Wall Street investors urged to 'wake up' as Warren Buffet makes 'bearish' move against Donald Trump's economy

Economists are sounding the alarm over the Berkshire Hathaway CEO's recent sell-off, which some claim signals a lack of confidence in Donald Trump's economic agenda

Don't Miss

Most Read

Latest

Wall Street is being urged to "wake-up" to the "bearish" trajectory of the US economy in response to recent actions from legendary investor, Warren Buffet.

The chairman and CEO of Berkshire Hathaway, known as the "Sage of Omaha, has sold off a sizable proportion of his bank holdings in the United States.

Since the beginning of the year, Buffett has sold about $3.2billion (£2.4billion) of shares in American banks and financial companies through Berkshire Hathaway.

Furthermore, Buffett sold about about $1billion from his stake in Citigroup, got rid shares worth more than $2billion in Bank of America and and let go of some holdings in Capital One.

Analysts are issuing a warning about Warren Buffet's recent stock market moves

|GETTY / PA

Despite this sell-off, Goldman Sachs reported a 22 per cent jump in profits thanks to record trading revenue despite the impact of President Donald Trump's sweeping tariffs on the economy.

However, analysts are sounding the alarm that Buffet's moves in the market signal a pessimistic outlook for Wall Street down the line.

Larry Cunningham, the director of the John L. Weinberg Center for Corporate Governance at the University of Delaware, noted that investor's actions, which are considered predictive, do not paint a positive picture for the economy in the second half of the year.

Cunningham said: "Berkshire has clearly been reducing its exposure to US bank stocks. That activity signals a cautious or even bearish outlook on banking."

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The ruling specifically targeted the comprehensive 10 per cent tariffs imposed on virtually every US trading partner | Reuters

The ruling specifically targeted the comprehensive 10 per cent tariffs imposed on virtually every US trading partner | ReutersBuffet, who is due to retire from Berkshire Hathaway at the end of 2025 accrued a $350billion cash pile before the stock market slipped earlier this year.

The 94-year old investor is not the only Wall Street giant who appears anxious over the director of the stock market with Jamie Dimon, JP Morgan’s chief executive, selling around $31.5million of his holdings in the financial institution back in April.

Analysts are expecting the Trump administration's fixation on tariffs will have a tangible impact on economic data within the next few months with US inflation already jumping to 2.7 per cent in June.

Tariffs are expected to contribute to inflationary data, which will result in higher yields for the US Treasury as investors seek better returns. Experts warn this will put more pressure on lenders with bad loans potentially raising the amount borrowers needs to pay.

This comes amid the backdrop of Trump calling for the resignation of Jerome Powell as chair of the Federal Reserve, with the intention of appointing a replacement to the central bank who will bring interest rates down.

If this action is taken by Trump, analysts are sounding the alarm that long-term borrowing costs will soar which will also contribute to a hike in inflation.

LATEST DEVELOPMENTS:

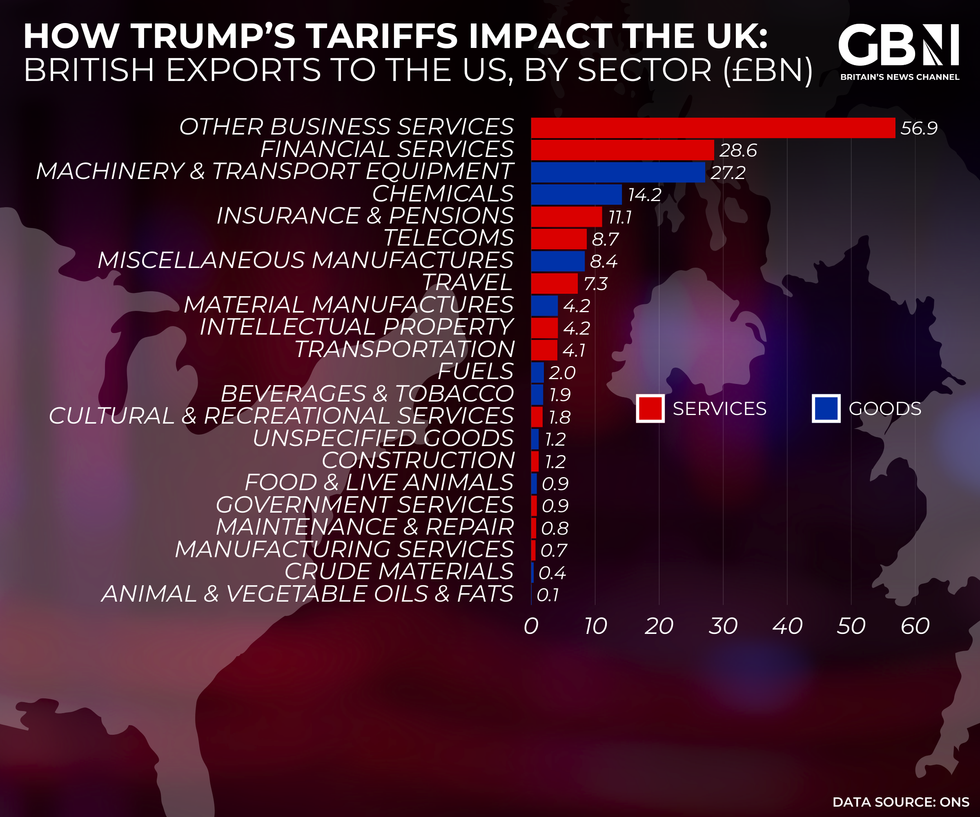

IN DEPTH: How could Trump's tariffs impact Britain? British exports to the US ranked | GB NEWS

IN DEPTH: How could Trump's tariffs impact Britain? British exports to the US ranked | GB NEWSBill Gross, the co-founder of bond trading giant Pimco, posted on X: "Investors wake up. I for one am moving defensively — more cash, buying value with four to five per cent dividend yields. And an emphasis on non-US."

The Fed has slashed gross domestic product (GDP) growth forecasts for 2025 down from 2.1 per cent in Decemeber to 1.4 per cent.

Kambiz Kazemi, the chief investment officer at Validus Risk Management, warned: "Uncertainty around tariffs, and more generally, uncertainty about most subjects, the way the administration is running things, is going to be slowly eroding the trust in the system. The reality has to catch up."