Rachel Reeves could confirm ISA overhaul next week despite U-turn on savings tax raid

Savers urged to be careful of tax on savings interest |

GB NEWS

Earlier reports suggested the Chancellor was floating a cut to the tax-free savings allowance attached to ISAs

Don't Miss

Most Read

Chancellor Rachel Reeves is set to temporarily abandon her controversial plans to reduce the tax-free allowance for cash ISAs with analysts suggesting she offer "targeted support" to British savers instead during next week's Mansion House address

It is understood Reeves is putting a pause on the stealth tax raid on the savings product following mounting criticism and a surge in new account openings at building societies.

The policy reversal comes after "differing views" emerged from within Government circles, coupled with calls for extended consultation with the financial sector and other stakeholders.

Building societies have reported a notable increase in customers opening new cash ISA accounts in recent days, apparently prompted by concerns about the proposed changes.

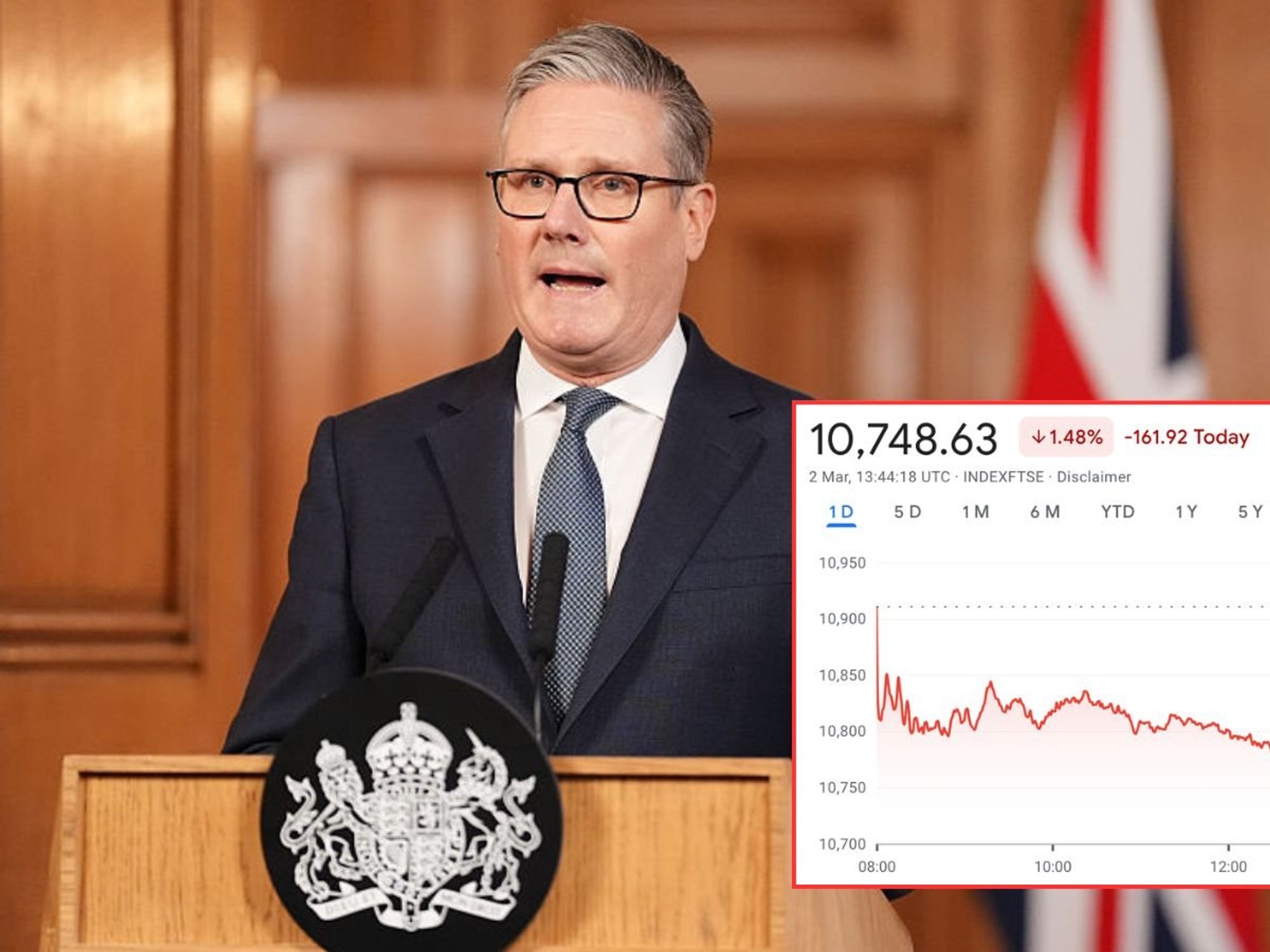

Rachel Reeves will announce ISA reforms next week but will not touch the tax-free allowance

|GETTY

The Chancellor's decision to pause the reforms is expected to be confirmed ahead of her upcoming Mansion House speech, marking a significant shift in the government's approach to savings policy.

Instead of limiting cash ISA allowances, the Government will introduce a new "targeted support" service from April to help savers make more informed decisions about their money.

The initiative is expected to assist the estimated seven million individuals who hold over £10,000 in investable assets solely in cash but have not received financial advice.

Furthermore, banks, building societies, pension providers and investment firms will be able to seek authorisation from the Financial Conduct Authority to offer this free service.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Britons are worried about their pension savings | GETTY

Britons are worried about their pension savings | GETTY Unlike full financial advice, the targeted support will not provide personalised recommendations based on individual circumstances, but will instead offer suggested courses of action to groups sharing common characteristics.

Steven Cameron, Pensions Director at Aegon, welcomed the Chancellor's decision to defer the cash ISA changes, stating: "While we agree many customers may not have the best balance between cash savings and stocks and shares investments, cutting back cash ISA allowances may not be the best way forward and would further complicate the ISA regime."

He emphasised that the new targeted support service represents "a better alternative" by equipping "consumers to make the right decisions for themselves."

The service will operate between existing options of general guidance and full financial advice, allowing firms to reach out to customer groups with suggested courses of action.

LATEST DEVELOPMENTS:

Rachel Reeves will announce reforms in next week's Mansion House address | GB News

Rachel Reeves will announce reforms in next week's Mansion House address | GB NewsCameron explained that the targeted support will help savers understand "the trade-off between the security of cash savings and the greater longer term growth potential from stocks and shares investments."

The Government hopes that encouraging people to invest some of their excess cash will direct funds towards UK companies, potentially boosting economic growth.

Beyond investment decisions, the service may also suggest increasing pension contributions for adequate retirement income or provide guidance on choosing between different retirement income options.

Cameron noted that many of those holding substantial cash savings "who are prepared to take some investment risk and have no short term need for their funds might get a better return on their money by investing some of it in a stocks and shares ISA."

More From GB News