Premium Bonds warning: Britons could lose up to £3,800 in savings by 'playing it safe'

Premium Bond holders are being encouraged to invest and secure greater returns

Don't Miss

Most Read

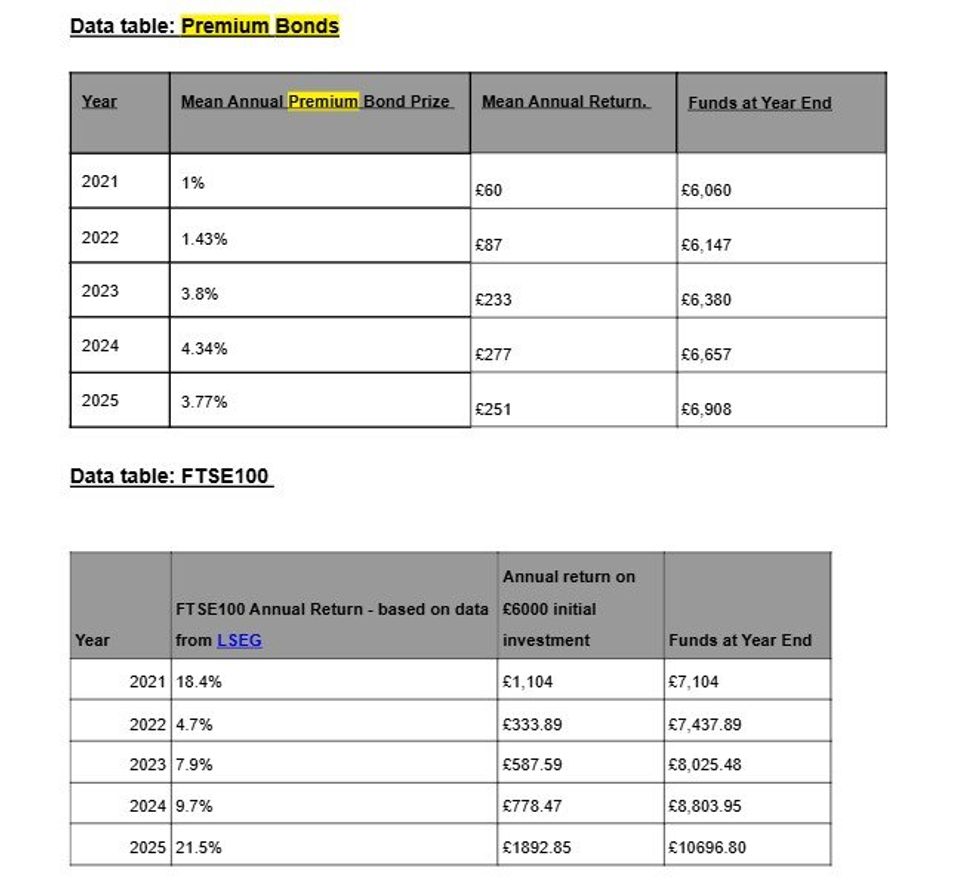

New research from investment platform Lightyear reveals that savers keeping their money in Premium Bonds rather than the stock market may be forgoing close to £3,800 in potential earnings.

According to the analysis, someone holding the average Premium Bond balance of £6,000 would have accumulated merely £908 in prize money between early 2021 and 2025, based on typical returns and reinvested winnings.

In contrast, placing an identical sum into a FTSE100 stocks and shares ISA during the same timeframe would have yielded £10,696.80, representing a difference of £3,788 in favour of stock market investors.

The Ftse 100 achieved compound annual growth of 12 per cent across the five-year period, buoyed by strong performance in 2021, 2024, and 2025, despite experiencing volatility in 2022.

Britons are being urged to invest instead of use Premium Bonds

|GETTY

Premium Bonds, meanwhile, delivered an effective average return of just 2.85 per cent over the same timeframe, even though the prize fund rate reached its peak of 4.65 per cent in September 2023.

This analysis arrives as Premium Bond holders check their National Savings and Investments (NS&I) accounts following the second prize draw of 2026.

The stark contrast in returns highlights the significant opportunity cost facing those who opt for the Government-backed savings product over equity investments.

Despite these findings, Premium Bonds continue to attract substantial interest from British savers.

How have Premium Bonds compared to the Ftse 100?

|LIGHTYEAR

More than 22 million people currently hold the product, with a combined total exceeding £134billion invested, meaning roughly one in three Britons owns a Premium Bond.

Stocks and shares ISAs, by comparison, have just over four million subscribers according to the latest HM Revenue and Customs (HMRC) data.

Wander Rutgers, Lightyear's UK CEO, said: "Now more than ever, Brits want their money to work harder for them. While many see Premium Bonds as a responsible way to store their hard-earned cash, they're missing out on thousands by 'playing it safe'.

"With more than £134billion sitting in Premium Bonds, millions of Brits are effectively opting into a lottery rather than putting their money to work. For people with long-term financial goals, that trade-off needs a serious rethink."

The timeline shows the UK Business investment since 2016 | FACTS4EU

The timeline shows the UK Business investment since 2016 | FACTS4EUEarlier today, NS&I confirmed the Premium Bonds winners for February 2026, with two lucky individuals from Liverpool and Central Bedfordshire taking home the £1million prize.

For this month, NS&I reports there were more than 6.1 million Premium Bonds prizes worth over £408 million won by Bond holders.

On this month's draw, Andrew Westhead, NS&I's retail director, said: "Congratulations to our two jackpot winners from Central Bedfordshire and Liverpool, who each start February £1 million richer.

"ERNIE has spread the love ahead of Valentine's Day and we hope this brings both winners and their loved ones plenty to celebrate.

He noted that Premium Bonds are secure because they are backed by NS&I | GETTY

He noted that Premium Bonds are secure because they are backed by NS&I | GETTY"It’s not just about the jackpot winners though; this month we’ve paid out over 6.1 million prizes worth more than £408 million, bringing the total won by Premium Bonds holders since the first draw in 1957 to £40billion."

Sarah Coles, head of personal finance, Hargreaves Lansdown, shared: "When people win a prize on their Premium Bonds they get more than just the money, they also feel a sense of getting something for nothing, which is a powerful incentive to stay put.

"However, in reality, you’re actually paying for the prizes yourself, because your cash doesn’t earn any interest. Given the fact that the average bond holder will win nothing in the average month, it means your savings are likely to lose money after inflation.

"The longer you hold money in the bonds, the bigger the impact this can have. Families buying for children could see the real value of the bonds shrink considerably over the years."More From GB News