State pension warning as retirees hit with £100million repayment demands after DWP error

Sir Geoffrey Clifton-Brown says pension reform needs to be addressed or the next generation is at risk of bankruptcy |

GBNEWS

Welfare advocates warn that reclaiming these amounts could push vulnerable pensioners into severe financial difficulties

Don't Miss

Most Read

Latest

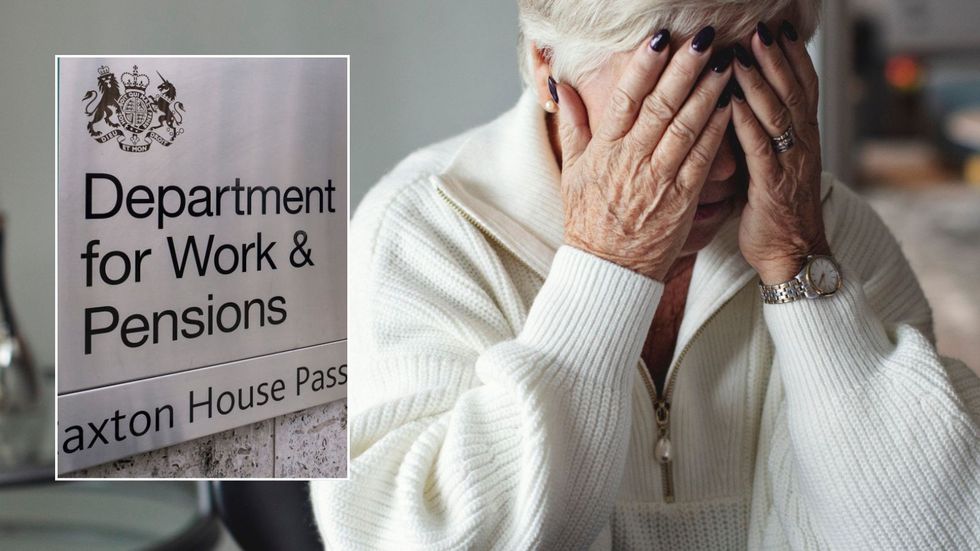

Thousands of pensioners are being chased by the Government to repay more than £100million in state pension overpayments caused by official errors.

New figures reveal that state pension overpayments surged by £89million in the past year alone, with more than 220,000 people estimated to be affected.

The Department for Work and Pensions admitted the overpayments were due to departmental mistakes, not any wrongdoing by claimants.

Despite this, only £3million of pensioner debt caused by government error was written off in the last financial year.

Charities have accused the DWP of being "on shaky legal ground" for demanding money back from pensioners who were overpaid through no fault of their own.

TRENDING

Stories

Videos

Your Say

The Department for Work and Pensions (DWP)has acknowledged that administrative blunders resulted in excessive payments to pensioners, with the total amount jumping dramatically from £30million to £109million within a single year.

These errors stem entirely from departmental failures rather than any wrongdoing by recipients. Despite the government's responsibility for the mistakes, authorities are actively seeking to recover the funds from more than 220,000 affected pensioners across the country.

The scale of these administrative blunders has expanded dramatically, with overpayments caused by official mistakes increasing by £79 million in just twelve months. Data obtained through freedom of information requests r

The state pension is under more scrutiny | GETTY

The state pension is under more scrutiny | GETTY Data obtained through freedom of information requests lodged by The i Paper showed reveals that approximately 220,000 pensioners have been caught up in these departmental failures during 2024-25.

Despite the errors originating entirely within government offices, authorities have written off merely £3million of the resulting debts.

This represents just one per cent of affected pensioners receiving debt forgiveness, with those fortunate few seeing an average of £1,160 cleared from their accounts.

The DWP has confirmed these payments occurred "not as a result of a failure to disclose or misrepresentation by the claimant but instead as a result of a departmental error."

LATEST DEVELOPMENTS

The DWP has confirmed these payments occurred as a result of a departmental error

| PACharitable organisations have condemned the recovery efforts, arguing the department stands "on shaky legal ground in demanding repayments of state pensions or benefits caused by its own incompetence."

Welfare advocates warn that reclaiming these amounts could push vulnerable pensioners into severe financial difficulties.

Citizens Advice highlighted that affected individuals often receive minimal clarification about why they must repay funds, noting the DWP "provides very little information, especially in cases of historic overpayments."

The lack of transparency leaves elderly recipients confused and distressed about debts they never knew existed.

Parliamentary concerns have also emerged, with Lord Davies of Brixton cautioning in June that increased account monitoring could generate false accusations and "may incur further privacy intrusion let alone penalties."

A departmental spokesperson defended the recovery efforts, stating they are "determined to tackle fraud, error and debt" through new legislation described as "the biggest crackdown in a generation."

Officials claim their reforms will generate £1.5billion in savings over five years, contributing to broader plans targeting £9.6billion by 2030.

Charitable organisations have condemned the recovery efforts

| GETTYMeanwhile, the department faces scrutiny over a separate pension scandal involving underpayments.

The National Audit Office calculates that roughly 200,000 pensioners, predominantly widows and women eligible for enhanced rates, are collectively owed £1.5 billion following historical miscalculations.

This parallel crisis highlights ongoing systemic issues within state pension administration.