First-time homeowners forced to pay extra £3,000 outside mortgage or face ‘financial nightmare’

Mortgage repayments and stamp duty are not the only expenses first-time homeowners need to think about

Don't Miss

Most Read

Latest

First-time homebuyers could be forced to pay extra costs of up to £3,000 outside of their mortgage down payment and stamp duty, experts have warned.

Those looking to get on the property ladder are being reminded of the hidden expenses that will need to be paid.

These include solicitors fees and a survey of the property with both being vital to making sure the sale is legitimate.

According to Pete Mugleston at Online Money Advisor, a detailed survey of a home may be “daunting” and cost upwards of £1,425 but could save households a lot of money down the line.

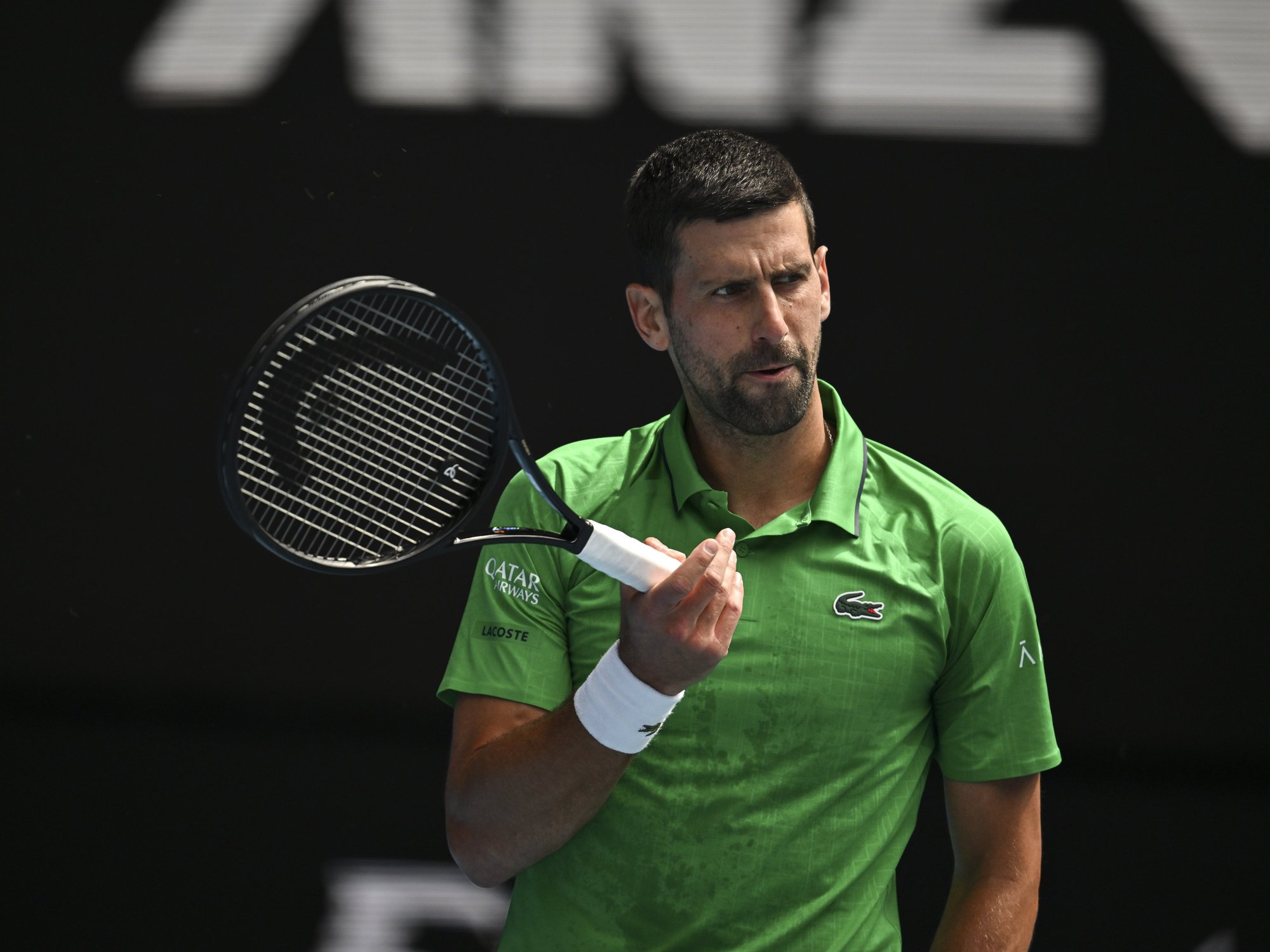

First-time homebuyers are being hit with 'nightmare' hidden costs

|GETTY

Speaking exclusively to GB News, Mr Mugleston said: “Many first-time buyers are eager to find their dream home, but they may underestimate the importance of a thorough property survey.

“While a basic valuation is often required by mortgage lenders, investing in a more comprehensive survey can uncover hidden issues that might turn your dream home into a financial nightmare.

“It cannot be understated how important a Building Survey is, especially for older properties. These surveys delve into the structural integrity, potential repairs and any immediate or future issues that might demand attention.”

On top of this, homebuyers need to take into account the “intricacies” of legal fees when looking to get onto the property ladder.

Experts estimate that prospective homeowners could be forced to out anywhere between £850 to £1,500 plus VAT.

Mr Mugleston added: “Solicitor fees are a crucial yet often unexpected cost that first-time buyers should be prepared for. Legal professionals play a key role in ensuring the legitimacy of the property transaction, conducting searches and handling the necessary paperwork.

“The transparency of obtaining detailed quotes from solicitors early in the process is integral for first-time buyers to budget accordingly and avoid surprises.

“While solicitor fees vary, considering this cost as an integral part of the overall budget is essential for a seamless homebuying experience.”

LATEST DEVELOPMENTS:

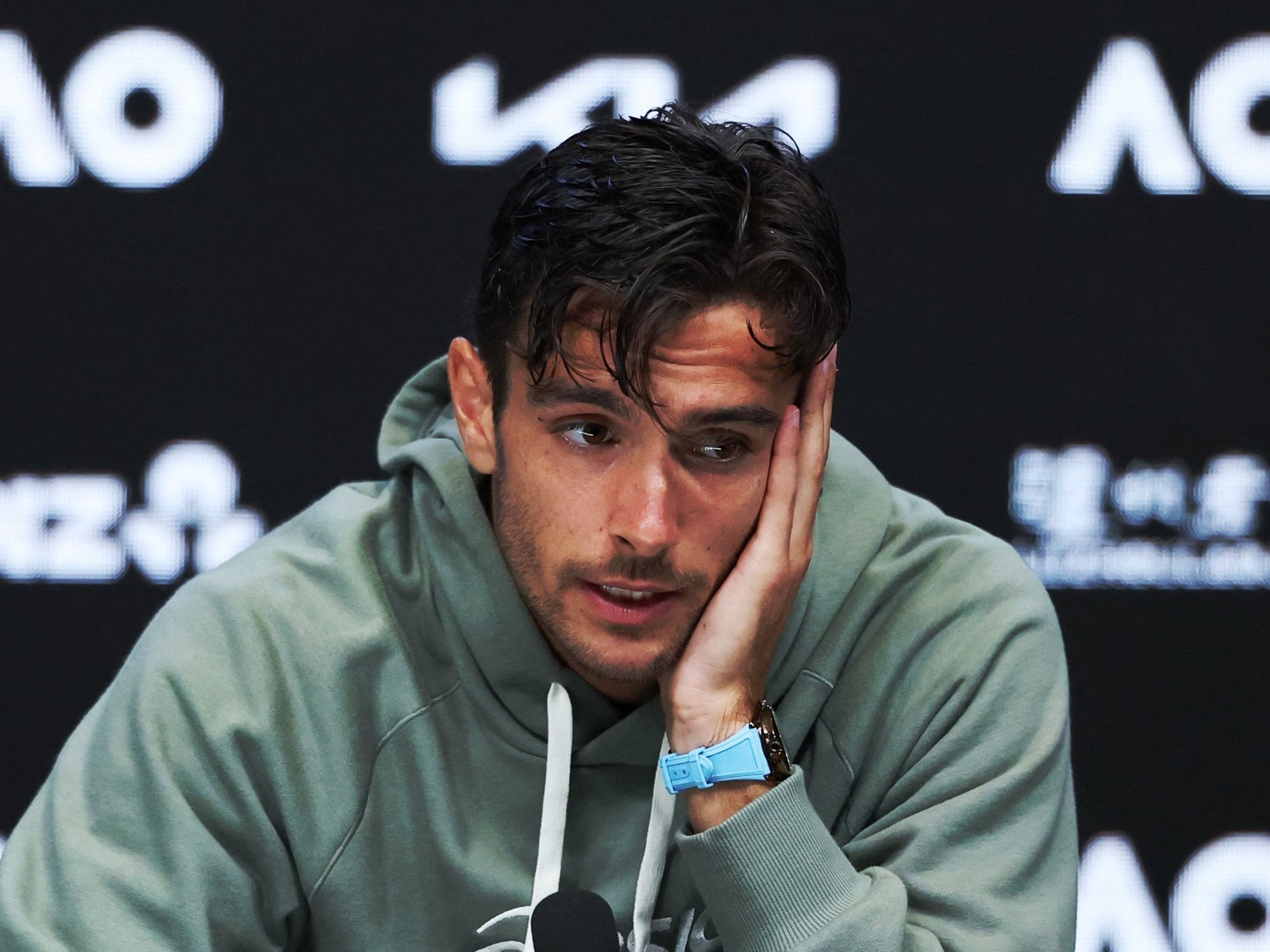

Interest rates are set to come down which will affect mortgage repayments | GETTY

Interest rates are set to come down which will affect mortgage repayments | GETTY As well as this, the money experts also cited the costs of moving home and any repairs that need to be done upon arrival.

However, these vary depending on the property, the location and the distance between someone’s old to new home.

Stamp duty is another charge which first-time buyers may have to pay.

Over the past year, homeowners have been straddled with rising interest rates which have also pushed repayment costs up.