Pensions under fire as Rachel Reeves could slash tax relief in 'hammer-blow' to millions

GB NEWS

The Chancellor has reportedly ruled out a tax on wealth but pensions could be targeted in a potential raid as part of the Autumn Budget

Don't Miss

Most Read

Chancellor Rachel Reeves could target pension tax relief in her upcoming Autumn Budget as part of efforts to balance the books in a blow to retirement savings for millions of Britons.

Reeves has faced intense demands from Labour MPs for a two per cent levy on fortunes exceeding £10million as she grapples with filling an estimated £30billion deficit in Government finances.

Despite backbench pressure for the wealth charge, senior government insiders suggest the Chancellor has privately dismissed this option, with one source telling The Times that such a tax was "not going to happen".

Tax professionals and Cabinet colleagues have cautioned that implementing a wealth levy would accelerate the exodus of affluent individuals from the UK, further complicating the Treasury's revenue challenges.

Reports suggest the Chancellor is floating cutting tax relief for pensions to generate revenue for the Treasury

|GETTY

Instead, Treasury could reduce pension tax relief from 40 per cent to the basic rate of 20 per cent for higher earners, a move that could generate approximately £15billion in revenue, analysts warn.

The proposal would mark a significant shift from current arrangements where higher-rate taxpayers receive substantial tax benefits on retirement contributions.

Such changes would compound existing concerns about inadequate retirement savings among British workers, particularly as pension withdrawals already face taxation.

The measure gained renewed consideration after being previously dismissed last year, as the Chancellor's fiscal position has deteriorated significantly amid growing economic pressures.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Many taxpayers are unaware of the benefits provided by pension tax relief | GETTY

Many taxpayers are unaware of the benefits provided by pension tax relief | GETTY Pension industry specialists have expressed serious reservations about potential changes to retirement savings incentives.

Tom Minnikin, partner at Forbes Dawson, warned that whilst pension relief modifications would be "relatively simple to implement and generate easy money for the Exchequer", he questioned "the wisdom of targeting pensions at a time when the government should be encouraging people to save for retirement".

He described potential removal of the 25 per cent tax-free lump sum as a "hammer-blow to those who have actively saved money in their pensions under the encouragement of past governments".

Lily Megson-Harvey from My Pension Expert acknowledged that whilst pension tax relief represents "an incredibly generous policy", she urged ministers to "focus on implementing sustainable changes that will benefit all savers" rather than adding complexity through piecemeal adjustments.

Analysts note that the Chancellor's options remain severely constrained by Labour's manifesto commitments to avoid raising income tax, employee national insurance or VAT rates.

LATEST DEVELOPMENTS:

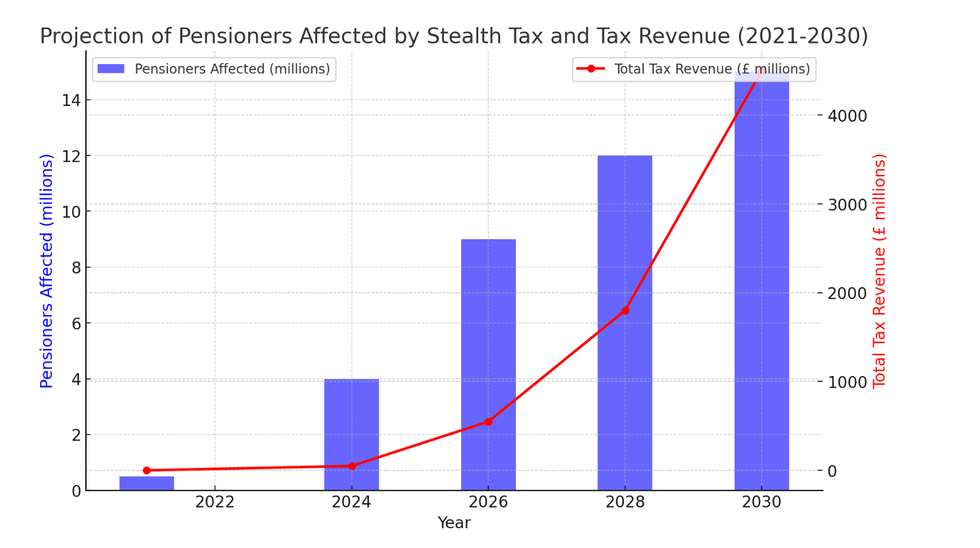

Graph projects the number of retirees facing a stealth tax on their state pensions will rise in the coming years | Chat GPT

Graph projects the number of retirees facing a stealth tax on their state pensions will rise in the coming years | Chat GPT Rising inflation and economic deceleration have compounded Treasury difficulties, with analysts suggesting the funding shortfall could reach £31billion.

Furthermore, UK's tax burden already approaches historic peaks following October's £41billion revenue package, the largest single tax increase on record.

Ministers are reportedly considering prolonging the current freeze on tax thresholds beyond its 2028-29 expiry date, a measure that has already drawn 4.2 million additional people into the tax system since 2022.

A capital gains tax (CGT) raid is also understood to under consideration as potential revenue sources.