Bank of England Governor warns global financial system at risk of shocks

Nigel Farage lifts lid on what he told Bank of England chief as they locked horns over cash crackdown |

GB News

Andrew Bailey warned G20 finance ministers over vulnerabilities in global markets

Don't Miss

Most Read

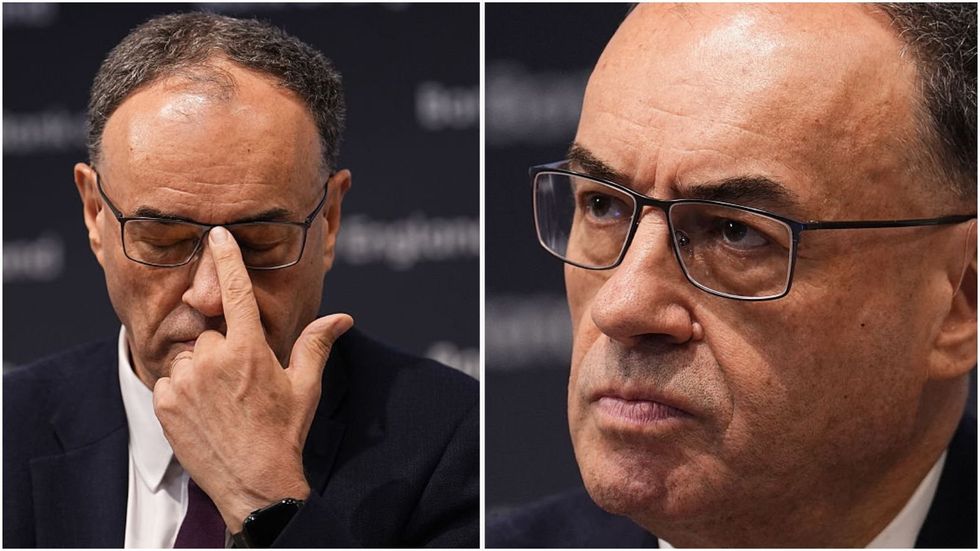

The Governor of the Bank of England has delivered a sobering assessment to G20 finance ministers regarding the precarious state of international markets.

Andrew Bailey, who serves as chairman of the Financial Stability Board (FSB), has highlighted significant vulnerabilities within the global financial architecture.

His concerns centre on three critical factors threatening market stability.

Share prices and other assets have experienced substantial increases recently, creating potential valuation bubbles.

Mounting debt burdens across multiple jurisdictions compound these risks, with the incomplete adoption of previously agreed financial safeguards leaving the system exposed.

His position at the helm of the FSB, which monitors fiscal risks for the world's major economies, lends particular weight to these warnings.

Mr Bailey warned that "while most jurisdictions have seen a rebound in financial markets in recent months, valuations could now be at odds with the uncertain outlook, leaving markets susceptible to a disorderly adjustment."

The Bank of England Governor has warned of global instability

|GETTY

The Governor's reference to a possible "disorderly adjustment" indicates that asset values could experience sharp declines from their elevated positions.

Despite widespread recovery in financial markets across various countries, Mr Bailey's analysis suggests that present valuations may not accurately reflect underlying economic uncertainties.

Recent market movements have underscored his concerns regarding financial instability.

American equities experienced their sharpest decline in half a year after an extended rally period.

Leading financial figures have echoed similar apprehensions about market conditions.

Jamie Dimon, who heads JPMorgan Chase & Co, has expressed particular concern about equity markets.

He has cautioned that a substantial correction in stock prices could materialise within the coming six months to two years.

These warnings from prominent banking executives reinforce Mr Bailey's assessment of market fragility.

The convergence of views between Britain's central bank governor and Wall Street's most influential voices suggests widespread unease about current valuations.

Mr Bailey emphasised the necessity for enhanced international collaboration to fortify financial systems against potential shocks.

His appeal for stronger multilateral cooperation between countries comes as policymakers gather for the International Monetary Fund's (IMF) latest assembly

| IMF/PAHis appeal for stronger multilateral cooperation between countries comes as policymakers gather for the International Monetary Fund's (IMF) latest assembly.

The Bank of England Governor's position suggests that fragmented approaches to financial regulation leave dangerous gaps in the global safety net.

He highlighted the effectiveness of regulatory frameworks established over the past decade-and-a-half.

He stated: "The reforms put in place by the FSB and other standard-setting bodies since 2009 have helped contain the fallout from more recent crises, including the Covid-19 pandemic, Russia's illegal full-scale invasion of Ukraine and the swift resolution of the 2023 banking turmoil."

LATEST DEVELOPMENTS:

His sounding of the alarm comes just weeks ahead of Chancellor Rachel Reeves' Autumn Budget

| GB NewsThe Governor emphasised that international standards and cooperation remain as vital now as they were 15 years ago.

He argued that such measures serve dual purposes beyond crisis prevention.

Mr Bailey noted: "Ultimately, a resilient system allows for the efficient allocation of capital and supports G20 member economies in boosting growth."

His sounding of the alarm comes just weeks ahead of Chancellor Rachel Reeves' Autumn Budget, set to be announced on November 26.

More From GB News