Car tax changes launching soon could see costs hiked for drivers of popular vehicles

James Murray MP said the changes could take effect from October 2026

Don't Miss

Most Read

Latest

Ministers have unveiled measures to soften the financial blow for drivers of plug-in hybrid vehicles facing steeper taxation due to more stringent emissions testing requirements.

The Treasury has disclosed that transport officials will soon open discussions regarding the implementation of Euro 6e-bis emission regulations across Great Britain, set to take effect for newly registered cars and vans from April 2026.

These tougher standards could see carbon dioxide measurements for certain plug-in hybrids increase threefold, prompting concerns about substantially higher Benefit-in-Kind rates for employees.

The Government has pledged to enact laws creating a transitional relief period to cushion the taxation impact.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

Popular vehicles could be included in the new tax regime next year

|GETTY

Britain currently operates under Euro 6d emission regulations, while Northern Ireland adopted the stricter Euro 6e-bis standards alongside other EU nations in January 2025.

Projections from the Department for Transport illustrate stark increases in recorded emissions under the new testing regime.

A plug-in hybrid currently rated at 10g/km with 80 kilometres of electric range could jump to 30g/km.

More dramatic shifts emerge for vehicles with longer electric capabilities - those achieving 120 kilometres on battery power might see figures rise from 10g/km to 40g/km.

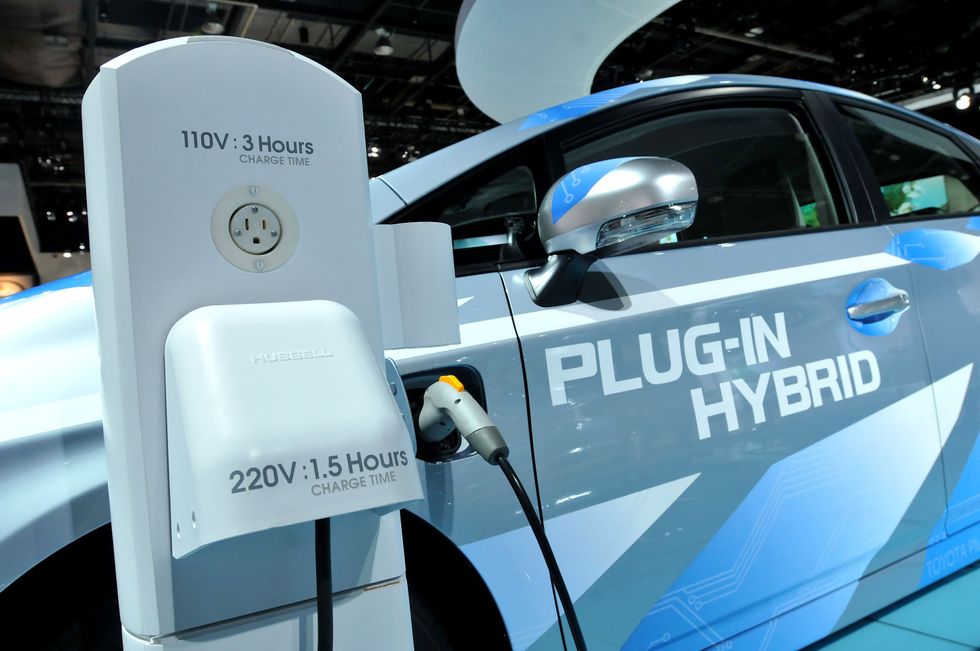

Plug-in vehicles are becoming more popular with company car owners

| GETTYModels registering 30g/km with 40 kilometres electric range could double to 60g/km, while those managing 80 kilometres electrically might surge from 30g/km to 90g/km.

Treasury Minister James Murray addressed Parliament, stating: "The Government recognises that while it is right that higher emitting vehicles pay more tax, company cars continue to play an important role supporting our transition towards zero emission vehicles and the decarbonisation of transport."

His announcement acknowledged the delicate balance between environmental objectives and practical considerations for businesses relying on company vehicle fleets.

Murray confirmed that ministers would pursue legislative changes following the consultation process.

LATEST DEVELOPMENTS:

He emphasised the administration's commitment to supporting the shift towards cleaner transport while avoiding excessive financial burdens on employers and employees during the transition period.

The proposed relief measures will operate across the entire UK from April 2026 through to April 2028, providing a two-year buffer period for affected motorists.

Northern Ireland will benefit from backdated provisions extending to January 2025, ensuring parity throughout the nation despite the region's earlier adoption of Euro 6e-bis standards.

Without intervention, the emissions recalculations could push benefit-in-kind rates dramatically higher.

Euro emissions standards were introduced in 1992

| PAThey could potentially rise from nine per cent to 24 per cent for vehicles in the most affected categories.

The consultation process will determine the precise nature of the easement, with the Department for Transport expected to publish detailed proposals shortly.

Many company car owners are moving towards electric vehicles thanks to the lower Benefit-in-Kind costs, with petrol and diesel vehicles remaining unattractive.