Pension tax raid on the cards as Rachel Reeves floats 'penalising' retirees with £7bn HMRC raid

Rachel Reeves on if there would be any change to VAT at the next Budget |

GB NEWS

The Chancellor is exploring ways to generate tax revenue ahead of next month's Autumn Budget with economists warning pensions could be in the firing line

Don't Miss

Most Read

Latest

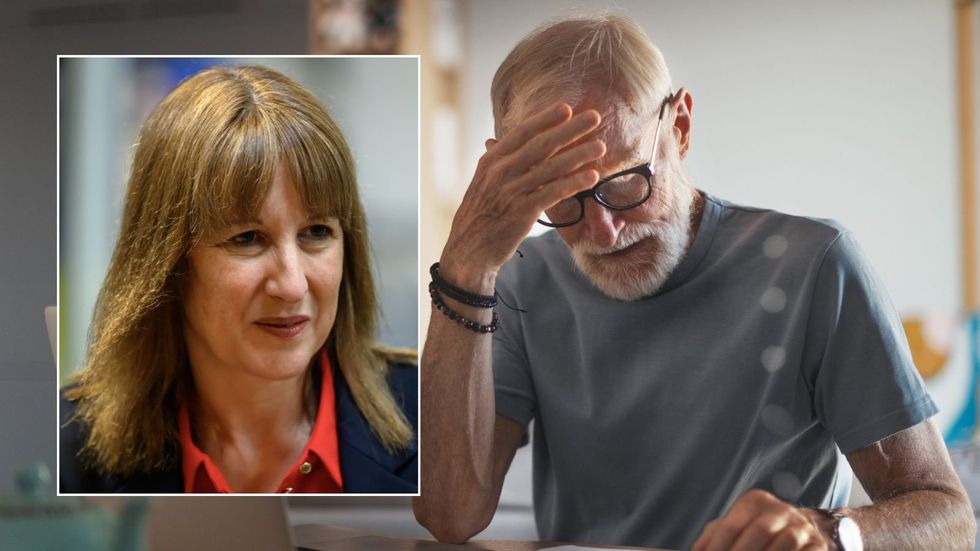

Pensions are expected to be targeted in a £7billion tax raid from Chancellor Rachel Reeves in her upcoming Autumn Budget on November 26 as the Treasury looks for ways to plug the estimated £30billion "black hole" in the public finances.

Analysts are warning that the Chancellor is considering raising taxes on pension contributions paid by working-age pension and savings withdrawals from retirees in an effort to balance the books.

Pensioner activists groups and anti-poverty campaigners are sounding the alarm that pensioners have already had to contend with inflation-hiked prices and stealth taxes, via fiscal drag, amid the cost of living crisis.

Conservative Shadow Chancellor Mel Stride has criticised Ms Reeves's handling of the economy, stating: "Pensioners who’ve worked hard and saved responsibly should not be the Chancellor’s cash machine."

The Chancellor is understood to be considering raising tax revenue via pensions

|GETTY / PA

Economists from Oxford Economics have estimated the Chancellor will need to secure savings of up to £30billion in next month's fiscal statement, including £6billion resulting from Labour's U-turn on benefits expenditure and Winter Fuel Payment means-tested.

According to economists, Rachel Reeves could make "modest" spending cuts, however it is likely the majority of savings is expected to come from hiking taxes in some form.

Among the options on the table include receiving £3billion through a uniform 30 per cent rate for tax relief on pension contributions, which would mean the Chancellor rakes in more money from higher-rate taxpayers putting cash away for retirement.

Furthermore, Ms Reeves could end up implementing National Insurance for the first time on the £50billion contribution that employers make to staff pension plans, earning another £2billion.

Labour has received backlash over its proposed changes to Winter Fuel Payments

| PAFinally, an extra £2bn could be raised from slashing the lump sum that Britons can claim tax-free from pension savings to £100,000, down from £268,275.

Overall, economist estimate this would earn a much-needed £7billion for the Treasury but would widely be perceived as a tax raid on peoples' pension futures.

Outside of traditional tax rises, the Chancellor is understood to be considering an extension to the current income tax and National Insurance rate freeze, which will likely generate more income.

Britons have found themselves pulled into higher tax brackets due to incomes exceeding these thresholds, which is otherwise known as fiscal drag.

The Treasury is eyeing up changes to pension tax

| GETTYA coalition of pensioner rights groups, who were brought together by Later Life Ambitions, have urged the Government to avoid exacerbating the cost of living burden on retirees.

Among the organisations speaking out ahead of a potential tax raid include the National Federation of Occupational Pensioners, the Civil Service Pensioners’ Alliance, and the National Association of Retired Police Officers.

Spokesperson Eamonn Donaghy said: "Britain’s pensioners need reassurance and clarity not endless speculation that causes stress about how financially tough the winter ahead may be.

"It’s an unsettling time for many pensioners who have seen their spending power ravaged by inflation and who are concerned about paying for food and heating bills. The Government’s chopping and changing on the Winter Fuel Payment caused distress and hardship.

Latest Development

Rachel Reeves will unveil her Budget next month | PA

Rachel Reeves will unveil her Budget next month | PA"And freezing income tax personal allowances is an underhand way to drag pensioners into paying more income tax when they have already done so all their working lives. The Government must not penalise pensioners yet again to fix their fiscal fiasco."

Going into last year's General Election, Labour pledged in its manifesto to not raise taxes on working-age people, including income tax, VAT and National Insurance.

A Treasury spokesperson said: “We remain committed to helping our pensioners live their lives with dignity and respect, which is why in April the basic and new state pension increased by 4.1 per cent.

"Pensioners will receive a boost of up to £470 to their income in 2025-26. Our commitment to the triple lock means millions will see their pension rise by up to £1,900 this parliament.”

More From GB News