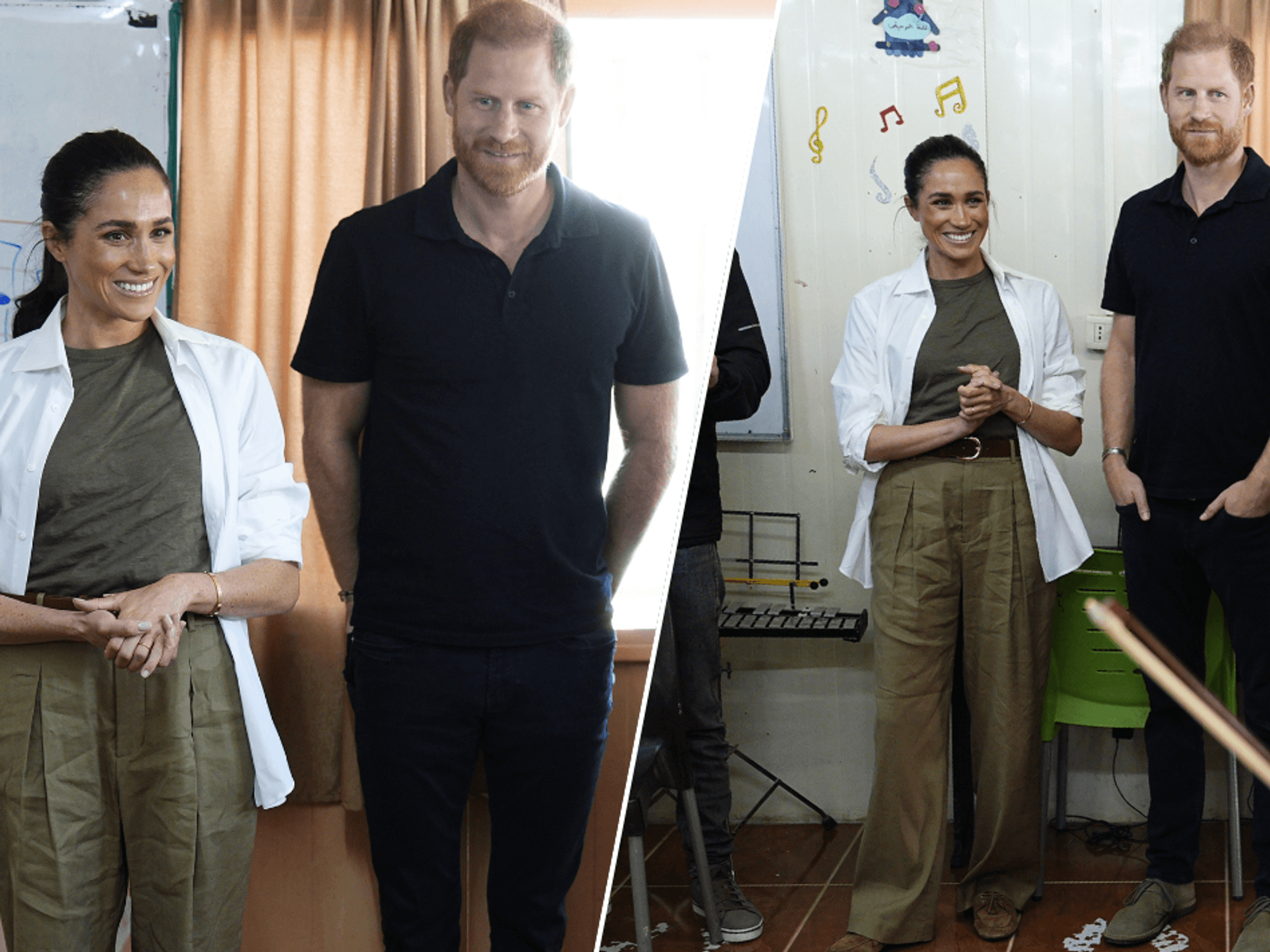

Skipton Building Society has launched its new Tracker Bond savings account today

|PA

The interest rate on this tracker product will then rise or fall as the Bank of England adjusts the Base Rate.

Currently, the top interest rate on a two-year fixed-rate bond is 5.10 per cent, according to money comparison website Moneyfactscompare.

Alex Sitaras, Head of Savings & Partnership Products at Skipton Building Society, said: “Two things are true in the savings market.

"Savers want choice, and savers want value.

“This new Tracker Bond moves the dial on both fronts and shows Skipton is here to bring innovation and new thinking to customers, ultimately giving them more choice and more value.”

Mr Sitaras said he thought it was “really important” to understand that this product is “more speculative in nature” pointing out the Bank of England could reduce the base rate throughout the two year term.

He added: “That said, customers have the reassurance of a rate of return on their money that is directly linked to Base Rate, itself a key influence of market interest rates.

Our new Tracker Bond gives customers the confidence they’ll get value throughout the term of the bond.”

LATEST DEVELOPMENTS:

The Bank of England has held the base rate at 5.25 per cent since August 2023

|GB NEWS

Savers can open this account with deposits of between £500 and £1million.

Money cannot be withdrawn and accounts cannot be closed until maturity at the end of the term.

New and existing customers can open this product, by telephone, post, in-branch and online.