Savings crisis: Britons losing £660bn to low-interest accounts as inflation rises - 'This is a wake-up call!'

Savers are being urged to take action to ensure they get the best possible deal from their bank account

Don't Miss

Most Read

More than 67 million UK savings accounts are failing to keep pace with inflation resulting in thousands of savers' money losing value in real terms, shocking new research has found.

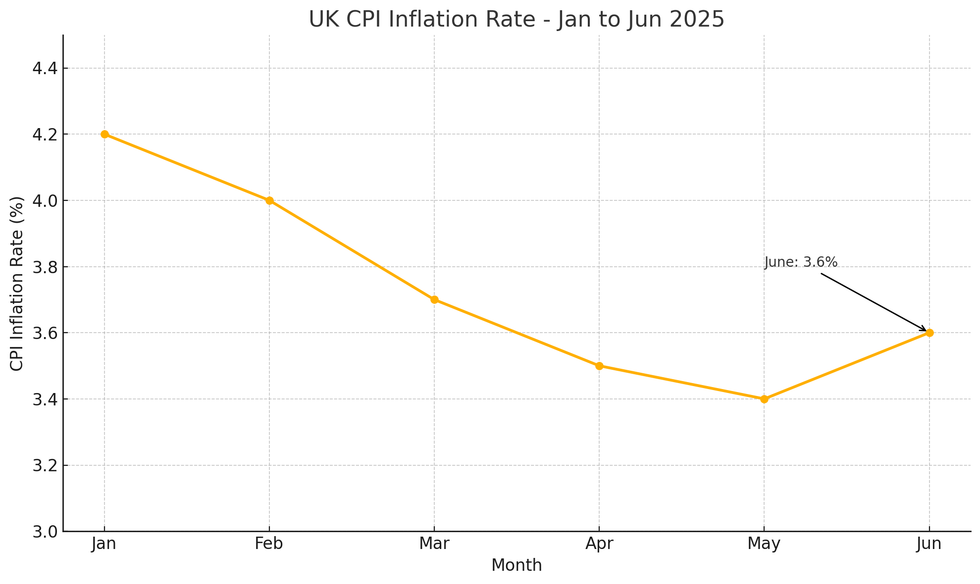

Analysis commissioned by savings app Spring has revealed these savings products, earning 3.5 per cent or less, hold a staggering £660billion whilst inflation stands at 3.6 per cent

Experts note the scale of the problem has worsened dramatically since January, when inflation was three per cent with number of accounts has jumped by nine million in just five months.

This represents a 14 per cent increase with total deposits that are trapped in these low-yielding accounts surging by 36 per cent over the same period, rising from £485billion to the current £660billion figure.

Savers are losing an interest boost to low-interest accounts

|GETTY

Derek Sprawling, the managing director of Spring, warned that the rising inflation rate makes it "more vital than ever" for British savers to ensure their money is working hard.

"Today's inflation figure should serve as a wake-up call," he said following the publication of the Office for National Statistics' (ONS) consumer price index (CPI) inflation figures for June 2025.

Sprawling urged savers to review their accounts immediately and find providers offering rates above 3.6 per cent.

He highlighted that when combined with nearly £300billion sitting in current accounts earning nothing, the amount of lost interest is significant.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Inflation has jumped this month | GETTY

Inflation has jumped this month | GETTYAccording to the managing director, Spring offers an alternative to traditional banking, connecting directly to current accounts within seconds to deliver better returns through its app.

"Unlike most big bank easy access savings accounts, there are no hidden surprises with Spring – no bonus rates, restrictions or fees," Sprawling explained.

The service allows unlimited withdrawals and provides easy access to funds whenever needed.

Users do not need to switch their current account, instead benefiting from competitive rates whilst maintaining their existing banking arrangements.

Sprawling cited that Spring's technology enables instant money transfers, allowing savers to immediately benefit from improved interest rates compared to major UK banks' offerings.

Recently, market analysts have identified several competitive alternatives for savers seeking to beat inflation.

LATEST DEVELOPMENTS:

Britons are looking to make their money go further

| PAAdam French, the consumer expert at Moneyfactscompare.co.uk, gave examples of some of the offerings available to bank and building society customers.

He said: "Some of the best returns can currently be found with easy access accounts, such as Plum's Cash ISA, which is paying 4.98 per cent, or the Cahoot Sunny Day Saver which is paying five per cent on balances of up to £3,000".

For those preferring fixed-term options, Castle Trust Bank leads the one-year cash ISA market at 4.31 per cent, while United Trust Bank tops the two-year category at 4.25 per cent.

However, French cautioned that variable rates "are liable to be cut if the base rate of interest continues to fall as expected this year".

More From GB News