Savers could ‘get around three times more’ in interest by switching bank accounts

Savings interest on easy access accounts have been on the rise over the past year compared to similar accounts in years before

Don't Miss

Most Read

Latest

Britons are being reminded of the benefits of switching bank accounts to bolster savings.

Savers could “get around three times more” in interest if they change savings accounts from a high street bank to a financial institution offering more competitive rates, according to experts.

With the New Year around the corner, savers will be looking for ways to better their finances and secure the best interest rates.

Savings interest have begun to be cut already, according to Rachel Springall, Moneyfacts’ finance expert.

Savings interest rates continue to be high

|GETTY

Rates are also expected to fall slightly further in 2024 but not until later in the year which means bank customers have some opportunity to shop around for the current rates.

Guy James, a finance writer for Hargreaves Lansdown, said everyone needs to “cash set aside” in an easy access account for emergencies.

According to Mr James, savers should turn their eye towards smaller banks which are more likely to offer favourable interest rates.

He explained: “Big banks are still lagging behind, even with Government pressure to pass the better rates on.

“In December, moving your money from the average big bank instant access to a competitive easy access rate could get you around three times more.

“Remember, inflation eats away at the spending power of your money.

"So, if you’re not getting the best rates in your current account, you’re losing out on more.

“Withdrawals from easy access account can take one working day.”

LATEST DEVELOPMENTS:

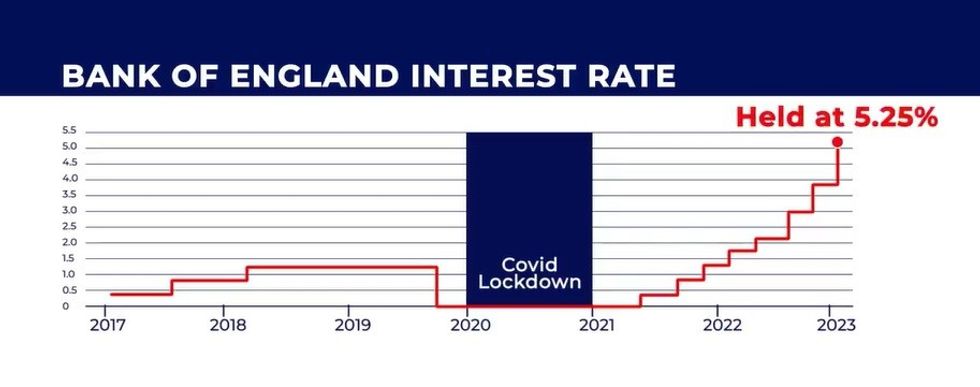

The Bank of England's MPC has voted to keep the base rate at 5.25 percent

| GB NEWSEasy access savings accounts are popular as they offer customers minimal restrictions when it comes to withdrawing and depositing cash.

According to Moneyfacts , Metro Bank is offering the top easy access interest rate at 5.22 percent.

However, customers need to deposit £500 into the account within 28 days of it being opened and the interest reverts to a much lower rate at the end of the year.

For those wanting to bank with a larger banking group, NatWest Group’s Ulster Bank is currently paying 5.2 percent but savers will need to deposit £5,000 or more into it.