Pensioners stuck in 'tax trap' as older Britons 'make up 50% of those affected' by HMRC raid on savings

Fiscal drag is resulting in more pensioners paying extra tax on earned savings interest

Don't Miss

Most Read

Latest

Almost half of all Britons facing a tax bill on the interest earned from their cash savings this year are pensioners, new analysis of HM Revenue and Customs (HMRC) figures can reveal.

New research conducted by investment platform AJ Bell fuelling warnings that retirees are being unfairly caught in the Treasury’s stealth "tax trap", caused by the impacted of fiscal drag.

Data obtained by the firm through a Freedom of Information (FoI) request shows 1.16 million people over state pension age will pay income tax on savings interest in 2025/26.

This accounts for the 44 per cent of the 2.64 million total older taxpayers expected to owe HMRC for their savings income this year.

New research is shining light on the 'tax trap' many pensioners find themselves stuck in

|GETTY

Among basic-rate taxpayers, pensioners make up nearly two-thirds of those hit, underlining how lower-income retirees have been hardest hit by frozen tax thresholds and rising interest rates.

The personal savings allowance, which lets basic-rate taxpayers earn £1,000 in interest tax-free and higher-rate taxpayers £500 , has remained unchanged since its introduction nearly a decade ago, despite interest rates climbing sharply over the past two years.

As a result, many pensioners who have modest sums in savings accounts have found themselves unexpectedly facing tax bills for the first time in years.

This phenomenon is commonly referred to as fiscal drag, which occur when people are pulled into higher frozen tax brackets due to their incomes rising.

Older Britons are already concerned about the rising tax burden

| GETTYCharlene Young, a senior pensions and savings expert at AJ Bell, said many pensioners “may not realise how tax applies on the income earned from savings accounts”.

This is due to interest payments often pushing them into higher tax brackets or triggering code changes in the PAYE system that quietly reduce their pension income.

“The Government could come calling for 20p, 40p or even 45p from every pound of interest your bank pays out, depending on your other income,” Ms Young warned.

“Most people have a personal savings allowance – £500 or £1,000 for higher and basic rate taxpayers respectively – which offers some protection from the taxman’s clutches. But millions are still being caught out, particularly pensioners who now make up nearly half of those affected.”

Chancellor Rachel Reeves has committed to maintaining this freeze until at least 2027/28 | PA

Chancellor Rachel Reeves has committed to maintaining this freeze until at least 2027/28 | PAIn retirement, many people prefer to hold more cash for security and short-term spending needs. But this can come at a cost, as higher savings balances generate more taxable interest — particularly when thresholds are frozen.

“Unfortunately, that appears to be leading to a large number of pensioners suffering a tax bill on their cash savings,” Ms Young said, adding that “increasing numbers are being dragged into higher tax bands too".

The retirement expert urged retirees to take steps to shield their money from unnecessary tax, including keeping money inside their pension pots wherever possible.

This is because withdrawals above the tax-free lump sum count as income and could push you into a higher bracket. Cash can still be held within a pension, and some providers offer competitive interest rates or money market funds as low-risk options.

LATEST DEVELOPMENTS

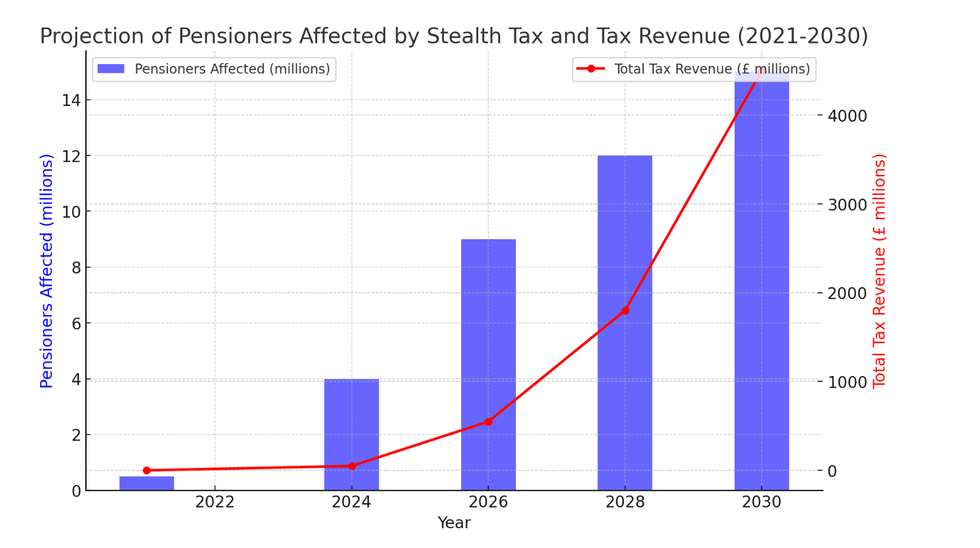

Graph projects the number of retirees facing a stealth tax on their state pensions will rise in the coming years | Chat GPT

Graph projects the number of retirees facing a stealth tax on their state pensions will rise in the coming years | Chat GPT She recommends Britons take advantage of ISAs, which allow savers to shield up to £20,000 a year from income and capital gains tax (CGT). However, Ms Young reminded those looking to bolster their savings that chasing slightly higher returns outside an ISA can backfire if the interest tips you into a tax bill.

Split savings with a spouse to make the most of both partners’ tax-free allowances, she shared. A higher-rate taxpayer could transfer savings to a basic-rate or non-taxpayer spouse to reduce the overall liability.

Finally, Ms Young urged families to make use of the “starting rate for savings”, which is worth up to an extra £5,000 in tax-free interest. If someone's non-savings income, such as pensions, is below £12,570.

"If one of you has income below the personal allowance, you could benefit from the starting rate for savings and earn up to £18,570 tax-free," Ms Young explained.

More From GB News